Blankets can be dropped off at this location:

Uday Foundation

D-233, Sarvodaya Enclave

New Delhi 110017

Phone: +91 11-26561333 /444 / 41098444Financial Assistance Details:

For Donation through Credit card, Debit card Net Banking, Payment Wallet or UPI please Click HereFor online transfers:

Uday Foundation For CDRBG Trust

Account No: 03361450000251 (Savings)

HDFC Bank, Adchini, New Delhi - 110017

IFSC Code: HDFC0004397

Donation through UPI : udayfoundation@hdfcbank For DD/Cheques:

Drawn in favour of "Uday foundation For CDRBG Trust". Payable at Delhi.

(Can also be couriered to

Uday Foundation's address)

Note: This information has been provided / published on a good faith basis, without any commercial motive. NDTV does not vouch for the authenticity of the claims made by the intending donee, nor can we guarantee that the donations made by a donor will be used for the purpose as stated by the intending donee. You are requested to independently verify the contact information and other details before making a donation. NDTV and/or its employees will not be responsible for the same.

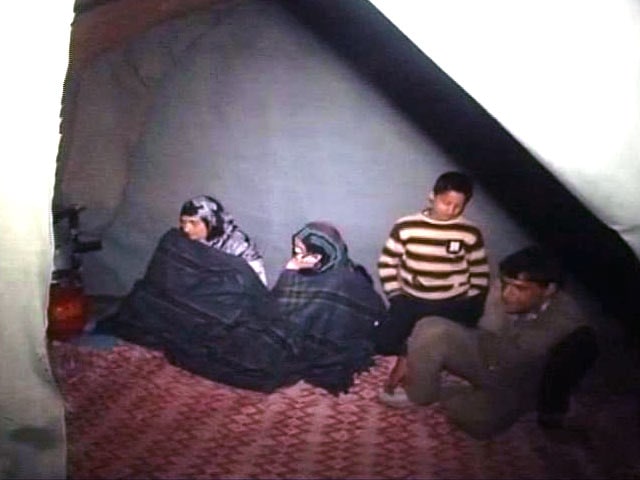

Blanket Collection Target

| State-Wise | Target | |

| Delhi-NCR | 25,000 | |

| Himachal Pradesh | 5,000 | |

| Jammu and Kashmir | 10,000 | |

| Uttarakhand | 10,000 | |

| Uttar Pradesh | 10,000 | |

| Total | 60,000 | |

Tax Exemption Details

Donations to Uday Foundation are exempt from 50% tax under section 80G of the Income Tax Act.

Please share the details after you have made the donation to reena.sen@udayfoundation.org, along with your complete address and PAN card no, enabling the Foundation to send a 80G tax exemption receipt of the same.

Uday Foundation is not registered with FCRA and they cannot accept foreign donations. They can accept donation from Non-Resident Indians only through any bank account operational in India. Contributions made by a citizen of India living in another country (i.e., Non-Resident Indian), from his personal savings, through the normal banking channels, is not treated as foreign contribution. However, while accepting any donations from such NRI, it is advisable to obtain his passport details to ascertain that he/she

is an Indian passport holder.

In case you are a Non-Resident Indians and Indian passport holder and wish to donate, please write to Ms Reena Sen at reena.sen@udayfoundation.org or speak to her at 09599635450.