Usha Silai School Programme Stitching Together Empowerment And Economic Growth Across India: IIT Delhi Study

Empowering women across diverse backgrounds, the Usha Silai School programme not only offers sewing and stitching skills but also fosters inclusivity and economic independence. A recent independent study by IIT Delhi highlights its profound impact, showcasing how this initiative not only transforms individual lives but also contributes significantly to achieving Sustainable Development Goals (SDGs). Take a look!

For over 12 years, USHA has been empowering and transforming the lives of lakhs of Silai School women, offering sewing and stitching skills through its many programs and partnerships across India. To assess the impact of the Usha Silai School programme, IIT Delhi began an independent study in January 2023 in collaboration with Usha, its NGO partners, and the beneficiaries.

The study included going into the field and understanding how the project has impacted the individual beneficiaries and the community at large. It also evaluated the inclusiveness of the Usha Silai School program which attracts various women from different economic, and social backgrounds, and life circumstances.

The Usha Silai program goes beyond teaching sewing skills; it also leaves a mark in the world of fashion. The introduction of the USHA Silai label has helped many beneficiaries connect with markets, providing many women with opportunities to showcase their skills and collaborate with India's top fashion designers at the Lakme Fashion Week.

The IIT Delhi report shows a significant economic impact of the investment made by Usha Silai Schools in empowering and enabling women. As much as 59.41 per cent of Usha Silai School teachers surveyed reported a monthly income of Rs 5,000; 32.82 per cent earned between Rs 5,000 and Rs 10,000 per month, 4.65 per cent reported monthly incomes between Rs 10,000 and Rs 15,000, 1.01 per cent between Rs 15,000 and Rs 20,000 per month, and 2.11 per cent said their earnings are over Rs 20,000 per month.

................................ Advertisement ................................

