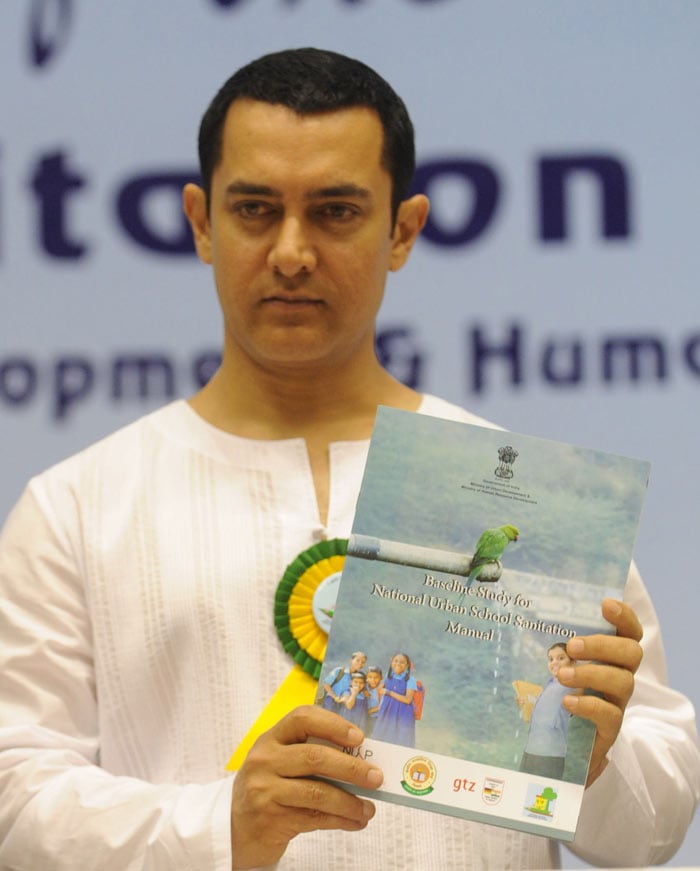

Aamir to promote cleanliness in schools

Bollywood star Aamir Khan was Tuesday appointed sanitation brand ambassador to promote cleanliness in all Central Board of Secondary Education (CBSE) schools across India - but not without being mobbed by his young fans.

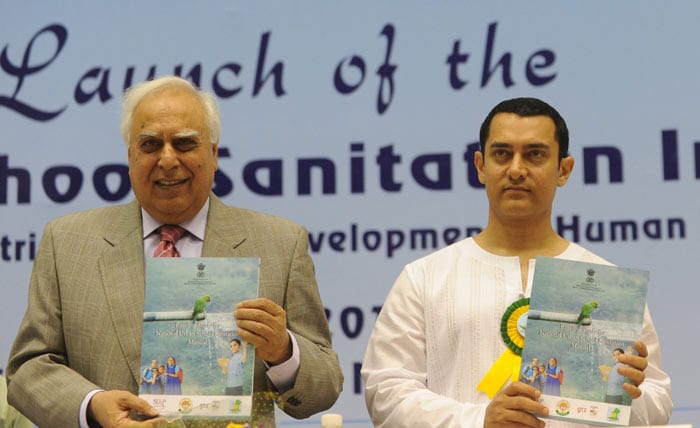

However, after the programme got over, hundreds of students mobbed the actor while asking for his autograph. With little security at his disposal, the situation became quite unmanageable. But Sibal came to the rescue of the actor and took him away from the conference hall. Earlier, Sibal had announced that health and wellness clubs would be set up in all schools for better sanitation practices. (Photo: AFP)

"With this initiative, we will create awareness about sanitation at the school level. Students are change agents and we are targeting them," Reddy said.

The initiative is a collaboration between the HRD ministry and the urban development ministry. It is estimated that 17 percent of the urban population in the country has no access to sanitation facilities, while 50-80 percent of the wastewater is disposed untreated. (Photo: AFP)

................................ Advertisement ................................

Opinion

Opinion | Why States, Not Centre, Should Get All The Credit For GST 'Savings'Derek O’Brien

Wednesday October 22, 2025Amidst all the hoopla, it is the State governments that truly deserve recognition for coming together for the GST revision. Because the States are the ones bearing the brunt of massive revenue losses.

Opinion: GST Cut, Inflation Under Control: Optimism As Festival Season ApproachesBharti Mishra Nath

Friday September 19, 2025Away from politics, floods, rain-related tragedies and the Trump tariffs, there is optimism in the air. With GST rationalized, inflation in control, the upcoming festival season promises good times.

Opinion | Next-Generation GST: A Reform That Places The Middle Class At The CentrePradeep Bhandari

Saturday September 06, 2025By ensuring both direct tax relief and rationalised indirect taxes, the government has empowered the common citizen to save more, spend more, and aspire more.

Opinion | Observations From A Student of Political Communication - By Derek O'BrienDerek O’Brien

Friday September 05, 2025For a student of political communication, this week has been fodder. The language used to describe GST reforms has been nothing short of grand. "Landmark". "Biggest ever since the 1990s". The Opposition has been advocating for such 'reforms' for eigh

Latest Videos

MoreNews

More- Saturday January 10, 2026

Restaurants cannot charge more than the printed MRP for packaged items such as bottled water, irrespective of service, surroundings or dining experience.

- Indo-Asian News Service | Friday January 09, 2026 , New Delhi

The Centre has told the Delhi High Court that matters relating to the rate, classification, and reduction of Goods and Services Tax (GST) on air purifiers fall exclusively within the domain of the GST Council.

- Thursday January 08, 2026 , New Delhi

The recovery in auto component is expected to be driven by improved vehicle sales after the GST cut, which has eased cost pressures and supported consumer demand.

- Reported by Ashish Kumar Pandey | Wednesday January 07, 2026

A Congress leader and transport company executive has been arrested in connection with a GST evasion case involving more than Rs 28 crore, officials from the Directorate General of GST Intelligence (DGGI) said.

- Written by NDTV Auto Desk | Sunday January 04, 2026

Audi India closed 2025 with 4,510 sales, driven by festive demand, SUV growth, preowned business momentum, and steady traction across flagship and popular models.

- Edited by Priyanka Negi | Sunday January 04, 2026 , New Delhi

Candidates with a relevant engineering degree under 28 years (General/EWS) are eligible. Selection will be through a written exam at BEL Ghaziabad. SC, ST, PwBD candidates are fee exempt.

- Written by Toshita Sahni , Edited by Neha Grover | Friday January 02, 2026

Service charges on bills are not mandatory in restaurants in India. A Mumbai restaurant was recently fined Rs 50,000 for failing to follow the established guidelines. Here's what customers should know.

- Indo-Asian News Service | Thursday January 01, 2026 , New Delhi

Vodafone Idea on Thursday said it has received a GST penalty order of Rs 637.91 crore, passed under Section 74 of the Central Goods and Services Tax Act (CGST), 2017.

- Press Trust of India | Wednesday December 31, 2025 , New Delhi

The country's largest airline IndiGo on Tuesday said authorities have slapped a GST penalty of over Rs 458 crore, and that it would contest the decision.

- Indo-Asian News Service | Tuesday December 30, 2025 , New Delhi

The GST Council may consider cutting goods and services tax on air and water purifiers for domestic use from 18 per cent to 5 per cent, reclassifying them as essential items rather than discretionary consumer goods.

................................ Advertisement ................................