Inside Pics of Arpita's Mandi Reception, Starring Salman Khan

Salman Khan attended Arpita's reception in Mandi

Actor Salman Khan's sister Arpita shared exclusive pictures of her wedding reception hosted by her in-laws in Mandi, Himachal Pradesh, on May 25. The out-of-towners at the reception included her superstar brother and others from the Khan family. Arpita married Aayush Sharma, son of Himachal Pradesh's Panchayati Raj Minister Anil Sharma, in November 2014.

This image was posted on Twitter by Arpita Khan Sharma

Arpita, who looked pretty in a red lehenga, posed for a picture with her mother-in-law Suneeta Sharma, sister Alvira and mother Salma Khan.

This image was posted on Twitter by Arpita Khan Sharma

Salman Khan attended the reception amid cheers and greetings from the crowd.

This image was posted on Twitter by BajrangiBhaijaan

The actor looked dashing in a blue suit.

This image was posted on Twitter by BajrangiBhaijaan

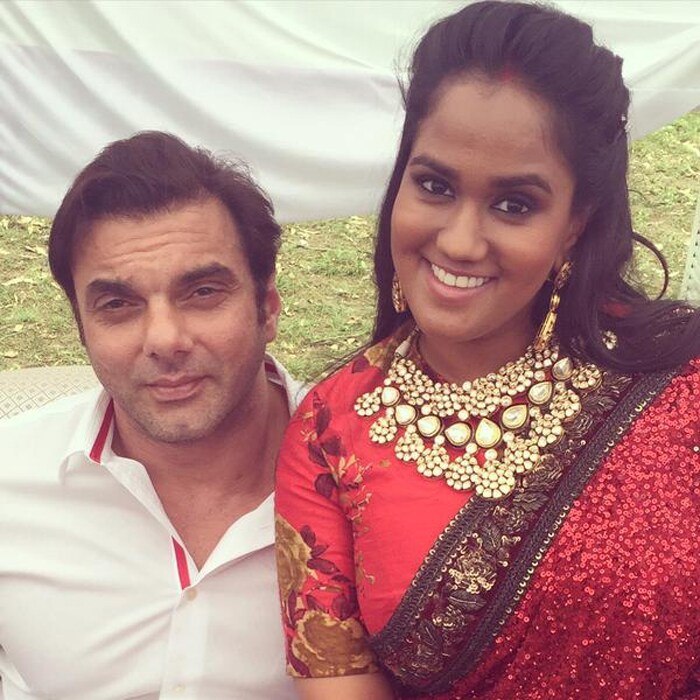

Arpita was all smiles as she posed with her actor-filmmaker brother Sohail Khan. .

This image was posted on Twitter by Arpita Khan Sharma

Arpita also posed with her gang of girls.

.

This image was posted on Twitter by Arpita Khan Sharma

Actor Salman Khan loves Kashmir, where he is currently shooting for Kabir Khan's Bajrangi Bhaijaan. The actor shared his Kashmir travel diaries on Twitter:

Wah yaar Mazza aah Gaya kamal karte ho Kashmirji.

This image was posted on Twitter by Salman Khan

He captioned this image: "KASHMIR bahut AMEER in natural beauty... Maashallah Maashallah."

This image was posted on Twitter by Salman Khan

That tweet led to this: "Maashallah. Maashallah se yaad aya Katrina Kaif bhi Kashmir se hai"

This image was posted on Twitter by Salman Khan

The Dabangg star hung out with little fans: "Kashmiri sev se sweeter hai Kashmiri bachhe."

This image was posted on Twitter by Salman Khan

He also wrote: "Flood Kashmir with only tourism tourism tourism."

This image was posted on Twitter by Salman Khan

You ain't seen nothing if you haven't seen the Valley: "Kashmir nahi dekha toh Kya dekha kehtey hai kahin jannat hai toh woh idharich hai idharich hai idharich hai"

This image was posted on Twitter by Salman Khan

................................ Advertisement ................................

Opinion

दूसरी आज़ादी लाई GST - पहले परांठा, अब आटा, हीरे पर कम, स्याही पर ज़्यादा...Ravish Kumar

Tuesday July 19, 2022मोहम्मद ज़ुबैर का केस कानून की प्रक्रिया को लेकर एक गंभीर बहस का मुद्दा बन गया है. महंगाई से लेकर मुकदमे का एक ही हाल है.अब तो चीफ जस्टिस भी कह रहे हैं कि जल्दबाज़ी में गिरफ्तारी होने लगी है.

