5 Delhi-NCR Sweet Shops You Can't Miss This Monsoon For Irresistible Ghevar

Monsoon and ghevar - a match made in sweet-tooth heaven! This Rajasthani delicacy has become a must-have during the rainy season, especially during festivals like Rakhi and Teej. Picture this: a batter of refined flour sizzling in pure desi ghee, creating a crispy and delightful treat. But wait, there's more! Ghevar isn't just a one-size-fits-all affair. From plain to malai to kesar, there's a ghevar for every craving. So, if you're ready to embark on a ghevar adventure, check out these five legendary spots in Delhi-NCR where you can get your hands on the most delicious ghevar ever:

Central Delhi's Bengali Sweet House is no stranger to culinary excellence, and their ghevar is here to prove it. With a price of around Rs. 600 per kilogram, this ghevar will have you swooning from the first bite. From snacks to sweets, this iconic shop knows how to win hearts - one ghevar at a time.

Tucked away in the charming streets of Chandni Chowk, Chaina Ram Sindhi Confectioners is a ghevar paradise. Their khoya ghevar is a crowd favourite, so good that you might want to gift it to your relatives (if you're willing to part with it!). But be ready to splurge a bit; these delectable delights come at a price tag of more than Rs. 600.

For generations, Nathu has upheld a reputation for its exceptional quality sweets, evident through its widespread presence across numerous outlets. Indulge in a diverse selection, ranging from the classic plain to the delectable malai ghevar. The sweet shop offers different varieties of ghevar such as plain, malai, mawa, and kesar. Moreover, there are other mouth-watering options to try like kaju katli, sohan halwa, gujia, laddu, and more.

................................ Advertisement ................................

