- Home/

- Highlights

Highlights

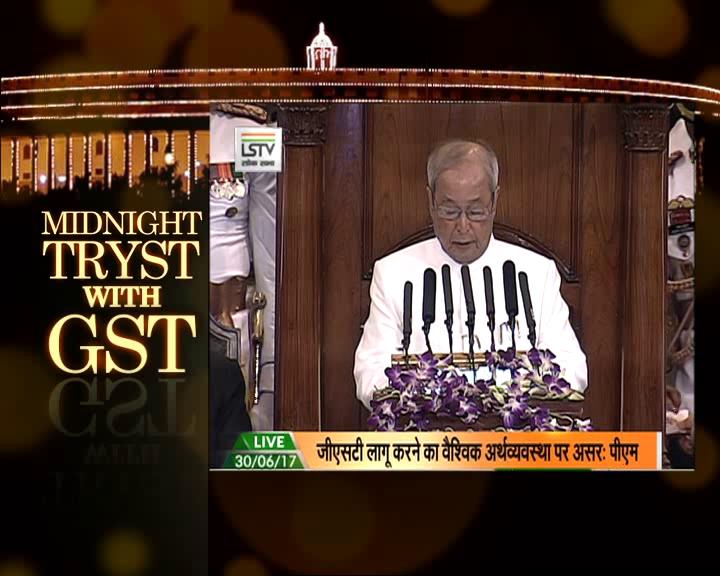

GST Launch Highlights: President Pranab Mukherjee, PM Modi Launch India's Biggest Tax Reform

Follow NDTV.com to track detailed coverage on GST and its impact on businesses, markets and people.

GST Is Here. How It Will Impact You In 10 Pointshttps://t.co/2tj5M5yqFT

- NDTV Profit (@NDTVProfit) June 30, 2017

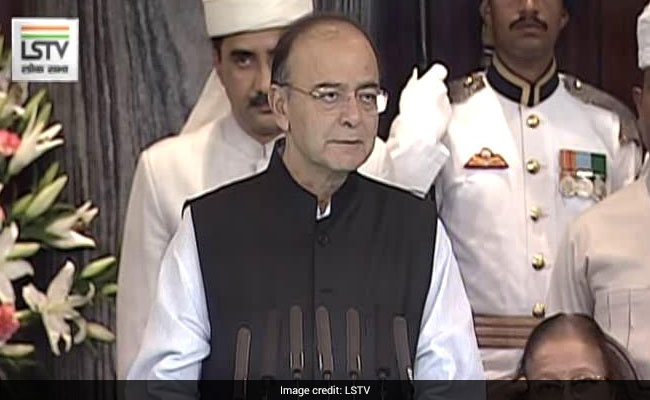

Switching from English to Hindi, Mr Jaitley said, "Mr President, this journey started 15 years ago.... (when) the NDA 1 created a committee that gave a historic report..."

Underscoring that the GST is an "important achievement for whole country", he said, "The consensus highlights that India can rise above politics in interest of the nation... that India can collectively think and act with maturity for a broader purpose."

#GSTForNewIndia | #GST, launched by President Pranab Mukherjee, PM @narendramodi in Central Hall of Parliament https://t.co/jAz3XFJEnupic.twitter.com/H206RdDbTs

- NDTV (@ndtv) June 30, 2017

- It is also a moment of satisfaction to me personally

- In meetings with Chief Ministers and officials, I found most of them had a constructive approach

- I therefore remained confident that GST was a matter of time and it would eventually be enacted

- It is remarkable in 18 meetings of the GST council, all decisions taken by consensus

