- Cashless Bano India/

- Features/

- Beginner's Guide: Decoding Mobile Wallets

Beginner's Guide: Decoding Mobile Wallets

Written by Simar Singh | Updated: June 30, 2017 20:47 IST

New Delhi: Over the past few years, mobile wallets facilitating cashless transactions, driven by the increasing penetration of smartphones in the India, have been growing in popularity. A testament to this is the number of companies offering mobile wallet services that have mushroomed and existing businesses venturing into this space (read Airtel, Vodafone). So far, the biggest singular impetus to the mobile wallet business came after the central government's decision to demonetise currency notes in November 2016. Some like Paytm saw a 13 per cent jump in users within 40 days of the announcement. But for some mobile wallets can be a bit of an enigma. Here is everything you need to know about mobile wallets.

What are mobile wallets?

Like the name suggests, mobile wallets are essentially virtual wallets in which users can put in some money which can then be used to make online and offline transactions. For instance, one can simply pay for groceries through their cellphones at a grocery store that accepts payments made through mobile wallets as long as there is enough money pre-loaded into the wallet.

Mobile wallets can also be used to recharge DTH plans, mobiles and pay utility bills as well as transfer money to friends and family.

Mobile wallets are also becoming more sophisticated and some have begun to offer more services such as booking rail, bus and movie tickets right from the app.

These wallets can be operated via an app on one's smartphone or through the service provider's website. Generally, mobile wallets allow users to use net banking, debit cards or credit cards to load money, however, some service providers have begun accepting cash.

What are the different types of mobile wallets?

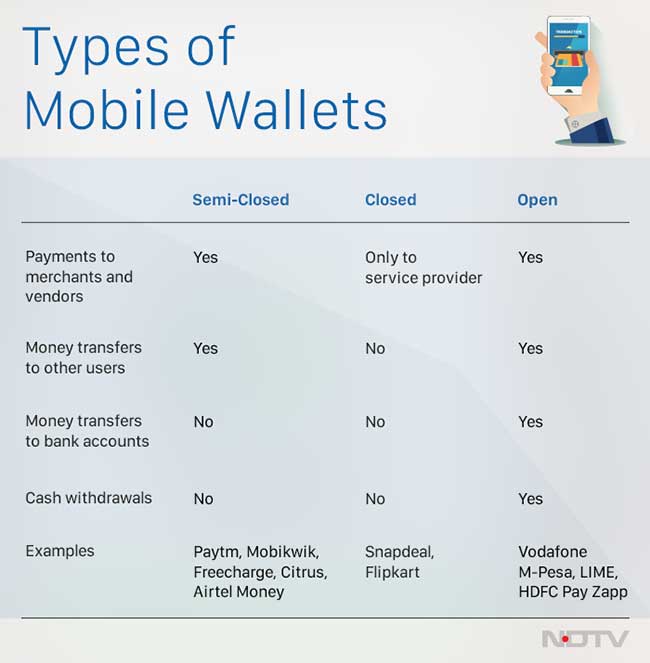

To understand which is the right mobile wallet for you and how these work it is essential to understand the different type of wallets out there. Mobile wallets usually fall into one of 3 categories-Open, Semi-Closed and Closed.

Semi-Closed Wallets: Allow payments to partnering merchants and transfers to other users. These do not allow transfers to other bank accounts or cash withdrawals. (For example, Airtel Money, Paytm, Mobikwik).

This means that once the money is loaded it has to be spent on goods and services offered by merchants which have partnered with the service provider and cannot be withdrawn. Most mobile wallets in India fall into this category.

Open Wallets: Allow payments, transfers to other users, other bank accounts and cash withdrawals (For example, Vodafone M-Pesa).

These wallets can only be offered in partnership with a bank.

Closed Wallets: Money loaded can only be used on goods and services offered by the provider. (For example, Flipkart, Snapdeal). These type of wallets are popular with e-commerce companies for refunds, cancellations and gift cards and allow money spent by users to remain within the company's ecosystem.

What are the benefits of using a mobile wallet?

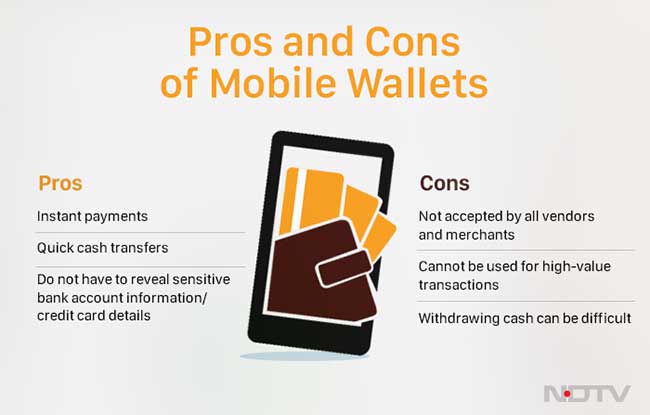

The primary reasons to use a mobile wallet are that they make the payment process faster and are considered by many to be safer.

