- Cashless Bano India/

- Features/

- From Electricity Bills To Shopping, Telangana's T Wallet Is A Truly Holistic Payment Wallet

From Electricity Bills To Shopping, Telangana's T Wallet Is A Truly Holistic Payment Wallet

New Delhi: As the transition towards a digital economy becomes a focus for both the Union and state governments in India, Telangana has taken a step forward towards easing cashless transactions for its citizens. On June 1 2017, the Government of Telengana launched T Wallet, the state's official payment wallet. By doing so, the state became the first in India to have an official payment wallet of its own. The wallet was launched by the state's Information and Technology Minister, K.T. Rama Rao. The wallet encourages cashless transactions among citizens, and has brought on board both government departments and private merchants with whom transactions can be conducted using the wallet.

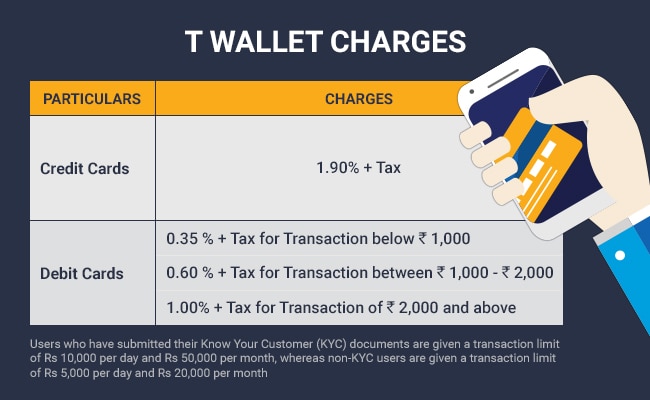

Following the government's demonetisation move of November 2016, the Telengana state government began working on a payment wallet. The intention to release a payment wallet was announced by the government in December 2016. T Wallet works similar to payment wallets like PayTM and Mobikwik, allowing the user to sync the wallet to their debit cards, credit cards and bank accounts. Users can access the wallet using web browsers, along with their mobile phones. Users can load money using any of these options, though charges are levied for each of the respective options.

A charge of 1.90 per cent plus service tax is levied when money is loaded into the wallet from credit cards. For loading money using debit cards, a charge of 0.35 per cent is levied if an amount below Rs 1,000 is loaded, 0.60 per cent levied for an amount between Rs 1,000 and below Rs 2,000, and 1.00 per cent for an amount of Rs 2,000 or more. Users who have submitted their Know Your Customer (KYC) documents are given a transaction limit of Rs 10,000 per day and Rs 50,000 per month, whereas non-KYC users are given a transaction limit of Rs 5,000 per day and Rs 20,000 per month.

In order to bring the whole state under the ambit of cashless transactions, the state government of Telangana has brought several private merchants onboard. Within two weeks of the wallet's launch, 11,740 merchants have created accounts using the wallet, enabling consumers to conduct transactions using T Wallet. The wallet has more than 30,000 active users daily, and the government expects it to become 50,000 users daily by the end of June 2017. The wallet can also be used by those who do not possess a mobile phone, as T Wallet allows Aadhar and biometric details to sync the wallet to bank accounts of people without a mobile.

The state government has facilitated the use of T Wallet to conduct transactions across various government departments as well. The biggest of these is Mee Seva, the state government's good governance initiative. Mee Seva kiosks can be used by citizens to avail government services such as issuance of caste certificates, application for government bursaries and application for loans. T Wallet can be used across all Mee Seva kiosks in the state. The wallet can also be used to pay municipal bills, electricity bills and water bills across the state. To ensure that more people use the wallet, the interface supports Telugu and Urdu, along with English. For smartphone users, the app is available for free download on both iOS App Store and Android Playstore.

Unlike BHIM (Bharat Interface for Money), which is a mobile app, T Wallet can function even if the person does not possess a smartphone. BHIM facilitates transfer of money across bank accounts, but cannot be used to conduct transactions with merchants, T Wallet can be used for both.