- The council has pleasantly surprised all of us by completing its task in time

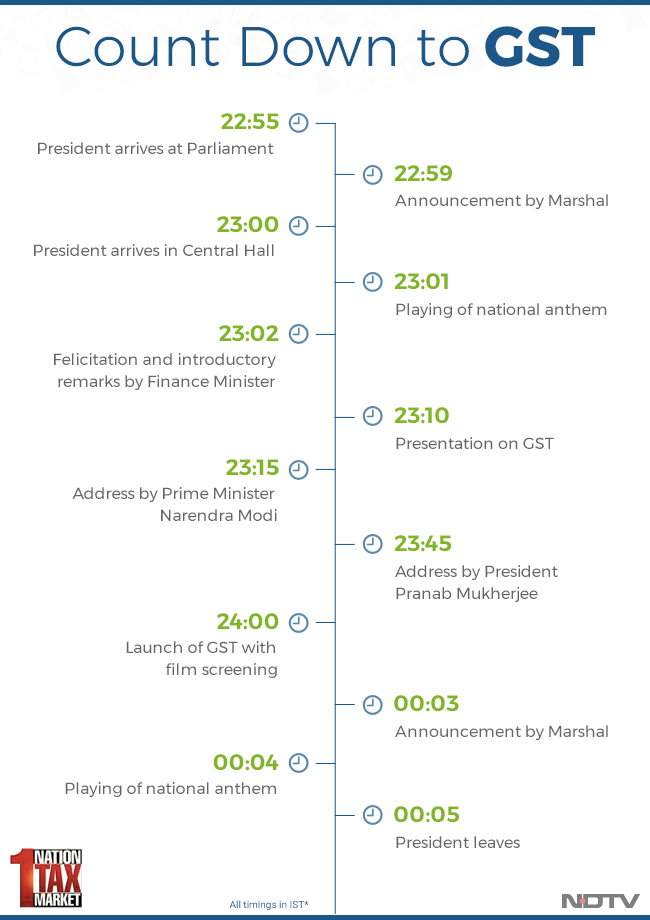

- In a few minutes from now, we will witness the launch of GST

- A unified tax system in the country

- This historic moment is the culmination of a 14-year journey

- The proposal for GST was first moved in 2007

- There are regions of India, like Bihar and West Bengal, that are rich with resources yet they lag in development.

- GST is the biggest opportunity to develop these regions.

- GST in one way is like our railways. States and Centre run it but we see one railway

- We have all lived tax terrorism and inspector raj. Today, due to the transparency of GST, grey areas will end

- This will end the exploitation of traders

- Traders up to Rs 20 lakh are totally exempt from this. Traders up to Rs 75 lakh also have many exemptions

- There were 500 different kinds of tax all over the country. Today we are free from them and we have one nation, one tax.

- Albert Einstein had once said if there is one thing that is most difficult to understand, it is income tax.

- I wonder what he would have said if he had seen our tax system.

- Chanakya had said however difficult the goal may be, we can achieve it through tireless work

- If Sardar Vallabh Bhai Patel hadn't united all kingdoms of India just try and think what India would have seemed like today. Just like that, GST is uniting all markets of India today.

- Some of the best brains of the country have debated on this. GST is a result of that.

- We have always strived for equal opportunities, equal rights. GST is an exemplary example of cooperative federalism. GST is the sign of the power of Team India.

- I congratulate everybody who has helped in this process.

- Today, GST Council had its 18th meeting. And in a while GST will be enacted. It is a coincidence that the Holy book Gita also has 18 chapters.

- Today at 12 midnight, we have united in the Central Hall. This is a place where uncountable icons of our country have set foot.

- The Constitutional Assembly's first meeting was held here.

- Pandit Nehru, Azad, Patel... these great souls were sitting in the front row.

- This place has been witness to the night of 14th August 1947 when the country embraced Independence.

- Today, after years, for a new economy, give new power to our federalism - there can be no better place.

- At different times, under the guidance of great souls, we have been led to new heights that we find ourselves at this stage

- I am grateful to all of you for being here

- The direction that we have picked, the system we have developed is not an achievement of one party or one government, it is our shared inheritance

- In the building of the nation there are some moments when we reach a new turn and try to reach newer heights.

- At midnight we will together decide the course of the future of this country.

- In a while, the country will start a new journey.

- 1.25 billion people will witness this.

FM @arunjaitley at #GST launch: " GST Council met 18 times, and there was never any need for voting, because of the unanimity"

- PIB India (@PIB_India) June 30, 2017

Every decision in the GST council was taken with a consensus, not a vote. Principal of equivalence, revenue neutrality and not burdening the weaker sections were the guiding principles, said Arun Jaitley in opening remarks on GST.

- We have implemented a constitutional amendment displaying high point of Indian politics at a time when world is experiencing slow growth, isolationism

- This journey started 15 years ago. NDA-I created a committee that gave a historic report.

- In the 2006, UPA announced it would try to implement this by 2010.

- After your (President Pranab Mukherjee) constitutional amendment, the parliamentary standing committee gave important suggestions

While enacting the GST neither centre, nor state give up sovereignty. They pool their sovereignty.

- At the midnight hour we will be launching one of India's most ambitious tax reforms

- For India it will begin a new journey

Picture this! You take your partner out for a date on his/her birthday to a posh restaurant, have an engaging conversation, wish him/her as the clock strikes 12. You wrap up and call for check.

This is the moment GST makes it presence felt.

With a single tax replacing the current system of multiple taxes, eating out may become cheaper, but restaurants are looking at ways to bill their midnight diners tonight.

