- Cashless Bano India/

- Features/

- Going Cashless: Digital Payment Systems Available In India and What You Need To Know About These

Going Cashless: Digital Payment Systems Available In India and What You Need To Know About These

Written by Simar Singh | Updated: June 30, 2017 20:46 IST

New Delhi: The benefits of going cashless are countless for India with digital payments holding the key for greater financial inclusion, formalisation and integration of the economy, increasing the tax net and making payments and money transfers faster and simpler for citizens. So it is little wonder that both the government and the banking sector are bullish on this. To facilitate this transition, several digital payment options have been created by both the government and the private sector. Here is a look at the most popular options and how they work.

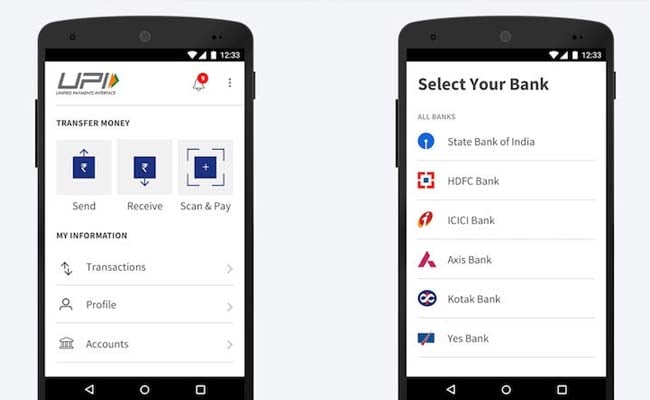

Unified Payments Interface (UPI)

United Payments Interface (UPI) is simply a system which integrates multiple banking features into one app. The system was launched by the National Payments Corporation of India in April 2016 and allows anyone with a bank account to send and receive money from their smartphones either through any bank's UPI app (this does not even have to be the account or the government's BHIM App).

Users need to just need to select their bank account and setup a Virtual Payment Address (VPA) and an MPIN (Mobile Banking Personal Identification Number) which are the only two things required to make transactions. This makes the transactions done through UPI faster and safer.

VPAs essentially create a virtual address for every user, masking their real bank details and the IFSC code. This means that when a payment or transfer is made, these sensitive details will not be made known to the receiving party.

Additionally, UPI-based apps also provide users the option to use QR Codes which can be scanned by their smartphones to ascertain the payment's recipient.

The cost of using UPI is minimal. Each transaction can cost a maximum of Rs 0.50 and the value of transfers is capped at Rs 1 lakh per day.

Unstructured Supplementary Service Data (USSD)

Most digital payments instruments are internet based which can become a problem for those without access to smartphones or mobile data. To solve this problem, the National Payments Corporation of India launched the Unstructured Supplementary Service Data (USSD) which enables anyone to do mobile banking transactions as long as they have a basic mobile phone and telecom service on it.

Users simply need to dial *99# which will take them to an interactive menu where one can transfer funds, check the balance, generate mini statements, etc. from any bank account that is linked to that particular mobile number.

Telecom companies charge use Rs 0.50 each time this service is used.

The service currently covers 51 banks and can be accessed in 12 different languages including Hindi, English, Tamil, Bengali, Telugu, Malayalam, Kannada, Gujarati, Marathi, Punjabi, Assamese and Oriya.

Aadhaar Enabled Payment System (AEPS)

Aadhaar Enabled Payment System (AEPS) is a model that was developed for remote areas without access to banking infrastructure. This system allows people to use their Aadhaar numbers to access various banking services through a Business Correspondent or a 'Bank Mitra' (an authorized person who acts as an agent of the bank at places where it is not possible to open a branch of the bank).

Once the 'Bank Mitra' is able to verify their identity, he/she can help people deposit and withdraw cash, as well as pay utility bills and transfer money using an internet-based interface provided by the bank.

Mobile Wallets

Like the name suggests, mobile wallets are essentially virtual wallets in which users can put in some money which can then be used to make online and offline transactions. For instance, one can simply pay for groceries through their cellphones at a grocery store that accepts payments made through mobile wallets as long as there is enough money pre-loaded into the wallet. These wallets can be operated via an app on one's smartphone or through the service provider's website. Generally, mobile wallets allow users to use net banking, debit cards or credit cards to load money, however, some service providers have begun accepting cash.

Mobile wallets can also be used to recharge DTH plans, mobiles and pay utility bills as well as transfer money to friends and family. However, most wallets only allow people to transfer money to other users of the same service, partnering vendors and do not permit the withdrawal of cash.

Read More: Beginner's Guide: Decoding Mobile Wallets

Internet Banking

Internet banking refers to banking services and products provided by any bank online. These include making transfers, payments, checking one's balance, etc. via a bank's website. There are different types of internet banking transactions:

National Electronic Fund Transfer (NEFT): This is a country- wide payment system that facilitates the transfer of funds from one entity to the other. Under this Scheme, individuals, firms and corporates can electronically transfer funds from any bank branch to any individual, firm or corporate that has an account with any other bank within the country. NEFT payments are capped at Rs 50,000 per transaction.

Real Time Gross Settlement (RTGS): RTGS is meant to be used for high-value transactions with the minimum amount that can be transferred being set at Rs 1 lakh. Transactions made through this are monitored by the Reserve Bank of India and cannot be reversed.

Electronic Clearing System (ECS): This service facilitates the payment of utility bills in particular.

Transaction charges levied on using these services vary from bank to bank.

Mobile Banking

These banking services can be accessed by anyone as long as they have cellular data, a smartphone and an app for the particular bank they have an account that they want to operate in. Different banks offer their own apps and offer various banking services through them.

