- Home/

- Latest Videos/

- Prannoy Roy Speaks To Arvind Subramanian On State Of The Economy

Prannoy Roy Speaks To Arvind Subramanian On State Of The Economy

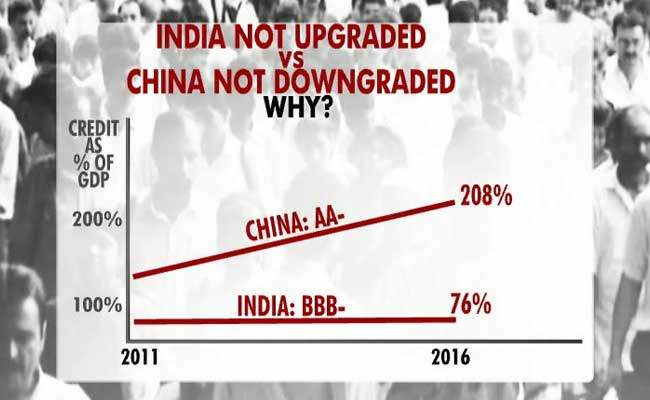

Chief Economic Adviser Arvind Subramanian, in an exclusive conversation with NDTV's Prannoy Roy, discusses the state of the Indian economy, inflation, the Goods and Services Tax or GST reform and the impact of the notes ban. On Thursday, Mr Subramanian had flayed global rating agencies, saying they haven't upgraded India "despite clear improvements in our economic fundamentals" which include inflation, growth, and current account performance. Despite its rapid growth, India still has a BBB rating. China's rating has been upgraded to AA, despite its slowing growth and rising debts. Earlier today, data showed India's consumer inflation eased in April to its lowest in at least five years.

Here are 10 graphics through which Mr Subramanian and Prannoy Roy discuss the state of the economy:

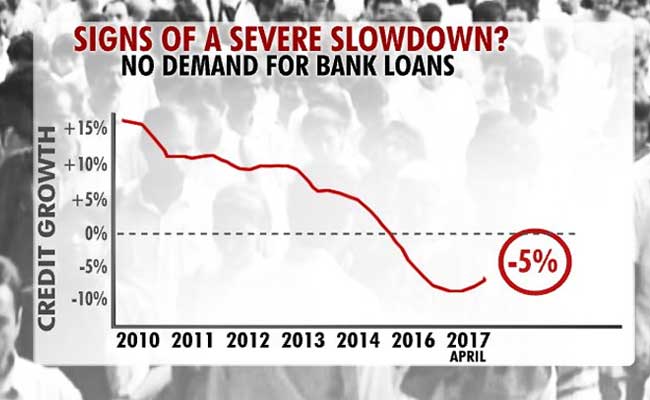

Bank credit growth falls sharply as demand for loans dries up

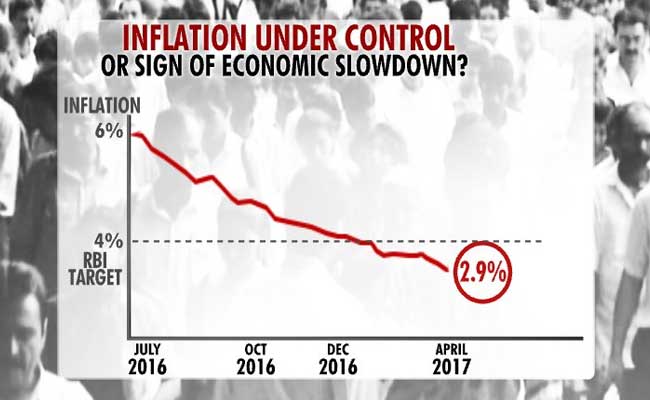

Inflation is down to 2.99%: Good news or bad news?

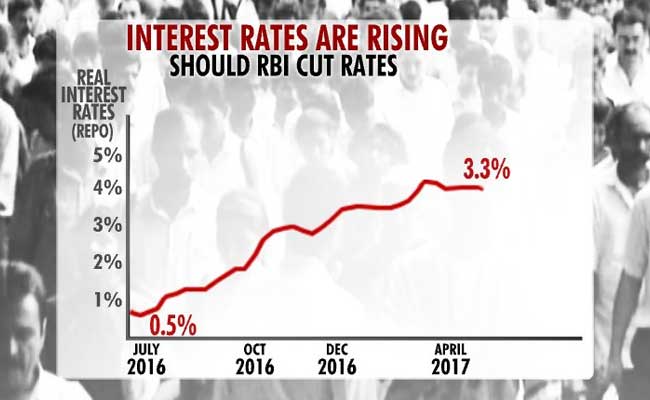

Time for central bank to cut interest rates?

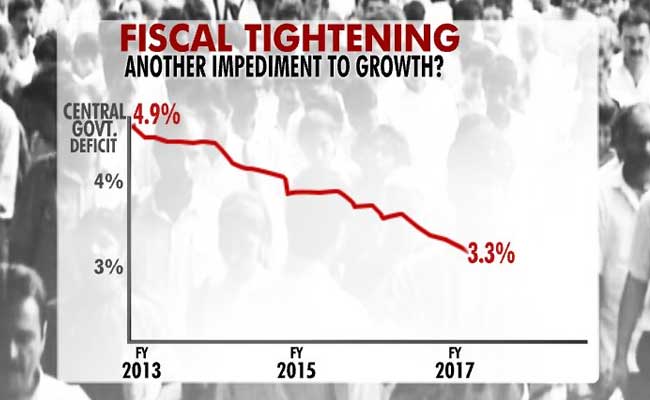

Should government relax fiscal deficit targets to boost growth?

