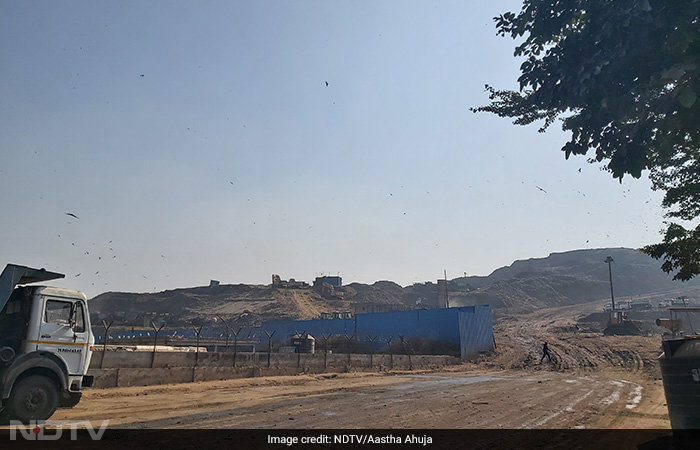

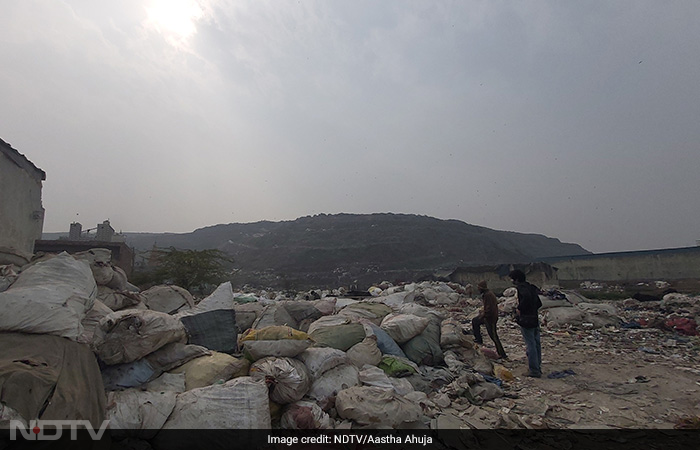

Garbage Mountains - Dotting The Landscape Of Delhi

Ghazipur, Bhalswa and Okhla - the three dumpsites in Delhi have collectively caused nearly Rs. 450 crore in damage to the environment. Can the national capital get rid of dumpsites and manage its waste effectively?

The National Capital Territory of Delhi is home to over 16 million people, as per the 2011 Census of India. A vast population comes with the challenges of a lack of infrastructure to cope with this surge and its fallout. One of the crises of this ever-growing nature of Delhi is the sheer volume of waste the city generates and its lack of proper disposal.

Delhi generates 11,332 tonnes of Municipal Solid Waste per day, as per the Municipal Corporation of Delhi. This includes 11,000 TPD (Tonnes Per Day) from the Municipal Corporation of Delhi (East, South and North Delhi Municipal Corporation), 260 TPD is generated by the New Delhi Municipal Council and 72 TPD comes from the Delhi Cantonment Board.

Following waste collection, it is treated using different techniques. Of the 11,332 TPD (Tonnes Per Day) of fresh waste, 53.64 percent or 6,078.5 TPD is processed at four waste-to-energy plants, 38.47 percent (4,360 TPD) is disposed of at the dumpsites, 5.49 percent (622.4 TPD) is processed at composters, biogas plants, organic waste convertors and compost pits, and the remaining 2.39 percent (271 TPD) is recycled through 170 Material Recovery Facilities (MRFs).

Ghazipur, the oldest dumpsite in Delhi, was commissioned in 1984 and crossed the permissible height of 20 meters in 2002. It has been overflowing since then and stands at around 40 meters, as per the MCD. Similarly, Bhalswa dumpsite, started in 1995, exceeded its capacity in 2006 and Okhla dumpsite commissioned in 1996 was declared exhausted in 2010. Ghazipur and Bhalswa continue to receive a fresh set of waste every day.

As per the report prepared by the joint committee comprising the Central Pollution Control Board (CPCB), National Environmental Engineering Research Institute, and IIT Delhi, the three dumpsites have collectively caused nearly Rs. 450 crore in damage to the environment. The study assessed the ecological damage due to Bhalswa dumpsite at Rs 155.9 crore, Okhla at Rs 151.1 crore and Ghazipur at Rs 142.5 crore.

