- Home/

- Latest Videos/

- More Room For Rate Cuts, Says Arvind Subramanian

More Room For Rate Cuts, Says Arvind Subramanian

For the first time today, the government presented a second or a mid-year economic survey for the year 2017-18 highlighting the new factors that the economy faces since the last such exercise in February. India's service sector, which was highly resilient even during the global financial crisis, has moderated to 7.7 per cent in 2016-17, according to the Economic Survey. The sector, which grew by 9.7 per cent in the previous year, however remains the key driver of India's economic growth, contributing almost 62 per cent of its gross value added growth in 2016-17. Policies like GST and FDI liberalisation coupled with initiatives for promoting digitalisation, tourism and shipping have brightened the growth prospects for this sector, the mid-year survey which was tabled in Parliament on Friday said. "India's services sector growth, which was highly resilient even during the global financial crisis, has been showing moderation in recent times," it said. In conversation with NDTV's Vikram Chandra, Chief Economic Adviser Arvind Subramanian explains the road ahead for the Indian economy.

Here are the highlights:

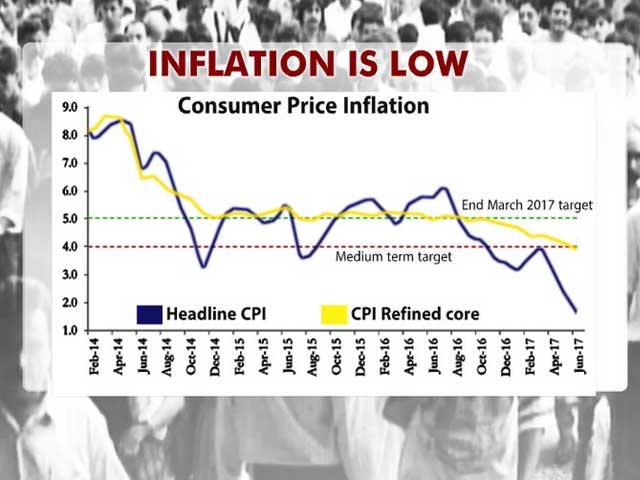

• The medium term (outlook) looks good... but there are worries for the near term. There is a trend deceleration heading towards deflation, that isn't slowing down. That is a worry: Chief Economic Adviser Arvind Subramanian

• Non-Performing Assets (NPA) are a big growth challenge: Arvind Subramanian

• A series of factors weighing on the economy like bad loans, high debt levels of some corporates: Arvind Subramanian to NDTV

• Are farm loan waivers sustainable? Farm loan waivers could add to deflationary pressures on economy. Since you have a ceiling, states have to cut down on other expenditure to compensate for farm loan waivers which means cutting down on infrastructure funding: Chief Economic Adviser.

• Over the next few years, inflation is expected to be lower than what we had in the past: Arvind Subramanian to NDTV

• Inflation is low and this is because of good decisions taken by the government and the RBI. Some of the factors are temporary and the trend might reverse (for inflation) somewhat, but it will go up and settle at a reasonable level: Chief Economic Adviser

• Interest rates still high: Real interest rates are rising and the cost of lending is high. Over the next few years, inflation is expected to be lower than what we had in the past. We can expect 3% or 4% going forward. In the next few years, we can expect inflation to remain low. Both in terms of scope and need for the economy, there is potential for interest rates (lending rates) to go down significantly. My technical assessment is that interest rates can come down by a fair amount. I am not the authority, so won't get into the numbers of it, said Mr Subramanian.

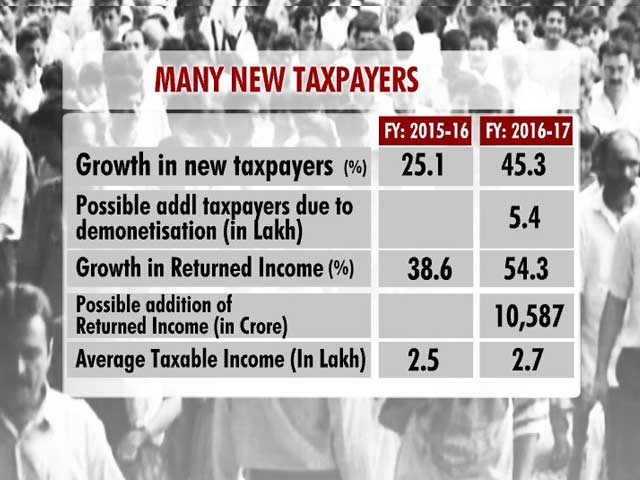

• More people now in tax net: GST has eased the logistics of businesses and increased turnover time. The removal of tax posts and borders has helped to a great extent. We see 13.5 lakh new tax payers after GST. And over 5 lakh new tax payers due to demonetisation. So both have had their positive effects. They (taxpayers) are coming into the net and can now be monitored at all times and that is a big success.