Industrialist Ratan Tata reaches Parliament to attend the midnight GST rollout

JUST IN: Prime Minister Narendra Modi arrives in the Parliament for the GST launch

Here's a short clip explaining Goods & Services Tax in a simplified manner #GSTforNewIndiahttps://t.co/HlQF7Wn5espic.twitter.com/rmWaHaj7QM

- MyGovIndia (@mygovindia) June 30, 2017

#GSTSimplified | Too many #GSTFAQs, too little clarity? We've got it covered for you

- NDTV (@ndtv) June 30, 2017

For more #GST related queries: https://t.co/FSoCF7pvPjpic.twitter.com/O6xiH7VjUO

@INCIndia has consistently backed #GST with inflationary, technological & bureaucratic safeguards. Hope it's original intent is retained

- Milind Deora (@milinddeora) June 30, 2017

#Parliament House illuminated for #GST launch ceremony.#AIRPics: Souvagya/Anupam pic.twitter.com/JprnUJiv0K

- All India Radio News (@airnewsalerts) June 30, 2017

NDTV EXCLUSIVE: Should Tide Over Hurdles In 3-6 Months: Arvind Subramanian On GST Launch

GST feedback & helpline numbers/emails by GST council and other departments... Use them for clarifications and feedback... pic.twitter.com/ZyMxrIWqSU

- Manish Sisodia (@msisodia) June 30, 2017

The aviation sector is likely to face "teething problems" for four to six months due to the implementation of the Goods and Services Tax (GST), SpiceJet CMD Ajay Singh told news agency PTI today.

The aviation ministry had earlier sought postponement of the GST implementation by two months on the ground that airlines needed more time to revamp their systems to comply with the new tax regime.

In a U-turn, the ministry later said it was prepared for the GST roll-out from the stipulated date.

#GSTForNewIndia

- Sushil Kedia (@sushilkedia) June 30, 2017

GST stands for Golden Sparrow Takes-off-again. Congratulations to @narendramodi@arunjaitley & to all Indians.

#GSTForNewIndia Cases in which GST registration is compulsory pic.twitter.com/hHASj1YUuH

- Prakash Javadekar (@PrakashJavdekar) June 30, 2017

There are five main slabs

GST Council chaired by Finance Minister Arun Jaitley in New Delhi during its 18th meeting. Mr Jaitley will throw a dinner for the council members after the meeting.

BJP's cumbersome GST w/5 tier Tax structure(5%,12%,18%,28%,43%), highest rates in the world, will hurt shopkeepers, traders, small business

- Shashi Tharoor (@ShashiTharoor) June 30, 2017

BJP's version of #GST excludes too many items, has too many rates, &eliminates UPA's 18% cap. Nation is unready for its hasty implementation

- Shashi Tharoor (@ShashiTharoor) June 30, 2017

#GstRollOut at midnight, still have Qs?

- NDTV (@ndtv) June 30, 2017

Log on to our special page for all #GST updates, interviews, #GSTFAQshttps://t.co/jAz3XFJEnupic.twitter.com/ZpNFTVwgFx

#Kerala CM Pinarayi Vijayan's statement on #gstrollouthttps://t.co/IGUmsTmCiz#GSTpic.twitter.com/rZaNNYssek

- CMO Kerala (@CMOKerala) June 30, 2017

At midnight with the GST a new direction will be given to the country's progress, PM Narendra Modi said while inaugurating a stadium in Gujarat.

We are in process of economic survey, which will come out in 3rd week of July. So we should wait. On the GST, there will be implementation challenges but whatever the impact wil be temporary. In the long term, it will boost growth potential substantially.

The scope for having uniform and lower rates are... the scope is enormous. In principal I think we should get down to you know something like, somewhere between 12, 13, 14 percent long term.

At some stage you know you can't keep talking about having a GST. You have to actually do it and then hope that things will improve over time.

I think that there's also the sense that now that it's going to happen, now that people know it's going to happen, the advantage of a credible deadline is that it just forces people to get to speed with preparation and I think probably in the last two to three weeks a lot of that has happened, obviously not fully but I expect that over time, next you know 3 to 6 months we should tide over these challenges.

For me the two big fixes will have to be

(1) the rates..I think we need to over time move to no more than two to three rates.

(2) But to me or equally more important is the base I think..land and real estate, power, health, education, alcohol petroleum, at some stage we have to aspire to bring all these into the net

Wider the base the more you bring down rates.

- The GST council has shown that it will work on basis of consensus. It is a democratic process.

- The quality and spirit of decision making has been remarkable

- States can still generate revenue from indirect taxes. They retain sovereignty.

After 17 years, a nationwide Goods and Services Tax (GST) will rollout from midnight tonight, overhauling India's convoluted indirect taxation system and unifying the $2 trillion economy with 1.3 billion people into a single market.

Read on to know the important events that led to its launch this midnight

#GST marks India's most comprehensive push towards formalisation and organisation of its economy: @arunmku, Chairman & CEO, @KPMGIndiapic.twitter.com/FSiQ0NYySK

- KPMG India (@KPMGIndia) June 30, 2017

GST panel has failed to deliver our PM @narendramodi 's One Nation One Tax message. GST has been made into a multiple n complex tax regime

- Kiran Mazumdar Shaw (@kiranshaw) June 30, 2017

Important FTP provisions in the context of the implementation of the GST regime applicable w.e.f. 01.07.2017https://t.co/M0hykFJElG

- DGFT (@dgftindia) June 30, 2017

GST will make the filing of returns easier for the people. For free assistance regarding GST, you can visit your nearest GST Seva Kendras. pic.twitter.com/4KzFxyALLe

- Piyush Goyal (@PiyushGoyal) June 30, 2017

- At the stroke of midnight on 14th August, 1947, India won her freedom. Now, at the midnight of 30th June, 2017, freedom and democracy stand to face grave danger.