Since 2019, a total of 69.64 lakh tonnes of legacy waste has been bio-mined at three sites. This means 24.87 per cent of the 280 lakh tonnes of waste dumped has been removed as on January 31, 2023. If all three contractors achieve the target of removing 90 lakh tonnes collectively by May 2024 even then roughly half of the piled-up waste will remain on these sites and will need to be addressed.

The Delhi government is targeting to remove the three garbage mountains in two years and has allocated Rs. 850 crore for flattening the sites. During the Delhi Government's budget presentation on March 22, Finance Minister Kailash Gahlot announced the ambitious deadline for clearing all three dumpsites by the end of 2024. Mr Gahlot said, that the Okhla dumpsite will be removed by December 2023, Bhalswa by March 2024 and Ghazipur by December 2024.

In March 2023, Chief Minister Arvind Kejriwal visited Okhla and Bhalswa dumpsites. He said that the government is aiming to clear the Okhla dumpsite by December 2023 against the target of May 2024 and clean up the Bhalswa site by March 2024. He said more Waste-to-Energy plants are being established to deal with future municipal solid waste. He said, "In most waste-to-energy plants, segregation of waste is not necessary anymore."

................................ Advertisement ................................

Opinion

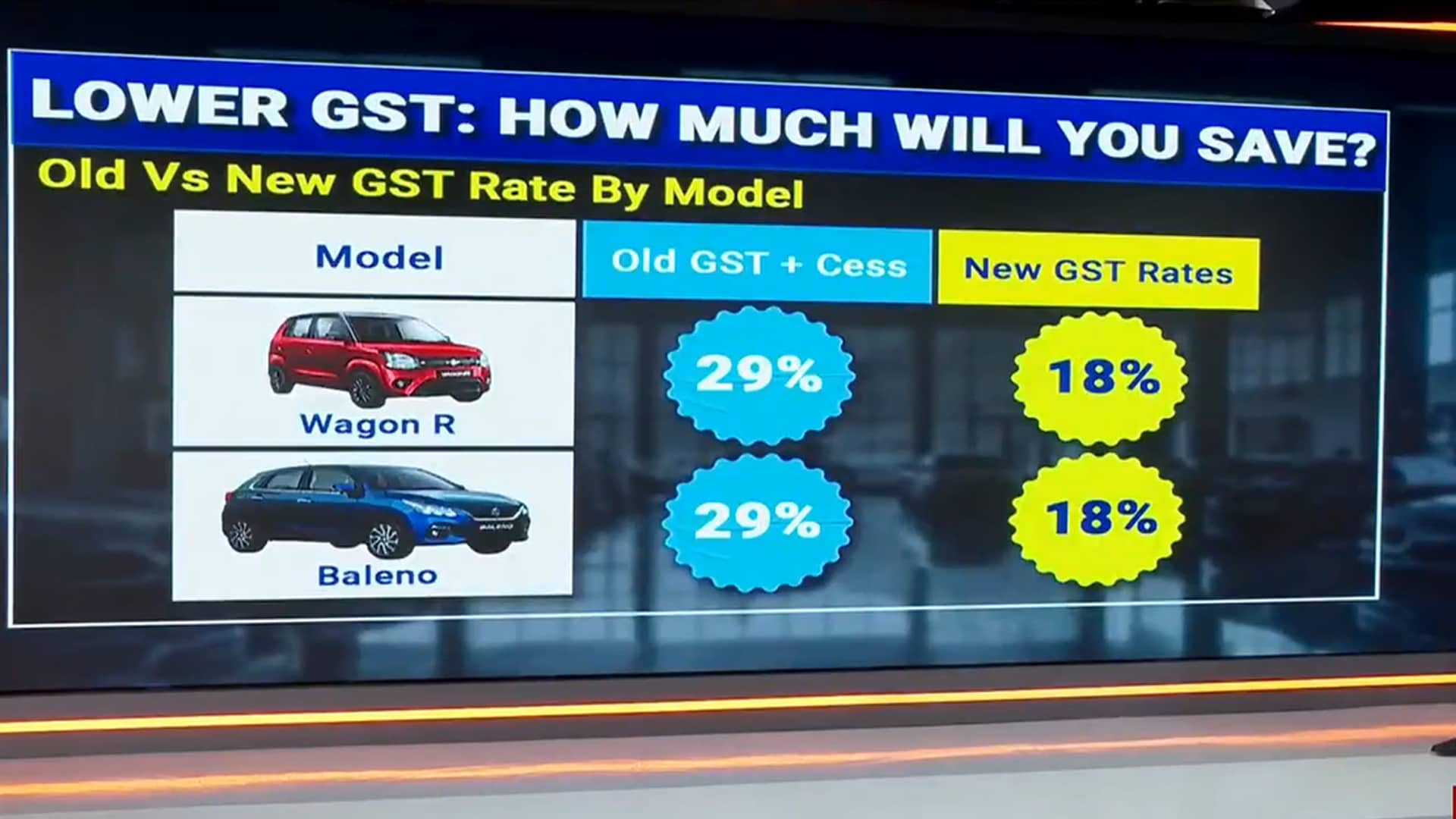

GST Reforms 2025: What A Tax Cut On Vehicles Means For India's Auto Industry

Tuesday August 19, 2025The Indian automotive industry could soon witness a GST cut on cars, and here's what the cut holds for the buyers and manufacturers.

दूसरी आज़ादी लाई GST - पहले परांठा, अब आटा, हीरे पर कम, स्याही पर ज़्यादा...Ravish Kumar

Tuesday July 19, 2022मोहम्मद ज़ुबैर का केस कानून की प्रक्रिया को लेकर एक गंभीर बहस का मुद्दा बन गया है. महंगाई से लेकर मुकदमे का एक ही हाल है.अब तो चीफ जस्टिस भी कह रहे हैं कि जल्दबाज़ी में गिरफ्तारी होने लगी है.

Opinion: GST, Historical Tax Reform, At 5 Years, Has Lost Its WayAndy Mukherjee | Bloomberg

Thursday July 07, 2022Five years ago, India's federal and state governments struck a historic deal. From July 1, 2017, a uniform tax on goods and services - marketed by Prime Minister Narendra Modi as "One Nation, One Tax, One Market" - replaced a bewildering array of loc

Opinion: In GST Row, Centre Throws Nationalism Argument At StatesPraveen Chakravarty

Monday August 31, 2020Rules by bureaucrats, legalese by lawyers and analysis by economists are cold, futile methods to resolve this crisis when the need of the distressed hour is a warm, empathetic hand of the political leadership.

