- Home/

- Latest Videos/

- Prannoy Roy And Ruchir Sharma On Top 10 Economic Trends Of 2018

Prannoy Roy And Ruchir Sharma On Top 10 Economic Trends Of 2018

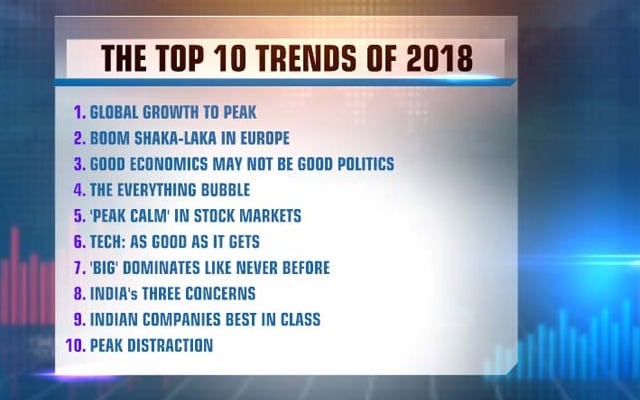

As the new year rolls outs, NDTV's Prannoy Roy and author and global investor Ruchir Sharma forecast the top 10 trends of 2018. From global growth to whether unemployment will fall or rise this year to the stock market, we look at the likely big trends.

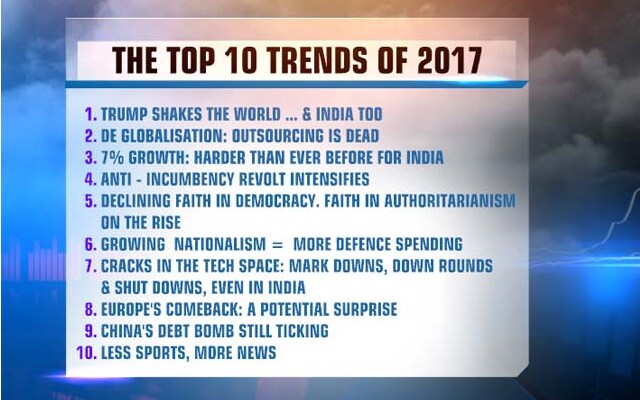

Here are the highlights of Prannoy Roy and Ruchir Sharma's discussion on top 10 trends of 2018:

"That time of the year again..."

"It's that time of year again - as they say if it's the first week of January - it has to be the moment to forecast what's going to happen this year," says Prannoy Roy. "More than that it's the time of year to listen and understand Ruchir Sharma, author, columnist and global investor. We are going to start by looking back and see how good we're with Ruchir's forecasts last year... Ruchir we shall spend three minutes on a quick recap of your trends vs reality," Dr Roy says.

On Donald Trump

Ruchir Sharma says there was more excitement on tax cuts forecast. "I think the big story was how much (Donald) Trump didn't matter. How little got done in terms of actual legislation compared to the noise, sound and fury. He shook the world a lot less."

Basic trade revival

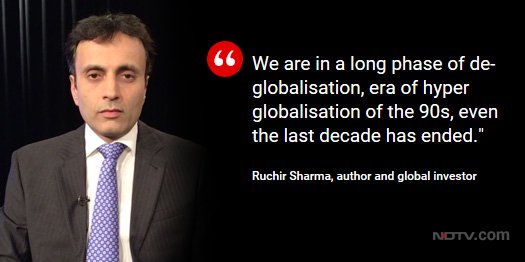

There was some basic trade revival last year because global growth picked up, says Mr Sharma. "We had seen global flows in terms of trade, migration, but that didn't just happen. We're in a long phase of de-globalisation in terms of capital flows, multi-year holding period at best."