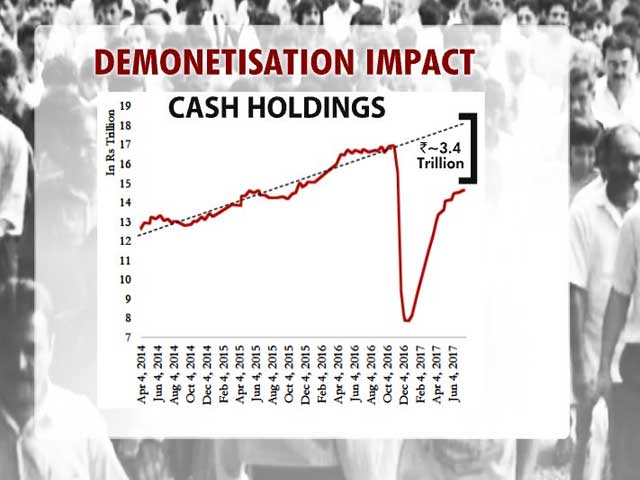

• Note ban: Boost to digitalization: People now hold 20 per cent less cash than they did before demonetisation and that is a great trend. It shows signs of moving towards a less-cash economy. Digitisation is on the rise and that is good for the economy, Chief Economic Adviser told NDTV's Vikram Chandra.

• The big benefit of GST, i.e. invoice matching, will come in over the next few months. Under that old system, a consumer saw only the state VAT on their invoice, but in reality there was also an embedded central excise and other levies. Now they see a higher GST rate, but there is no embedded central excise and does away with all other levies too. So the higher number does not mean a higher tax. People need to be made aware of it.

• Growth Slowing, But Still Reasonable: We aid farmers in various way - loan waivers being one of them. We can do something for the farmers where they can sell directly, whether we can transfer money to them directly. We can help them find a better and easier marketplace for them to sell their produce.

Related Videos

................................ Advertisement ................................

News

More- Tuesday February 17, 2026

The wholesale PV growth is likely to grow by 5-7 per cent in FY26, supported by improved affordability following GST rate cuts.

- Written by Gadgets 360 Staff | Friday February 13, 2026

Written and directed by Srujan Lokesh, GST: Ghosts in Trouble is a comedy-drama film that explores the themes of comedy, transformation, and drama.

- Written by Akarsh Anant | Wednesday February 11, 2026

India's automobile sector contributes 15% of GST revenue, supports 30 million jobs, and posted strong 2025 production, sales, and export figures across all categories. Here's a detailed report you must check out.

- Edited by Priyanka Negi | Tuesday February 10, 2026

The Ministry of Skill Development offers free one-month online internships in the BFSI sector for Class 12 pass candidates, covering GST, income tax, financial reporting, stock market analysis, and financial modelling.

- Indo-Asian News Service | Thursday February 05, 2026 , New Delhi

The Goods and Services Tax (GST) exemption of lifesaving cancer drugs and higher taxation on tobacco products are the steps aimed at strengthening public health in the country, according to a new study led by oncologists from

Opinion

MoreOpinion | Why States, Not Centre, Should Get All The Credit For GST 'Savings'Derek O’Brien

Wednesday October 22, 2025Amidst all the hoopla, it is the State governments that truly deserve recognition for coming together for the GST revision. Because the States are the ones bearing the brunt of massive revenue losses.

Opinion: GST Cut, Inflation Under Control: Optimism As Festival Season ApproachesBharti Mishra Nath

Friday September 19, 2025Away from politics, floods, rain-related tragedies and the Trump tariffs, there is optimism in the air. With GST rationalized, inflation in control, the upcoming festival season promises good times.

Opinion | Next-Generation GST: A Reform That Places The Middle Class At The CentrePradeep Bhandari

Saturday September 06, 2025By ensuring both direct tax relief and rationalised indirect taxes, the government has empowered the common citizen to save more, spend more, and aspire more.

Opinion | Observations From A Student of Political Communication - By Derek O'BrienDerek O’Brien

Friday September 05, 2025For a student of political communication, this week has been fodder. The language used to describe GST reforms has been nothing short of grand. "Landmark". "Biggest ever since the 1990s". The Opposition has been advocating for such 'reforms' for eigh

................................ Advertisement ................................