Latest Videos

MoreNews

More- Indo-Asian News Service | Thursday August 28, 2025

BMI, a Fitch Solutions company, said India is likely to remain one of the fastest-growing emerging market economies in Asia through this decade.

- Monday August 25, 2025 , New Delhi

PM Narendra Modi announced on August 15 to bring "next-generation" GST reforms that will reduce the tax burden across the country.

- Press Trust of India | Saturday August 23, 2025 , New Delhi

The high-powered GST Council, chaired by Finance Minister Nirmala Sitharaman, will meet on September 3-4 to discuss moving to a two-slab taxation.

- Friday August 22, 2025

The Centre's proposed reduction in GST is also expected to lead to a drop in costs for car buyers, reducing on-road prices as well as EMIs.

- ANI | Saturday August 23, 2025 , New Delhi

Proposed GST cuts on petrol and diesel vehicles could reduce EVs price advantage, slowing adoption while causing major revenue losses for the government - HSBC.

- Indo-Asian News Service | Thursday August 21, 2025

A key meeting of the Group of Ministers (GoM) on GST rate rationalisation on Thursday ended with state finance minister accepting the Centre's plan to reduce the number of tax slabs.

- Indo-Asian News Service | Thursday August 21, 2025 , New Delhi

Over 50 million Micro, Small and Medium Enterprises in India, who have GST and Business PAN (B-PAN), can have digital procurement access through Amazon Business ahead of the upcoming festive season, the global e-commerce giant said on Thursday

- Press Trust of India | Wednesday August 20, 2025 , New Delhi

The Lok Sabha on Wednesday passed a legislation to ban online games played with money as it looks to check rising instances of addiction, money laundering and financial fraud through such applications.

- Press Trust of India | Wednesday August 20, 2025 , New Delhi

The Centre has proposed exempting life and health insurance premium from GST, Bihar Deputy Chief Minister and convenor of insurance GoM Samrat Choudhary said on Wednesday.

- Indo-Asian News Service | Tuesday August 19, 2025 , New Delhi

Finance Minister Nirmala Sitharaman is likely to present the Centre's proposal for rationalising goods and services tax (GST) rates before a Group of Ministers (GoM) at a two-day meeting starting August 20 in the national capital.

................................ Advertisement ................................