Convenience

The biggest selling point for mobile wallets is convenience. Using a mobile wallet means that one does not have to deal with cash or punch in debit/credit card numbers, pins and passwords each time they need to pay for something. Additionally, transferring money to friends and family can be far easier with a mobile wallet which usually just requires their mobile number to complete the process.

Safety

The fact that one does not have to give out their bank account or credit/debit card details means that mobile wallets can often be a safer digital payments option. Users can also load small amounts of money which can significantly reduce the potential loss in case the mobile wallet's credentials and details are compromised.

What are the downsides of using a mobile wallet?

To use a mobile wallet one also has to find a vendor or merchant who accepts this form of payment. The downside is that many stores still do not offer such payment options. Additionally, most mobile wallets have limits on how much can be loaded and spent every day which means that they cannot be used for high-value transactions.

Are mobile wallets subject to regulations?

Yes. The Reserve Bank of India has a set of guidelines for mobile wallet companies in place which requires them to obtain authorisations and licences, maintain a minimum paid-up capital of Rs 25 crores at all times, submit yearly audits and limits the validity of any money loaded in a wallet to one year, among other things.

What are mobile wallets?

Like the name suggests, mobile wallets are essentially virtual wallets in which users can put in some money which can then be used to make online and offline transactions. For instance, one can simply pay for groceries through their cellphones at a grocery store that accepts payments made through mobile wallets as long as there is enough money pre-loaded into the wallet.

Mobile wallets can also be used to recharge DTH plans, mobiles and pay utility bills as well as transfer money to friends and family.

Mobile wallets are also becoming more sophisticated and some have begun to offer more services such as booking rail, bus and movie tickets right from the app.

These wallets can be operated via an app on one's smartphone or through the service provider's website. Generally, mobile wallets allow users to use net banking, debit cards or credit cards to load money, however, some service providers have begun accepting cash.

What are the different types of mobile wallets?

To understand which is the right mobile wallet for you and how these work it is essential to understand the different type of wallets out there. Mobile wallets usually fall into one of 3 categories-Open, Semi-Closed and Closed.

Semi-Closed Wallets: Allow payments to partnering merchants and transfers to other users. These do not allow transfers to other bank accounts or cash withdrawals. (For example, Airtel Money, Paytm, Mobikwik).

This means that once the money is loaded it has to be spent on goods and services offered by merchants which have partnered with the service provider and cannot be withdrawn. Most mobile wallets in India fall into this category.

Open Wallets: Allow payments, transfers to other users, other bank accounts and cash withdrawals (For example, Vodafone M-Pesa).

These wallets can only be offered in partnership with a bank.

Closed Wallets: Money loaded can only be used on goods and services offered by the provider. (For example, Flipkart, Snapdeal). These type of wallets are popular with e-commerce companies for refunds, cancellations and gift cards and allow money spent by users to remain within the company's ecosystem.

What are the benefits of using a mobile wallet?

The primary reasons to use a mobile wallet are that they make the payment process faster and are considered by many to be safer.

Convenience

The biggest selling point for mobile wallets is convenience. Using a mobile wallet means that one does not have to deal with cash or punch in debit/credit card numbers, pins and passwords each time they need to pay for something. Additionally, transferring money to friends and family can be far easier with a mobile wallet which usually just requires their mobile number to complete the process.

Safety

The fact that one does not have to give out their bank account or credit/debit card details means that mobile wallets can often be a safer digital payments option. Users can also load small amounts of money which can significantly reduce the potential loss in case the mobile wallet's credentials and details are compromised.

What are the downsides of using a mobile wallet?

To use a mobile wallet one also has to find a vendor or merchant who accepts this form of payment. The downside is that many stores still do not offer such payment options. Additionally, most mobile wallets have limits on how much can be loaded and spent every day which means that they cannot be used for high-value transactions.

Are mobile wallets subject to regulations?

Yes. The Reserve Bank of India has a set of guidelines for mobile wallet companies in place which requires them to obtain authorisations and licences, maintain a minimum paid-up capital of Rs 25 crores at all times, submit yearly audits and limits the validity of any money loaded in a wallet to one year, among other things.

Published: May 22, 2017 19:43 IST

About The Campaign

NDTV along with MasterCard is launching a multi-platform campaign “Cashless Bano India”, to create digital awareness and educate the masses about digital payment solutions for day to day transactions.

The campaign aims to take the message of a cash free India to the country, all while educating them on the ways and means to do it.

We aim to reach out to people and educate them on:

1). Digital and financial literacy

2). New generation digital payment solutions

3). Enabling merchants and consumers to understand and adopt secured and safe payment Solutions

4). Ease of usage at point of sales

Comments