Banking Cards

Credit cards, debit cards and prepaid cards all fall under these categories. These can be used to either make payments online using a digital payment gateway (which is provided by the merchants) or at a physical store via a machine.

To ensure security, banking cards generally provide a two-step verification process using PINS which can be created by users or passwords which can either be preset by users or single-use auto-generated passwords that are sent to a user's registered mobile number or email.

Banking cards can also be used to access other pre-paid digital payments instruments like mobile wallets.

Only vendors have to pay a small percentage of the amount they receive via a banking card as transaction charges.

Unified Payments Interface (UPI)

United Payments Interface (UPI) is simply a system which integrates multiple banking features into one app. The system was launched by the National Payments Corporation of India in April 2016 and allows anyone with a bank account to send and receive money from their smartphones either through any bank's UPI app (this does not even have to be the account or the government's BHIM App).

Users need to just need to select their bank account and setup a Virtual Payment Address (VPA) and an MPIN (Mobile Banking Personal Identification Number) which are the only two things required to make transactions. This makes the transactions done through UPI faster and safer.

VPAs essentially create a virtual address for every user, masking their real bank details and the IFSC code. This means that when a payment or transfer is made, these sensitive details will not be made known to the receiving party.

Additionally, UPI-based apps also provide users the option to use QR Codes which can be scanned by their smartphones to ascertain the payment's recipient.

The cost of using UPI is minimal. Each transaction can cost a maximum of Rs 0.50 and the value of transfers is capped at Rs 1 lakh per day.

Unstructured Supplementary Service Data (USSD)

Most digital payments instruments are internet based which can become a problem for those without access to smartphones or mobile data. To solve this problem, the National Payments Corporation of India launched the Unstructured Supplementary Service Data (USSD) which enables anyone to do mobile banking transactions as long as they have a basic mobile phone and telecom service on it.

Users simply need to dial *99# which will take them to an interactive menu where one can transfer funds, check the balance, generate mini statements, etc. from any bank account that is linked to that particular mobile number.

Telecom companies charge use Rs 0.50 each time this service is used.

The service currently covers 51 banks and can be accessed in 12 different languages including Hindi, English, Tamil, Bengali, Telugu, Malayalam, Kannada, Gujarati, Marathi, Punjabi, Assamese and Oriya.

Aadhaar Enabled Payment System (AEPS)

Aadhaar Enabled Payment System (AEPS) is a model that was developed for remote areas without access to banking infrastructure. This system allows people to use their Aadhaar numbers to access various banking services through a Business Correspondent or a 'Bank Mitra' (an authorized person who acts as an agent of the bank at places where it is not possible to open a branch of the bank).

Once the 'Bank Mitra' is able to verify their identity, he/she can help people deposit and withdraw cash, as well as pay utility bills and transfer money using an internet-based interface provided by the bank.

Mobile Wallets

Like the name suggests, mobile wallets are essentially virtual wallets in which users can put in some money which can then be used to make online and offline transactions. For instance, one can simply pay for groceries through their cellphones at a grocery store that accepts payments made through mobile wallets as long as there is enough money pre-loaded into the wallet. These wallets can be operated via an app on one's smartphone or through the service provider's website. Generally, mobile wallets allow users to use net banking, debit cards or credit cards to load money, however, some service providers have begun accepting cash.

Mobile wallets can also be used to recharge DTH plans, mobiles and pay utility bills as well as transfer money to friends and family. However, most wallets only allow people to transfer money to other users of the same service, partnering vendors and do not permit the withdrawal of cash.

Read More: Beginner's Guide: Decoding Mobile Wallets

Internet Banking

Internet banking refers to banking services and products provided by any bank online. These include making transfers, payments, checking one's balance, etc. via a bank's website. There are different types of internet banking transactions:

National Electronic Fund Transfer (NEFT): This is a country- wide payment system that facilitates the transfer of funds from one entity to the other. Under this Scheme, individuals, firms and corporates can electronically transfer funds from any bank branch to any individual, firm or corporate that has an account with any other bank within the country. NEFT payments are capped at Rs 50,000 per transaction.

Real Time Gross Settlement (RTGS): RTGS is meant to be used for high-value transactions with the minimum amount that can be transferred being set at Rs 1 lakh. Transactions made through this are monitored by the Reserve Bank of India and cannot be reversed.

Electronic Clearing System (ECS): This service facilitates the payment of utility bills in particular.

Transaction charges levied on using these services vary from bank to bank.

Mobile Banking

These banking services can be accessed by anyone as long as they have cellular data, a smartphone and an app for the particular bank they have an account that they want to operate in. Different banks offer their own apps and offer various banking services through them.

Banking Cards

Credit cards, debit cards and prepaid cards all fall under these categories. These can be used to either make payments online using a digital payment gateway (which is provided by the merchants) or at a physical store via a machine.

To ensure security, banking cards generally provide a two-step verification process using PINS which can be created by users or passwords which can either be preset by users or single-use auto-generated passwords that are sent to a user's registered mobile number or email.

Banking cards can also be used to access other pre-paid digital payments instruments like mobile wallets.

Only vendors have to pay a small percentage of the amount they receive via a banking card as transaction charges.

Published: May 26, 2017 12:43 IST

About The Campaign

NDTV along with MasterCard is launching a multi-platform campaign “Cashless Bano India”, to create digital awareness and educate the masses about digital payment solutions for day to day transactions.

The campaign aims to take the message of a cash free India to the country, all while educating them on the ways and means to do it.

We aim to reach out to people and educate them on:

1). Digital and financial literacy

2). New generation digital payment solutions

3). Enabling merchants and consumers to understand and adopt secured and safe payment Solutions

4). Ease of usage at point of sales

Comments