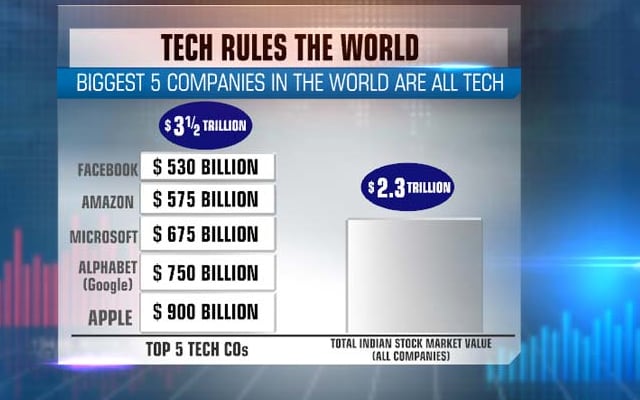

In 2017, tech was the defining factor, the defining trend, says Prannoy Roy.

"It's very difficult to imagine India attaining 7 per cent growth in the foreseeable future," says Ruchir Sharma.

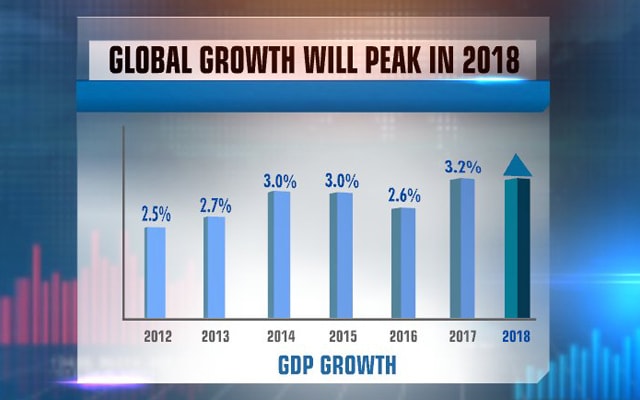

Global growth expected to remain strong in 2018

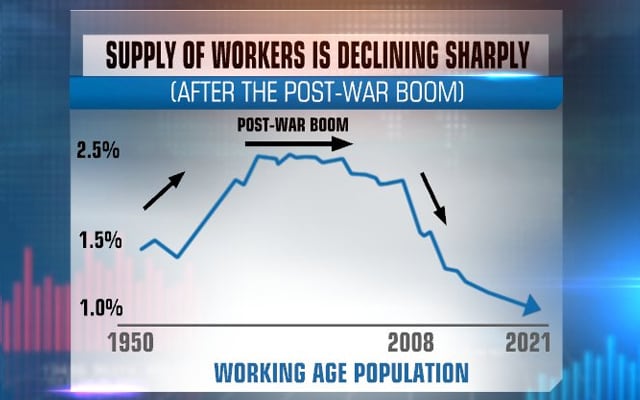

A greying world: Working-age population dwindling fast

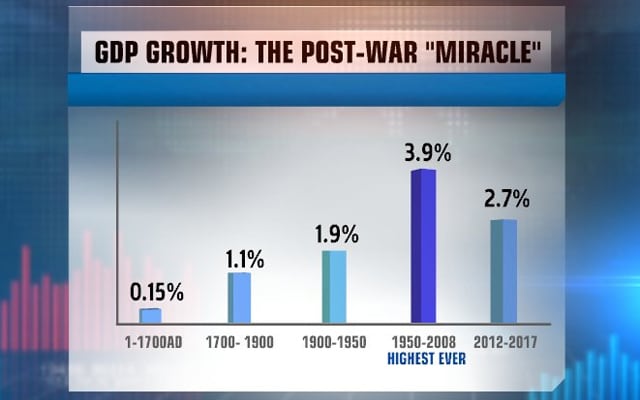

Global growth remains below the post-war 'miracle'

Of debt and world economy

China's debt is 216%, highest for any developing nation in history, says Ruchir Sharma. Any other country that would incur debt would have expected to blow up, but China's growth is still increasing, which is very unusual for a country this size, he says.

"There is new China, with tech innovations and no debt, and there's old China where record levels of debt are controlled by the government. This is the dichotomy of China as old china is dragging down the new China," he says.