- The mockery of Inspector Raj is back.

- I am shocked to find that the GST rules contain a rather draconian arrest clause which can lead to major harassment of business, particularly the small and medium, with some sections even being non-bailable too.

- Given the atmosphere in the country of vindictively targeting anyone who dares to disagree with the Central Government, I am deeply concerned that the arrest clause in GST may well be used to target business leaders who raise their voice of dissent on any policy matter or any practices.

"The protest is against the implementation of the law through an ordinance instead of discussing the same in the state assembly," Opposition leader Ramesh Chennithala said today.

At the dinner, Finance Minister Arun Jaitley will thank all the state Finance Minister who not only cooperated with the Centre but took every decision by consensus.

Prime Minister Narendra Modi will join in at the dinner after concluding his Gujarat trip.

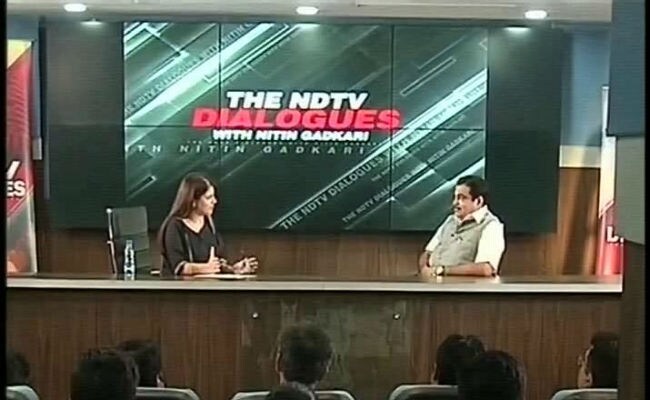

GST will increase growth as number of taxes and cesses will reduce and number 2 (illegal) transactions will end.

Digital currency is now the (preferred) currency, so, every transaction is recorded and they (companies, restaurants) now have to pay the tax.

Revenue will increase and we can use the money for the people and economy.

- Companies with turnover upto 20 lakh, there is no GST but those with turnover upto 75 lakh, 1-3 %

- Sanitary napkins, produced by multi-national companies- and hence they have to pay taxes.

- There are thousands of women self-help groups that manufacture sanitary napkins. We need to promote SMSEs and these groups too.

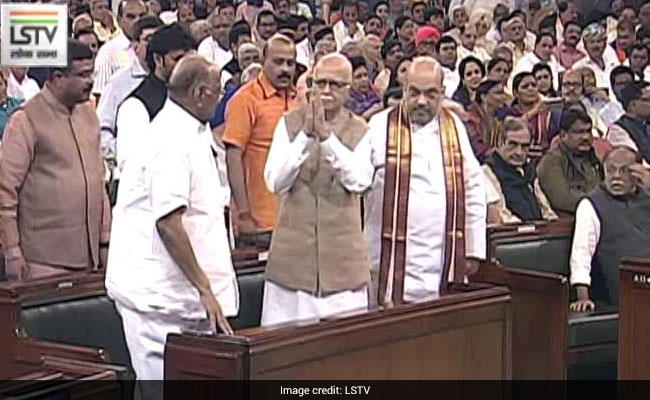

- Amit Mitra is a good man. But due to political compulsions he is saying that. (He is boycotting the GST launch)

- GST was unanimously supported by all. It is time for people to support it. Do not think politically on this subject.

- Before GST, there were 70% number 1 (legal) transaction, 30% number 2 (illegal) transactions. With GST, there will be 90% number 1 transactions.

- States will get 10-20% more taxes.

- Once more number of people pay taxes, we will eventually get to reduce rates.

- Due to GST, there is an abolishment of 17 taxes and 22 cesses. This is a relief to investors.

- Take the example of sugar. Compare the prices of sugar in Delhi pre-GST and post-GST. You will get the answer.

- The Finance Minister has given assurance that any cost - cost of GST - would not increase than previous rates levied by states.

- The Congress Chief Ministers and Finance Ministers in state assemblies and Congress in parliament supported the bill. Now they call it a 'tamasha'. This is a political compulsion. They once said GST is their child, now they are criticising their own child.

- When I was BJP chief, our party was convinced and supported GST.

- But there was a provision that tax would be collected by union and distributed to state. This was objected by Mr Modi, then Gujarat CM and Shivraj Chouhan, Madhya Pradesh Chief Minister.

- We conveyed it to Pranab Mukherjee, then Finance Minister.