Opinion

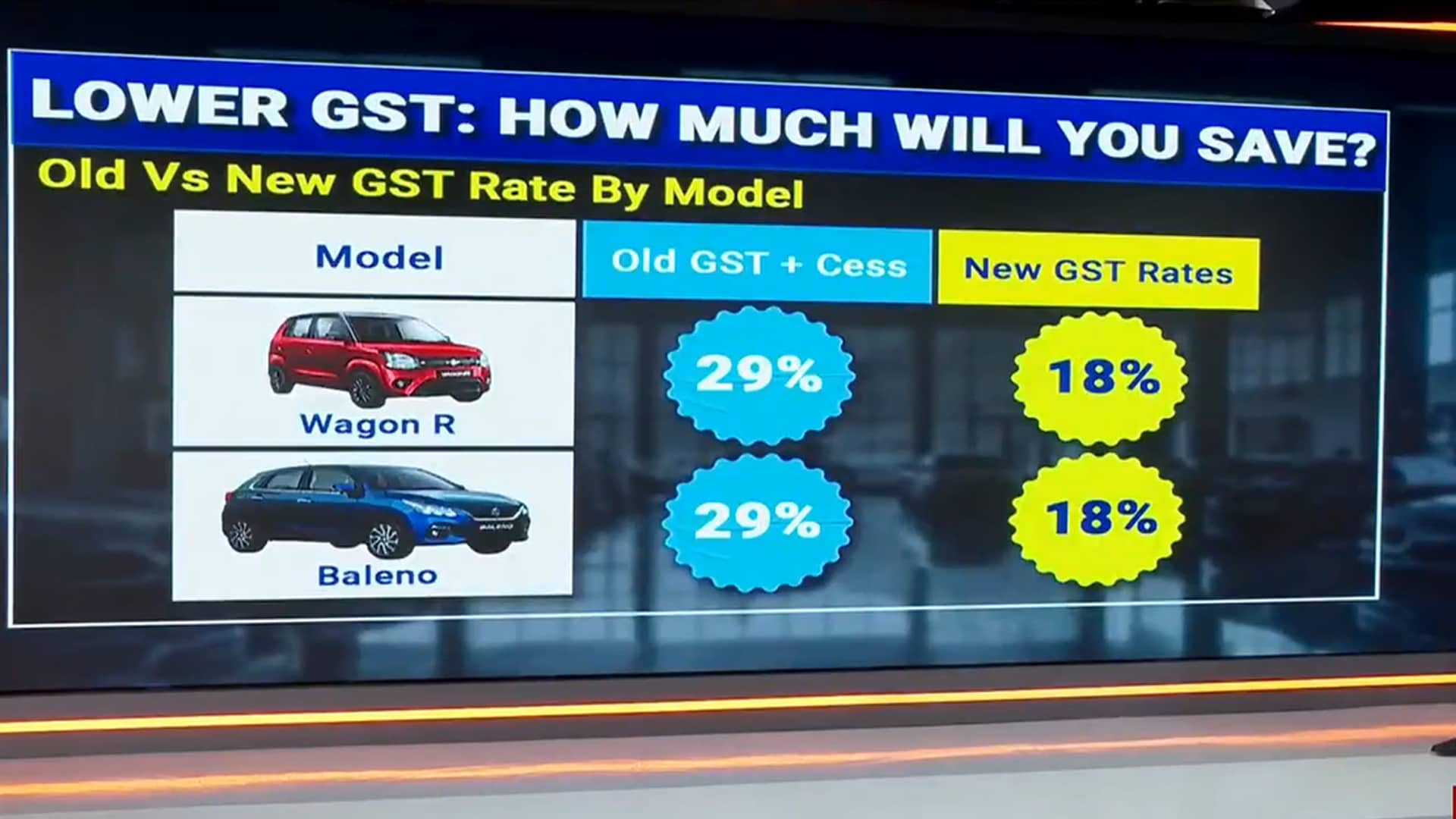

GST Reforms 2025: What A Tax Cut On Vehicles Means For India's Auto Industry

Tuesday August 19, 2025The Indian automotive industry could soon witness a GST cut on cars, and here's what the cut holds for the buyers and manufacturers.

दूसरी आज़ादी लाई GST - पहले परांठा, अब आटा, हीरे पर कम, स्याही पर ज़्यादा...Ravish Kumar

Tuesday July 19, 2022मोहम्मद ज़ुबैर का केस कानून की प्रक्रिया को लेकर एक गंभीर बहस का मुद्दा बन गया है. महंगाई से लेकर मुकदमे का एक ही हाल है.अब तो चीफ जस्टिस भी कह रहे हैं कि जल्दबाज़ी में गिरफ्तारी होने लगी है.

Opinion: GST, Historical Tax Reform, At 5 Years, Has Lost Its WayAndy Mukherjee | Bloomberg

Thursday July 07, 2022Five years ago, India's federal and state governments struck a historic deal. From July 1, 2017, a uniform tax on goods and services - marketed by Prime Minister Narendra Modi as "One Nation, One Tax, One Market" - replaced a bewildering array of loc

Opinion: In GST Row, Centre Throws Nationalism Argument At StatesPraveen Chakravarty

Monday August 31, 2020Rules by bureaucrats, legalese by lawyers and analysis by economists are cold, futile methods to resolve this crisis when the need of the distressed hour is a warm, empathetic hand of the political leadership.

Latest Videos

MoreNews

More- Monday August 25, 2025 , New Delhi

PM Narendra Modi announced on August 15 to bring "next-generation" GST reforms that will reduce the tax burden across the country.

- Press Trust of India | Saturday August 23, 2025 , New Delhi

The high-powered GST Council, chaired by Finance Minister Nirmala Sitharaman, will meet on September 3-4 to discuss moving to a two-slab taxation.

- Friday August 22, 2025

The Centre's proposed reduction in GST is also expected to lead to a drop in costs for car buyers, reducing on-road prices as well as EMIs.

- ANI | Saturday August 23, 2025 , New Delhi

Proposed GST cuts on petrol and diesel vehicles could reduce EVs price advantage, slowing adoption while causing major revenue losses for the government - HSBC.

- Indo-Asian News Service | Thursday August 21, 2025

A key meeting of the Group of Ministers (GoM) on GST rate rationalisation on Thursday ended with state finance minister accepting the Centre's plan to reduce the number of tax slabs.

- Indo-Asian News Service | Thursday August 21, 2025 , New Delhi

Over 50 million Micro, Small and Medium Enterprises in India, who have GST and Business PAN (B-PAN), can have digital procurement access through Amazon Business ahead of the upcoming festive season, the global e-commerce giant said on Thursday

- Press Trust of India | Wednesday August 20, 2025 , New Delhi

The Lok Sabha on Wednesday passed a legislation to ban online games played with money as it looks to check rising instances of addiction, money laundering and financial fraud through such applications.

- Press Trust of India | Wednesday August 20, 2025 , New Delhi

The Centre has proposed exempting life and health insurance premium from GST, Bihar Deputy Chief Minister and convenor of insurance GoM Samrat Choudhary said on Wednesday.

- Indo-Asian News Service | Tuesday August 19, 2025 , New Delhi

Finance Minister Nirmala Sitharaman is likely to present the Centre's proposal for rationalising goods and services tax (GST) rates before a Group of Ministers (GoM) at a two-day meeting starting August 20 in the national capital.

- Tuesday August 19, 2025

The Indian automotive industry could soon witness a GST cut on cars, and here's what the cut holds for the buyers and manufacturers.

................................ Advertisement ................................