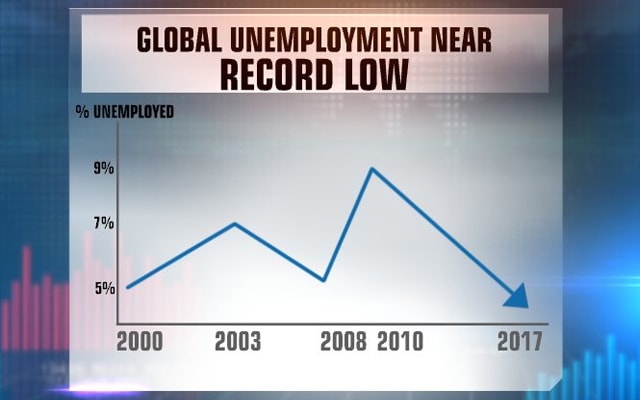

Global unemployment falling

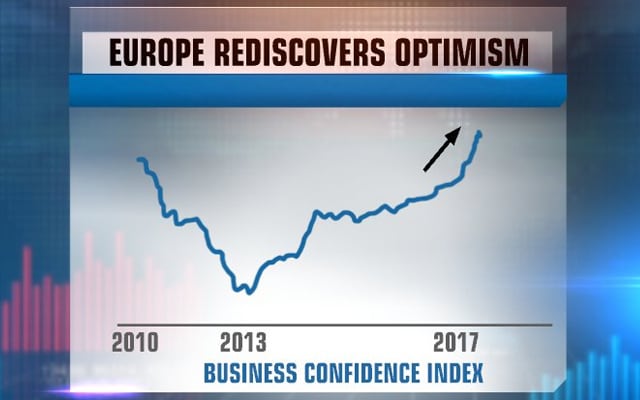

Rising business confidence index in Europe

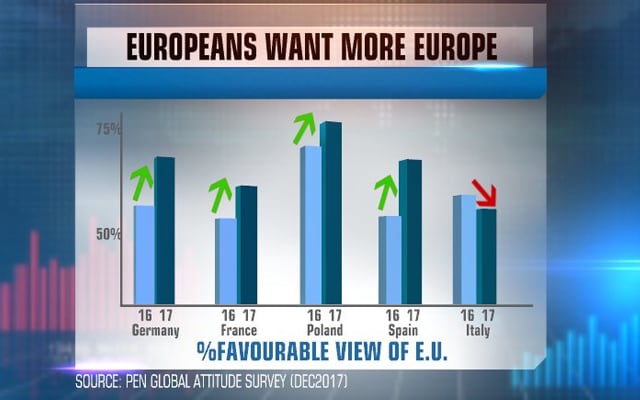

More Germans, French in favour of European Union

"Globally, stock market approval ratings have dropped sharply," says Prannoy Roy.

Growth in Europe

Prannoy Roy says growth in Europe is going to increase this year too and Europeans' business confidence shot up in 2017, he says, adding Europeans want to be a part of the EU.

"Not a single country in Europe is below 50 per cent. Even in Italy, they wanted more European integration. Outside, there is impression that the continent will break up, but more countries will have favourable impression of EU," says Ruchir Sharma. "There is risk in Italy of a far-right movement."

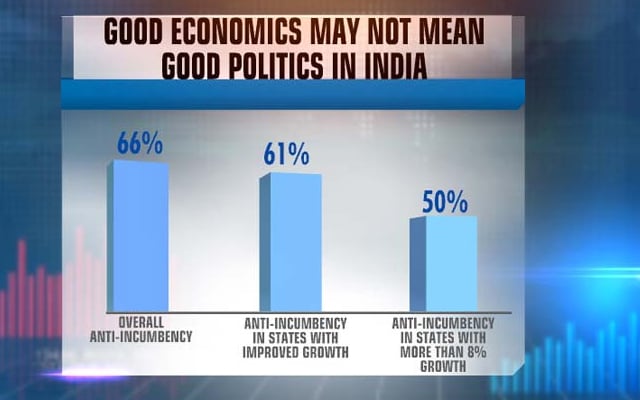

"Terrible time to be an incumbent. Popularity ratings of leaders across the world are at an all-time low," says Ruchir Sharma.