- It is important to give a new economic approach to the country.

- This revolutionary decision taken by the country, with the support of all parties.

Watch live: @nitin_gadkari to NDTV on #GST, midnight #gstrollout#FacebookLive on https://t.co/QV4m2vmiIZ or https://t.co/hMlRpgrUU6pic.twitter.com/AlST3eFQA6

- NDTV (@ndtv) June 30, 2017

'#GST half-baked,' says @OfficeOfRG; his party says boycott of launch is on | #gstrollouthttps://t.co/8SbqybjKQopic.twitter.com/5CO6ulWEJp

- NDTV (@ndtv) June 30, 2017

While the rollout day of July 1 will be known as 'GST Day', all the offices of the Central Board of Excise and Customs (CBEC) have been instructed to be open on Saturday as a trade facilitation measure.

"July one will be known as 'GST Day' and celebrated in all offices of CBEC just as we celebrate Central Excise Day and International Customs Day," CBEC Special Secretary and Member S Ramesh said.

With implementation of #GST cost of holidaying is going to come down considerably- Udhay S, CFO, @WorldOfSterlinghttps://t.co/jJ4iWKYFqx

- CII (@FollowCII) June 30, 2017

How will #GST impact the #realestate in India? #GSTMegaDebate#gstrollout Watch @istee decode with experts at 7&11 PM on @NDTVPrimepic.twitter.com/2suhCHsglg

- NDTVPropertyShow (@NDTVProperty) June 30, 2017

Sales tax department has started help line for #GST queries, anyone can call the num 1800225900 , informed Finance Minister @SMungantiwarpic.twitter.com/D2Wxg0U6bw

- MAHA INFO CENTRE (@micnewdelhi) June 30, 2017

The bandh call was given by Uttar Pradesh Udyog Vyapar Pratinidhi Mandal, which also got the support of around 50 trade organisations.

The traders alleged the bandh caused a loss of over Rs 2,000 crore.

GST would make doing business in the country tax neutral, irrespective of the choice of place of doing business #GSTrollout

- Suresh Prabhu (@sureshpprabhu) June 30, 2017

GST roll-out - Complete transformation of the Indirect Taxation Landscape;Some minute details of how it happened. https://t.co/2HnxfKqm8l

- Ministry of Finance (@FinMinIndia) June 30, 2017

101 #GST Help Desks have been set up by commercial tax dept. & 300+ work shops organised across the state to educate people for #GSTrollout.

- ShivrajSingh Chouhan (@ChouhanShivraj) June 30, 2017

Housing prices will come down after the GST rollout, Union Minister M Venkaiah Naidu today said, while expressing confidence that the landmark tax regime along with property law will bring big relief to home buyers.

My SandArt at Puri beach on #GST ,ONE NATION. ONE TAX. ONE MARKET . #WelcomeGSTpic.twitter.com/IKoV8d3IBm

- Sudarsan Pattnaik (@sudarsansand) June 30, 2017

We are not against #GST, But has the Govt prepared for GST? Have they helped small businessmen comply with GST?: @AnandSharmaINC#GSTTamashapic.twitter.com/7HohvchGHK

- INC India (@INCIndia) June 30, 2017

Madhya Pradesh traders on strike ahead of GST rollout https://t.co/E7tZzYzcdbpic.twitter.com/eQLBg2qRGC

- NDTV (@ndtv) June 30, 2017

Stays at five-star hotels could also get costlier. The GST rate of 18 per cent will apply on hotel rooms with tariff ranging between Rs. 2,500 and Rs. 7,500. The highest tax rate of 28 per cent is assigned to tariffs of Rs. 7,500 and above.

Currently, domestic hospitality industry pays tax in the range of 18-25 per cent, which includes luxury tax and service tax. Hotels and lodges that charge Rs. 1,000 a day or less are exempted from the GST, while those charging from Rs. 1,000 to Rs. 2,500 will be taxed at 12 per cent.

In further relief to small businesses, under the composition scheme, they will benefit from not having to meet with detailed compliances under GST. However, they will not get the benefit of input tax credit.

With a special session of the Parliament at midnight of June 30 to usher in GST, aren't we poised for a dramatic transformation into...1>2

- Shatrughan Sinha (@ShatruganSinha) June 30, 2017

...a brand new tax regime. Hope wish & pray that everything goes well with the implementation post roll-out & there are minimal problems.2>3

- Shatrughan Sinha (@ShatruganSinha) June 30, 2017

..and lesser confusion specially for small traders, small & medium business enterprises, the lesser fortunate & lesser literate who may..3>4

- Shatrughan Sinha (@ShatruganSinha) June 30, 2017

..find it difficult to handle computers & digitisation...

