- Home/

- News

Latest News

Arun Jaitley's "Prophets Of Doom" Dig At Opposition Over Notes Ban

Edited by Deepshikha Ghosh | Thursday November 08, 2018 , New DelhiFinance Minister Arun Jaitley today lashed out at critics of demonetisation, dubbing them "prophets of doom" hours after former prime minister Manmohan Singh's scathing takedown of the move he said had left scars and wounds that were getting more visible with time. Attacked by the opposition on the second anniversary of the notes ban, Mr Jaitley said India managed "re...

- Indo-Asian News Service | Tuesday November 06, 2018 , New Delhi

The Central Bureau of Investigation (CBI) has arrested an Assistant Commissioner of the Goods and Services Tax (GST) department of the Delhi government while accepting a bribe of Rs 6 lakh, officials said today.

- Indo-Asian News Service | Friday October 26, 2018

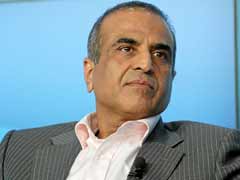

Mittal, however, also said that the recently released National Digital Communications Policy focuses on the concerns of the industry.

- Indo-Asian News Service | Friday October 26, 2018 , New Delhi

The high rate of GST and spectrum prices in the telecom sector go against Prime Minister Narendra Modi's vision of a digitally-empowered India, Bharti Airtel Chairman Sunil Bharti Mittal said today. Telecom is also among the most-taxed sectors globally, he said, addressing the inaugural session of the India Mobile Congress 2018. "I cannot see how this contradiction ca...

- Press Trust of India | Thursday October 18, 2018 , Bengaluru

A businessman was arrested Tuesday by the Karnataka commercial taxes department for allegedly evading GST of Rs 42 crore by raising fake invoices of Rs 245 crore in the name of deceased and fictituous people.

- Press Trust of India | Friday October 12, 2018 , New Delhi

A parliamentary panel headed by veteran BJP leader Murli Manohar Joshi, in a draft report prepared by it, has questioned the mechanism for calculating the country's Gross Domestic Product (GDP) and asserted that the methodology needs review to reflect the ground reality.

- Indo-Asian News Service | Thursday October 11, 2018 , New Delhi

With a 15-20 per cent average increase in direct tax collections in recent years, government revenues are certain to grow, even as the economy becomes more formalised with Indians adopting technology in greater numbers, Finance Minister Arun Jaitley said on Thursday.

- Reported by Sameer Contractor, Written by Sameer Contractor | Thursday October 11, 2018

In a bid to offer better service to customers beyond its products, Honda Motorcycle and Scooter India (HMSI) has introduced its new Honda Joy Club. The Joy Club is a digital customer loyalty programme and the first-of-its-kind for the two-wheeler industry in India. The programme is directed for both new and existing Honda two-wheeler customers, which can be availed fo...

- Press Trust of India | Wednesday October 10, 2018 , New Delhi

The Comptroller and Auditor General of India (CAG) should not shy away from holding the government accountable for decisions like demonetisation, GST that has caused serious economic distress, and defence purchases, PAC Chairman and Congress leader Mallikarjun Kharge said today.

- Press Trust of India | Tuesday October 09, 2018 , Dholpur (Rajasthan)

Rahul Gandhi claimed the government had destroyed the country's economy with decisions like demonetisation and GST.

- Press Trust of India | Tuesday October 09, 2018 , Washington

The International Monetary Fund or IMF on Tuesday predicted a growth rate of 7.3 per cent for India in the current year and 7.4 per cent in 2019.

- Indo-Asian News Service | Sunday October 07, 2018 , Dehradun

Prime Minister Narendra Modi today said India is going through major social and economic changes and the resultant New India will prove to be a catalyst for global development.

- Press Trust of India | Friday October 05, 2018 , New Delhi

Congress president Rahul Gandhi appealed to Prime Minister Narendra Modi on Friday to bring petrol and diesel under the purview of the Goods and Services Tax (GST), saying the people were distressed over their skyrocketing prices.

- Press Trust of India | Friday October 05, 2018 , New Delhi

The CBI has carried out searches at the Chennai residence of Additional Commissioner, GST, Senthil Valavaen in connection with the Gutkha scam, officials said Thursday.

................................ Advertisement ................................

Opinion

MoreOpinion | Why States, Not Centre, Should Get All The Credit For GST 'Savings'Derek O’Brien

Wednesday October 22, 2025Amidst all the hoopla, it is the State governments that truly deserve recognition for coming together for the GST revision. Because the States are the ones bearing the brunt of massive revenue losses.

Opinion: GST Cut, Inflation Under Control: Optimism As Festival Season ApproachesBharti Mishra Nath

Friday September 19, 2025Away from politics, floods, rain-related tragedies and the Trump tariffs, there is optimism in the air. With GST rationalized, inflation in control, the upcoming festival season promises good times.

Opinion | Next-Generation GST: A Reform That Places The Middle Class At The CentrePradeep Bhandari

Saturday September 06, 2025By ensuring both direct tax relief and rationalised indirect taxes, the government has empowered the common citizen to save more, spend more, and aspire more.

Opinion | Observations From A Student of Political Communication - By Derek O'BrienDerek O’Brien

Friday September 05, 2025For a student of political communication, this week has been fodder. The language used to describe GST reforms has been nothing short of grand. "Landmark". "Biggest ever since the 1990s". The Opposition has been advocating for such 'reforms' for eigh

Latest Videos

More................................ Advertisement ................................