Good economics may not be good politics and stock markets are going up, but leaders' popularity, approval ratings declined sharply, says Prannoy Roy.

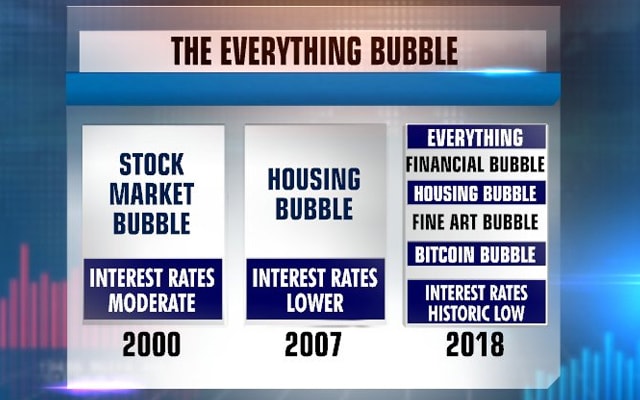

The valuation of almost every asset in the world is very expensive, says Ruchir Sharma. It may be because interest rates are low... It takes some years for bubble to form... but Bitcoins have jumped tremendously, he says.

Do lower interest rates create asset bubbles?

In 2004, it took 10,000 Bitcoins to buy a pizza; today those 10,000 Bitcoins are worth millions of dollars, says Ruchir Sharma.

Tech: As good as it gets

"Tech is ruling the world. The biggest five companies are all tech," says Prannoy Roy. "China has also joined the tech party... Alibaba is worth $470 billion."

"To me, it is unprecedented. The five largest companies by market value are all tech," says Ruchir Sharma. "If you look at Facebook and Google, those two companies account for 75 per cent of advertising in the US."

Big firms are more dominant than ever before, says Prannoy Roy. The top three companies have increased their market share from 40 per cent in 2001-07 to 65 per cent in 2007-16, he says.

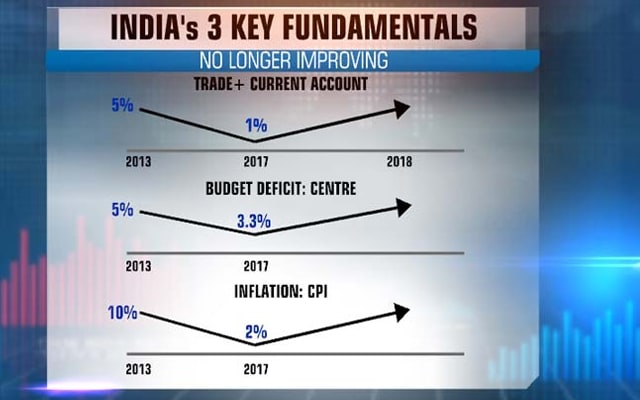

There has been a slight turnaround, says Prannoy Roy. Trade and current account deficit fell from 5 per cent in 2013 to 1 per cent in 2017. The next is budget deficit, which has fallen from 5 per cent in 2013 to 3.3 per cent in 2017, he says. The third key fundamental is inflation, which has fallen.

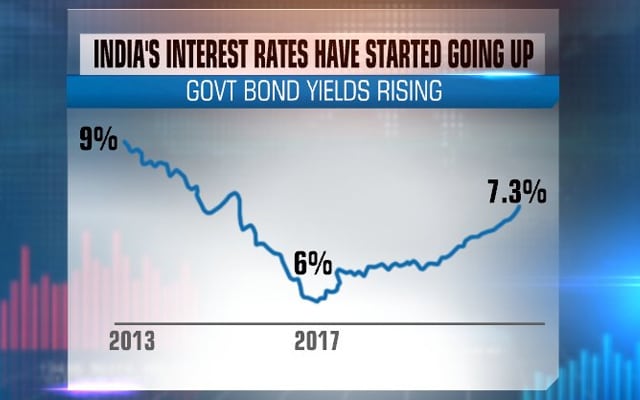

Interest rates may have bottomed out in India

Indian firms show high earnings growth, says Prannoy Roy. "Indian companies are growing fastest in terms of their strike rates... 51 per cent companies in India have doubled their value in five years."