- Shatrughan Sinha (@ShatruganSinha) June 30, 2017

and of course the common citizens of the nation. Congrats & Jai Hind! #gstrollout

#GST is a reform that is in interest of common man,traders,industry & the whole country. You need to be patient : @arunjaitley

- BJP Bengal (@BJP4Bengal) June 30, 2017

But like demonetisation,GST is being executed by an incompetent&insensitive Govt w/o planning foresight &institutional readiness #GSTTamasha

- Office of RG (@OfficeOfRG) June 30, 2017

Why has Team India consensus on GST shattered?Mamata's key minister Amit Mitra who led GST committee explainshttps://t.co/AANKMBOOYD

- sonia singh (@soniandtv) June 30, 2017

GDP growth will increase by 1-2% because of GST

Those businessmen and traders who do not understand are complicating the GST. It is quite simple and the IT platform that has been laid out is very good.

India deserves a #GST rollout that does not put crores of its ordinary citizens, small businesses & traders through tremendous pain &anxiety

- Office of RG (@OfficeOfRG) June 30, 2017

GST to boost steel sector: Minister for Steel Chaudhary Birender Singh https://t.co/A2A8D1eXY2

- FICCI (@ficci_india) June 30, 2017

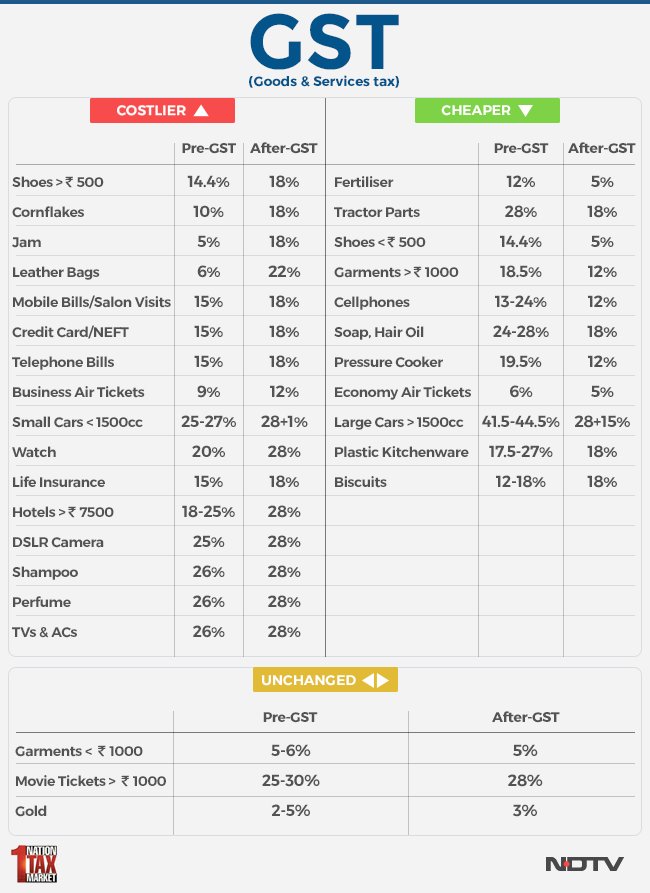

- There are some areas where the tax percentage has been increased marginally, but there are many areas where taxes have been lowered as well.

- So, let us not see this selectively and ignore the other.

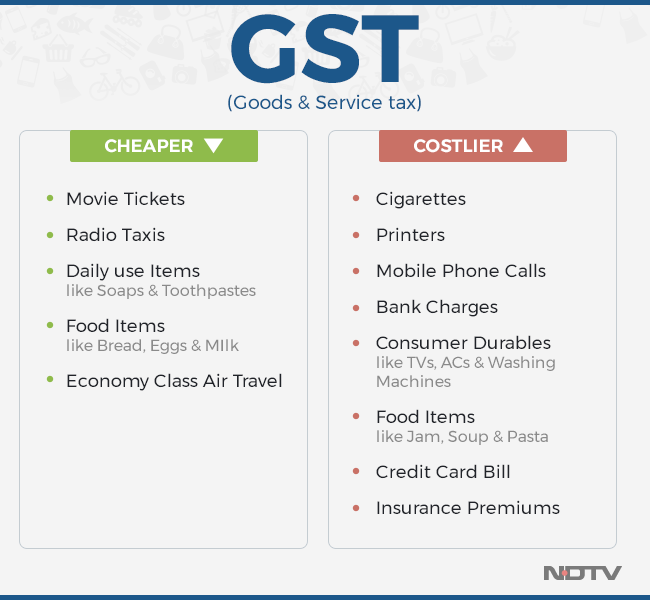

Here's a look at what gets expensive and what gets cheap

- GST is far simpler to the existing tax structure.

- The multiplicity of taxes at the state level has been done away with... similarly at the central level. Instead of traders having to file multiplicity of returns like they did till now, they will no longer have to do so.

- Yes, there are multiple forms to fill now, but the overall process is far simpler.

Watch | Policymaker Shaktikanta Das talks to NDTV ahead of #GST rollout.