"We are seeing a daily surge in both the number of users as well as the number of merchants who are using T Wallet for transactions. We already have 62 government departments where T wallet can be used to conduct transactions. We are planning to introduce the wallet to more such departments for citizens' ease. We also plan to announce some incentives for both merchants and users of the wallet in the coming months," said Jayesh Ranjan, Secretary, Information Technology, Electronics and Communication Department, Government of Telangana.

Also Read: Universities And Colleges Are Going Digital To Eliminate Cash Payments

Following the government's demonetisation move of November 2016, the Telengana state government began working on a payment wallet. The intention to release a payment wallet was announced by the government in December 2016. T Wallet works similar to payment wallets like PayTM and Mobikwik, allowing the user to sync the wallet to their debit cards, credit cards and bank accounts. Users can access the wallet using web browsers, along with their mobile phones. Users can load money using any of these options, though charges are levied for each of the respective options.

A charge of 1.90 per cent plus service tax is levied when money is loaded into the wallet from credit cards. For loading money using debit cards, a charge of 0.35 per cent is levied if an amount below Rs 1,000 is loaded, 0.60 per cent levied for an amount between Rs 1,000 and below Rs 2,000, and 1.00 per cent for an amount of Rs 2,000 or more. Users who have submitted their Know Your Customer (KYC) documents are given a transaction limit of Rs 10,000 per day and Rs 50,000 per month, whereas non-KYC users are given a transaction limit of Rs 5,000 per day and Rs 20,000 per month.

In order to bring the whole state under the ambit of cashless transactions, the state government of Telangana has brought several private merchants onboard. Within two weeks of the wallet's launch, 11,740 merchants have created accounts using the wallet, enabling consumers to conduct transactions using T Wallet. The wallet has more than 30,000 active users daily, and the government expects it to become 50,000 users daily by the end of June 2017. The wallet can also be used by those who do not possess a mobile phone, as T Wallet allows Aadhar and biometric details to sync the wallet to bank accounts of people without a mobile.

The state government has facilitated the use of T Wallet to conduct transactions across various government departments as well. The biggest of these is Mee Seva, the state government's good governance initiative. Mee Seva kiosks can be used by citizens to avail government services such as issuance of caste certificates, application for government bursaries and application for loans. T Wallet can be used across all Mee Seva kiosks in the state. The wallet can also be used to pay municipal bills, electricity bills and water bills across the state. To ensure that more people use the wallet, the interface supports Telugu and Urdu, along with English. For smartphone users, the app is available for free download on both iOS App Store and Android Playstore.

Unlike BHIM (Bharat Interface for Money), which is a mobile app, T Wallet can function even if the person does not possess a smartphone. BHIM facilitates transfer of money across bank accounts, but cannot be used to conduct transactions with merchants, T Wallet can be used for both.

"We are seeing a daily surge in both the number of users as well as the number of merchants who are using T Wallet for transactions. We already have 62 government departments where T wallet can be used to conduct transactions. We are planning to introduce the wallet to more such departments for citizens' ease. We also plan to announce some incentives for both merchants and users of the wallet in the coming months," said Jayesh Ranjan, Secretary, Information Technology, Electronics and Communication Department, Government of Telangana.

Also Read: Universities And Colleges Are Going Digital To Eliminate Cash Payments

Published: June 16, 2017 19:53 IST

About The Campaign

NDTV along with MasterCard is launching a multi-platform campaign “Cashless Bano India”, to create digital awareness and educate the masses about digital payment solutions for day to day transactions.

The campaign aims to take the message of a cash free India to the country, all while educating them on the ways and means to do it.

We aim to reach out to people and educate them on:

1). Digital and financial literacy

2). New generation digital payment solutions

3). Enabling merchants and consumers to understand and adopt secured and safe payment Solutions

4). Ease of usage at point of sales

Comments