Opinion: GST, Historical Tax Reform, At 5 Years, Has Lost Its WayAndy Mukherjee | Bloomberg

Thursday July 07, 2022Five years ago, India's federal and state governments struck a historic deal. From July 1, 2017, a uniform tax on goods and services - marketed by Prime Minister Narendra Modi as "One Nation, One Tax, One Market" - replaced a bewildering array of loc

Opinion: In GST Row, Centre Throws Nationalism Argument At StatesPraveen Chakravarty

Monday August 31, 2020Rules by bureaucrats, legalese by lawyers and analysis by economists are cold, futile methods to resolve this crisis when the need of the distressed hour is a warm, empathetic hand of the political leadership.

Blogs: सरकार ने दी कॉरपोरेट टैक्स में राहत, क्या आम आदमी को होगा फायदा?Ravish Kumar

Saturday September 21, 2019अगले शुक्रवार का इंतज़ार कीजिए क्या पता आम लोगों का भी टैक्स से राहत मिल जाए, या क्या पता पुरानी पेंशन व्यवस्था ही बहाल हो जाए. वित्त मंत्री जिस तरह शुक्रवार को अपना नया बजट पेश कर रही हैं, राहतों का एलान कर रही हैं, उसमें कुछ भी उम्मीद की जा सकती है. आखिर कारपोरेट ने कब सोचा होगा कि सरकार उसे एक दिन 1 लाख 45 हज़ार का घाटा उठाकर करों में छूट देगी. इस फैसले को ऐतिहासिक और साहसिक बताया गया है.

Latest Videos

MoreNews

More- Reported by Deepak Bopanna | Saturday July 12, 2025 , Bengaluru

In a major crackdown on tax fraud, the Directorate General of GST Intelligence (DGGI), Bengaluru Zonal Unit, has unearthed a massive fake invoicing racket involving six shell companies.

- NDTV News Desk | Sunday July 06, 2025

India does not take any decision under pressure from any country, Confederation of Indian Industry (CII) National President Rajiv Memani has said, asserting that New Delhi's interest will always be a priority as it nears a trade deal with Washington.

- NDTV News Desk | Wednesday July 02, 2025 , New Delhi

Cigarettes, carbonated drinks, and high-end cars are among items that may become more expensive if a proposal to replace the expiring compensation cess - in the Goods and Services Tax system - with cesses on health and clean energy.

- Reported by Akhilesh Sharma, Edited by Samiran Mishra | Wednesday July 02, 2025 , New Delhi

After a series of income tax concessions earlier this year, the Centre is now preparing to extend relief to middle and lower-income households in the form of a reduction in Goods and Services Tax (GST), sources have said.

- Written by Anurag Dwary | Monday June 30, 2025 , Bhopal

In what could be one of the biggest GST frauds uncovered in central India, the Economic Offences Wing (EOW) has unearthed a fake invoicing scam worth Rs 512 crore and fraudulent Input Tax Credit (ITC) claims of Rs 130 crore.

- Press Trust of India | Monday June 30, 2025 , New Delhi

Gross GST collections doubled in five years to reach an all-time high of Rs 22.08 lakh crore in the 2024-25 fiscal year, from Rs 11.37 lakh crore in FY21, government data showed on Monday.

- Press Trust of India | Thursday June 26, 2025 , New Delh

New India Assurance Company Ltd on Thursday said tax authorities have issued a show cause notice with a demand of Rs 2,298 crore Goods and Services Tax (GST) for five financial years.

- Written by Anushka Kumari | Saturday June 21, 2025 , New Delhi

The Central Bureau of Investigation (CBI) has launched a major crackdown in a case involving bogus GST refund claims amounting to nearly Rs 100 crore, allegedly orchestrated through fake export bills.

- Press Trust of India | Tuesday June 03, 2025 , Prayagraj

A division bench comprising Justices Shekhar B Saraf and Justice Vipin Chandra Dixit rejected Patanjali's argument that such penalties constitute criminal liability and can be imposed only after a criminal trial.

- Press Trust of India | Sunday June 01, 2025 , New Delhi

Gross GST collections remained above the Rs 2 trillion mark for the second month in a row, rising 16.4 per cent in May to over Rs 2.01 lakh crore.

................................ Advertisement ................................