- NDTV (@ndtv) June 30, 2017

Live on: https://t.co/hMlRpgak2y or on NDTV 24x7 pic.twitter.com/vPml3Bvbp6

- Over the last 6-8 months, there have been a number of awareness and outreach programs for trades.

- The preparation has been quite adequate.

- Since it is such a massive reform, there will always be some traders who have legitimate concerns, but they don't need to worry. Their concerns will be addressed.

Colouring books makes kids to forget pain of being in Hospital. No GST on Children's colouring books. Thank you PM @narendramodi#gstrolloutpic.twitter.com/lApAeugshZ

- Uday Foundation (@udayfoundation) June 30, 2017

'We must celebrate,' says Niti Aayog member Bibek Debroy, speaking to NDTV on #GST rollout. pic.twitter.com/P5ZP58OGKy

- NDTV (@ndtv) June 30, 2017

Some segments of industry dilly-dallied because they didn't believe that the July 1 deadline would be met. Now that the deadline is being met, they find themselves on the wrong foot.

- It is the biggest reform. Other countries have taken years to roll it out.... There will be some problems initially, but things will settle soon.

- Very limited number of countries have GST. Most countries have VAT, but that is somewhat different.

- Even among the countries that have the GST, Canada is the only other country that has a similar federal structure, and that too not as diverse as that of India.

LIVE: NDTV Exclusive With Niti Aayog's Bibek Debroy on #GST launch.

- NDTV (@ndtv) June 30, 2017

Watch on: https://t.co/hMlRpgak2y or on NDTV 24x7 pic.twitter.com/NpdwtZwPjg

Party's over, folks! For those who do not pay taxes even after running a business, will now be in a soup.

But the country's biggest tax reform since independence is promising to bring millions of firms into the tax net, boosting government revenues and India's sovereign credit profile.

The new tax will require firms to upload their invoices every month to a portal that will match them with those of their suppliers or vendors.

Read on to know more

Meanwhile, if you have any queries, write to askaboutGST@ndtv.com or call us at 011-29249911, a panel of experts live on NDTV 24x7 will attend to your queries in real time.

If you are planning to stay up late and tune in for the launch at the stroke of midnight, you can watch it live on Lok Sabha TV, Doordarshan. It will be webcast on NDTV.com as well

Congress decision of boycotting #GSTLaunch ceremony is condemnable & difficult to understand. Their FMs also contributed in making the Act.

- ShivrajSingh Chouhan (@ChouhanShivraj) June 30, 2017

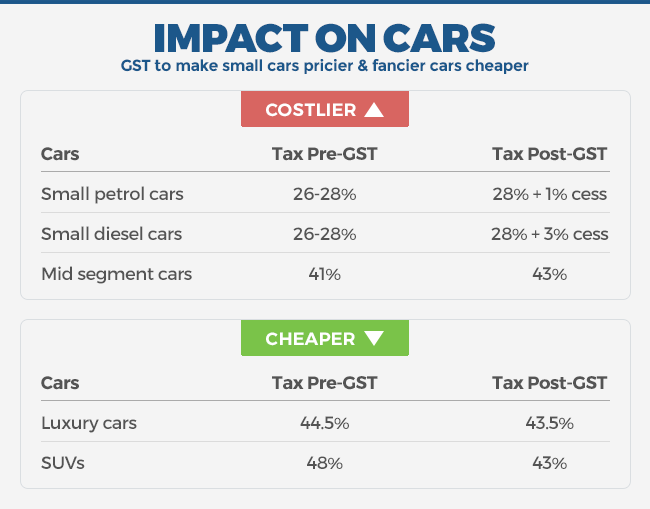

Here's how GST will impact cars

I am one of the members in GST council. I urged them to keep lowest tax rate. Higher tax rates will encourage dishonesty, grey market, Delhi's Deputy Chief Minister Manish Sisodia tells NDTV

What is the need to increase tax rates so much... taxes on food and clothing. Is this necessary? I have said this in meetings earlier and am saying so today as well.

Learn some simple steps for Return filing under #GST . pic.twitter.com/O2a129V6uC

- Ravi Shankar Prasad (@rsprasad) June 30, 2017

After GST rollout, many items like footwear below Rs. 500, garments and mobile phones could become cheaper. On the other hand, items like TV and small cars could become costlier.

Petroleum products such as petrol, diesel and aviation turbine fuel have been kept out of GST as of now. The GST Council will take a decision on it at a later date. Alcohol has also been kept out of GST.

Read on to know more

It's alarming that the GSTN Chairman doesn't think there is time to test software which will handle #GST

- AAP (@AamAadmiParty) June 30, 2017

: @msisodia at #TrystWithTaxpic.twitter.com/hR3mVdp3Ar

Opposition parties like the Congress, the Left, West Bengal Chief Minister Mamata Banerjee's Trinamool Congress, DMK and Lalu Yadav's RJD are boycotting the event.