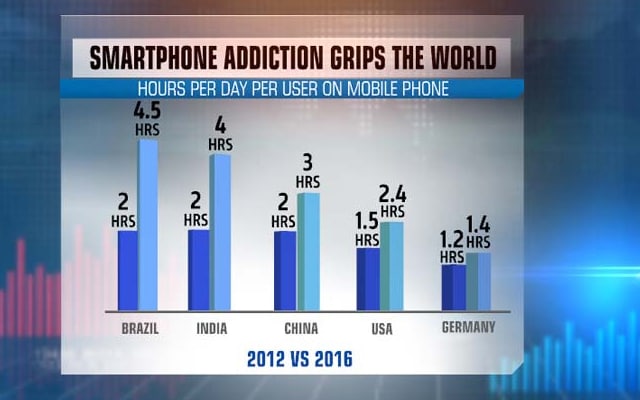

"Beyond a point, too much technology is counter-productive. Because of this maybe people's productivity has decreased," says Ruchir Sharma. "Research says an average iPhone user looks at it 80 times a day... But the good news is there's increased consciousness of that... A lot of people are using the term digital detox." Digital detox is the new yoga, says Ruchir Sharma.

On a recap of all the trends, the key thing to look out for is global growth, says Prannoy Roy, adding it did very well last year, but won't carry on forever. Ruchir Sharma says demographics is the key reason why growth may not increase.

Related Videos

................................ Advertisement ................................

News

More- Tuesday February 17, 2026

The wholesale PV growth is likely to grow by 5-7 per cent in FY26, supported by improved affordability following GST rate cuts.

- Written by Gadgets 360 Staff | Friday February 13, 2026

Written and directed by Srujan Lokesh, GST: Ghosts in Trouble is a comedy-drama film that explores the themes of comedy, transformation, and drama.

- Written by Akarsh Anant | Wednesday February 11, 2026

India's automobile sector contributes 15% of GST revenue, supports 30 million jobs, and posted strong 2025 production, sales, and export figures across all categories. Here's a detailed report you must check out.

- Edited by Priyanka Negi | Tuesday February 10, 2026

The Ministry of Skill Development offers free one-month online internships in the BFSI sector for Class 12 pass candidates, covering GST, income tax, financial reporting, stock market analysis, and financial modelling.

- Indo-Asian News Service | Thursday February 05, 2026 , New Delhi

The Goods and Services Tax (GST) exemption of lifesaving cancer drugs and higher taxation on tobacco products are the steps aimed at strengthening public health in the country, according to a new study led by oncologists from

Opinion

MoreOpinion | Why States, Not Centre, Should Get All The Credit For GST 'Savings'Derek O’Brien

Wednesday October 22, 2025Amidst all the hoopla, it is the State governments that truly deserve recognition for coming together for the GST revision. Because the States are the ones bearing the brunt of massive revenue losses.

Opinion: GST Cut, Inflation Under Control: Optimism As Festival Season ApproachesBharti Mishra Nath

Friday September 19, 2025Away from politics, floods, rain-related tragedies and the Trump tariffs, there is optimism in the air. With GST rationalized, inflation in control, the upcoming festival season promises good times.

Opinion | Next-Generation GST: A Reform That Places The Middle Class At The CentrePradeep Bhandari

Saturday September 06, 2025By ensuring both direct tax relief and rationalised indirect taxes, the government has empowered the common citizen to save more, spend more, and aspire more.

Opinion | Observations From A Student of Political Communication - By Derek O'BrienDerek O’Brien

Friday September 05, 2025For a student of political communication, this week has been fodder. The language used to describe GST reforms has been nothing short of grand. "Landmark". "Biggest ever since the 1990s". The Opposition has been advocating for such 'reforms' for eigh

................................ Advertisement ................................