Opinion

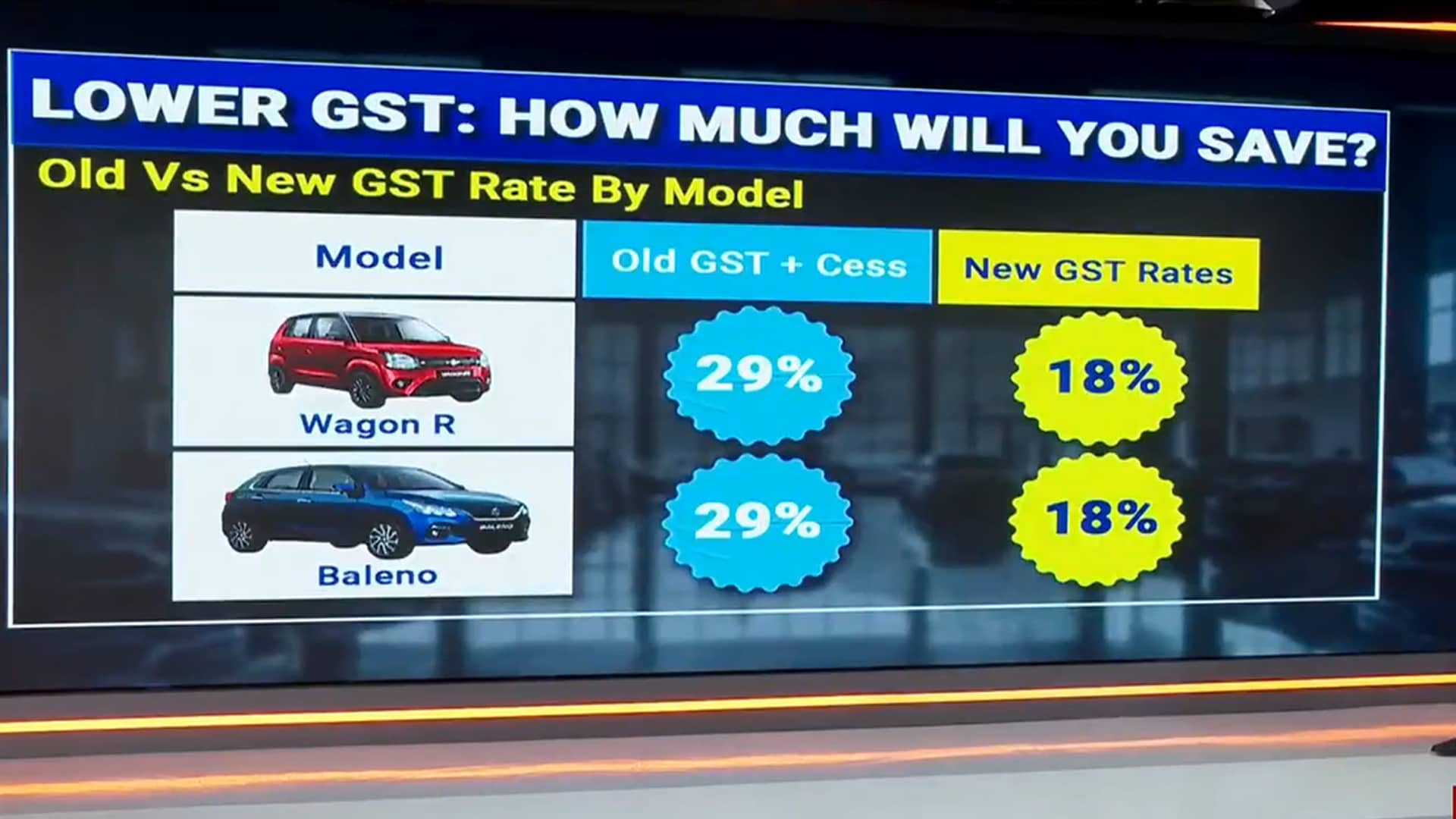

GST Reforms 2025: What A Tax Cut On Vehicles Means For India's Auto Industry

Tuesday August 19, 2025The Indian automotive industry could soon witness a GST cut on cars, and here's what the cut holds for the buyers and manufacturers.

दूसरी आज़ादी लाई GST - पहले परांठा, अब आटा, हीरे पर कम, स्याही पर ज़्यादा...Ravish Kumar

Tuesday July 19, 2022मोहम्मद ज़ुबैर का केस कानून की प्रक्रिया को लेकर एक गंभीर बहस का मुद्दा बन गया है. महंगाई से लेकर मुकदमे का एक ही हाल है.अब तो चीफ जस्टिस भी कह रहे हैं कि जल्दबाज़ी में गिरफ्तारी होने लगी है.

Opinion: GST, Historical Tax Reform, At 5 Years, Has Lost Its WayAndy Mukherjee | Bloomberg

Thursday July 07, 2022Five years ago, India's federal and state governments struck a historic deal. From July 1, 2017, a uniform tax on goods and services - marketed by Prime Minister Narendra Modi as "One Nation, One Tax, One Market" - replaced a bewildering array of loc

Opinion: In GST Row, Centre Throws Nationalism Argument At StatesPraveen Chakravarty

Monday August 31, 2020Rules by bureaucrats, legalese by lawyers and analysis by economists are cold, futile methods to resolve this crisis when the need of the distressed hour is a warm, empathetic hand of the political leadership.

Latest Videos

MoreNews

More- Indo-Asian News Service | Thursday August 28, 2025

BMI, a Fitch Solutions company, said India is likely to remain one of the fastest-growing emerging market economies in Asia through this decade.

- Monday August 25, 2025 , New Delhi

PM Narendra Modi announced on August 15 to bring "next-generation" GST reforms that will reduce the tax burden across the country.

- Press Trust of India | Saturday August 23, 2025 , New Delhi

The high-powered GST Council, chaired by Finance Minister Nirmala Sitharaman, will meet on September 3-4 to discuss moving to a two-slab taxation.

- Friday August 22, 2025

The Centre's proposed reduction in GST is also expected to lead to a drop in costs for car buyers, reducing on-road prices as well as EMIs.

- ANI | Saturday August 23, 2025 , New Delhi

Proposed GST cuts on petrol and diesel vehicles could reduce EVs price advantage, slowing adoption while causing major revenue losses for the government - HSBC.

- Indo-Asian News Service | Thursday August 21, 2025

A key meeting of the Group of Ministers (GoM) on GST rate rationalisation on Thursday ended with state finance minister accepting the Centre's plan to reduce the number of tax slabs.

- Indo-Asian News Service | Thursday August 21, 2025 , New Delhi

Over 50 million Micro, Small and Medium Enterprises in India, who have GST and Business PAN (B-PAN), can have digital procurement access through Amazon Business ahead of the upcoming festive season, the global e-commerce giant said on Thursday

- Press Trust of India | Wednesday August 20, 2025 , New Delhi

The Lok Sabha on Wednesday passed a legislation to ban online games played with money as it looks to check rising instances of addiction, money laundering and financial fraud through such applications.

- Press Trust of India | Wednesday August 20, 2025 , New Delhi

The Centre has proposed exempting life and health insurance premium from GST, Bihar Deputy Chief Minister and convenor of insurance GoM Samrat Choudhary said on Wednesday.

- Indo-Asian News Service | Tuesday August 19, 2025 , New Delhi

Finance Minister Nirmala Sitharaman is likely to present the Centre's proposal for rationalising goods and services tax (GST) rates before a Group of Ministers (GoM) at a two-day meeting starting August 20 in the national capital.

................................ Advertisement ................................