The Samajwadi Party is unsure about whether it would attend the function. It would be known "later in the day", senior party leader Naresh Agarwal was quoted as saying by news agency PTI.

K.E. Raghunathan, a Chennai-based business owner and president of the All India Manufacturers Association says "We are not ready."

"We do expect tremendous chaos," he added.

With the deadline looming, protests and industrial strikes broke out across the country over tax rates and compliance burdens. In the states of Tamil Nadu, Gujarat and Rajasthan, tens of thousands of textile workers went on strike, while the association that represents sellers of seeds, pesticides and fertilizers protested in the agricultural state of Punjab.

Officials at GST Seva Kendra office of the Commissioner of Excise and Service tax work for the implementation of Goods and Services Tax (GST) in Bengaluru

Behind white and blue cubicles, professionals with expertise in IT and taxation are putting in extra hours to ensure that the switch over to GST is a smooth affair. The biggest task for GSTN - a not-for-profit company set up to manage and collect indirect taxes - is to help traders and businessmen migrate to the GST platform.

For those of you following GST already, a gong will be your official sign that the Goods and Services Tax (GST), India's biggest tax reform, is launched at in the Central Hall of Parliament.

................................ Advertisement ................................

News

More- Tuesday February 17, 2026

The wholesale PV growth is likely to grow by 5-7 per cent in FY26, supported by improved affordability following GST rate cuts.

- Written by Gadgets 360 Staff | Friday February 13, 2026

Written and directed by Srujan Lokesh, GST: Ghosts in Trouble is a comedy-drama film that explores the themes of comedy, transformation, and drama.

- Written by Akarsh Anant | Wednesday February 11, 2026

India's automobile sector contributes 15% of GST revenue, supports 30 million jobs, and posted strong 2025 production, sales, and export figures across all categories. Here's a detailed report you must check out.

- Edited by Priyanka Negi | Tuesday February 10, 2026

The Ministry of Skill Development offers free one-month online internships in the BFSI sector for Class 12 pass candidates, covering GST, income tax, financial reporting, stock market analysis, and financial modelling.

- Indo-Asian News Service | Thursday February 05, 2026 , New Delhi

The Goods and Services Tax (GST) exemption of lifesaving cancer drugs and higher taxation on tobacco products are the steps aimed at strengthening public health in the country, according to a new study led by oncologists from

- Written by NDTV News Desk | Sunday February 01, 2026

Refunds cooled, slipping 3.1 percent to Rs 22,665 crore. Domestic refunds fell 7.1 percent, while export refunds inched up 2.9 percent.

- Sunday February 01, 2026

FM Nirmala Sitharaman Speech: Nearly Rs 1 lakh crore has evaporated from the ITC's market value in a month as the stock plunged close to 20 per cent after the sharp cigarette tax hike unveiled in late December.

- Edited by Srishti Singh Sisodia | Sunday February 01, 2026

Key changes from February 2026: FASTag KYC verification will be removed; banks will verify vehicle details at activation. Check Details

- Written by Nithya P Nair , Edited by David Delima | Wednesday January 28, 2026

GST Portal is the final destination for GST registration, return filing, tax payments, refunds, and other compliance-related activities. It is the official platform for interacting with GST authorities. Here is a step-by-step guide on how to log in to the GST portal. Users can verify their identity using the OTP sent to their registered mobile number or email.

- Tuesday January 27, 2026

In a sharp escalation of the row involving Shankaracharya Swami Avimukteshwaranand Saraswati and Yogi Adityanath, an Ayodhya bureaucrat has resigned, saying he is doing this in support of the Uttar Pradesh chief minister, the PM and the Constitution.

Opinion

MoreOpinion | Why States, Not Centre, Should Get All The Credit For GST 'Savings'Derek O’Brien

Wednesday October 22, 2025Amidst all the hoopla, it is the State governments that truly deserve recognition for coming together for the GST revision. Because the States are the ones bearing the brunt of massive revenue losses.

Opinion: GST Cut, Inflation Under Control: Optimism As Festival Season ApproachesBharti Mishra Nath

Friday September 19, 2025Away from politics, floods, rain-related tragedies and the Trump tariffs, there is optimism in the air. With GST rationalized, inflation in control, the upcoming festival season promises good times.

Opinion | Next-Generation GST: A Reform That Places The Middle Class At The CentrePradeep Bhandari

Saturday September 06, 2025By ensuring both direct tax relief and rationalised indirect taxes, the government has empowered the common citizen to save more, spend more, and aspire more.

Opinion | Observations From A Student of Political Communication - By Derek O'BrienDerek O’Brien

Friday September 05, 2025For a student of political communication, this week has been fodder. The language used to describe GST reforms has been nothing short of grand. "Landmark". "Biggest ever since the 1990s". The Opposition has been advocating for such 'reforms' for eigh

................................ Advertisement ................................