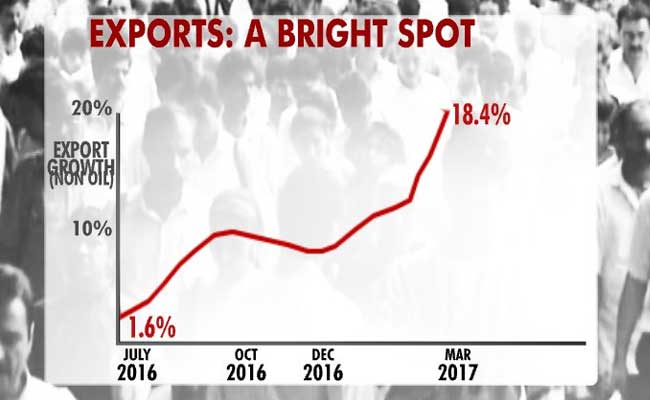

Export recovery a big positive for Indian economy

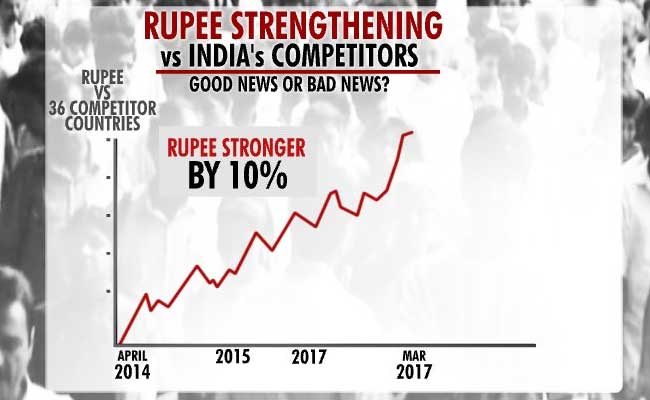

Rupee bounces back: assessing its rise

India not upgraded despite improving fundamentals. Global rating agencies unfair to India vs China

Industrial growth remains a concern

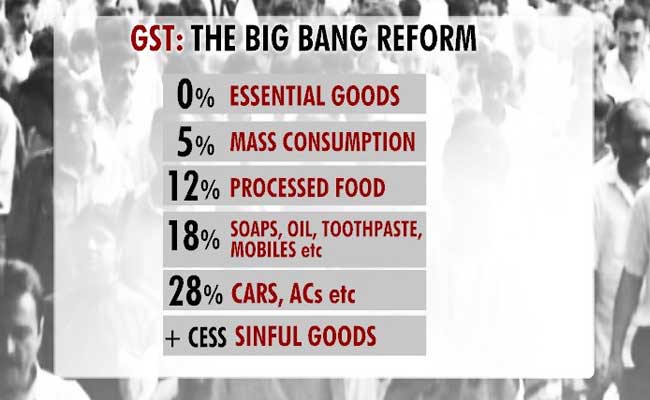

Prepping for mega reform Goods and Services Tax

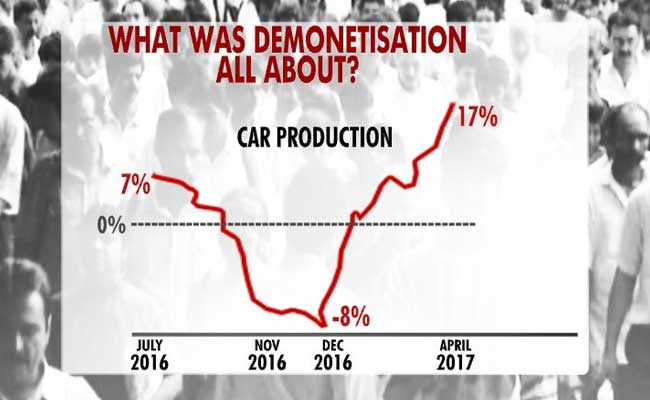

Auto industry back in top gear after demonetisation bump

Related Videos

................................ Advertisement ................................

News

More- Saturday January 10, 2026

Restaurants cannot charge more than the printed MRP for packaged items such as bottled water, irrespective of service, surroundings or dining experience.

- Indo-Asian News Service | Friday January 09, 2026 , New Delhi

The Centre has told the Delhi High Court that matters relating to the rate, classification, and reduction of Goods and Services Tax (GST) on air purifiers fall exclusively within the domain of the GST Council.

- Thursday January 08, 2026 , New Delhi

The recovery in auto component is expected to be driven by improved vehicle sales after the GST cut, which has eased cost pressures and supported consumer demand.

- Reported by Ashish Kumar Pandey | Wednesday January 07, 2026

A Congress leader and transport company executive has been arrested in connection with a GST evasion case involving more than Rs 28 crore, officials from the Directorate General of GST Intelligence (DGGI) said.

- Written by NDTV Auto Desk | Sunday January 04, 2026

Audi India closed 2025 with 4,510 sales, driven by festive demand, SUV growth, preowned business momentum, and steady traction across flagship and popular models.

Opinion

MoreOpinion | Why States, Not Centre, Should Get All The Credit For GST 'Savings'Derek O’Brien

Wednesday October 22, 2025Amidst all the hoopla, it is the State governments that truly deserve recognition for coming together for the GST revision. Because the States are the ones bearing the brunt of massive revenue losses.

Opinion: GST Cut, Inflation Under Control: Optimism As Festival Season ApproachesBharti Mishra Nath

Friday September 19, 2025Away from politics, floods, rain-related tragedies and the Trump tariffs, there is optimism in the air. With GST rationalized, inflation in control, the upcoming festival season promises good times.

Opinion | Next-Generation GST: A Reform That Places The Middle Class At The CentrePradeep Bhandari

Saturday September 06, 2025By ensuring both direct tax relief and rationalised indirect taxes, the government has empowered the common citizen to save more, spend more, and aspire more.

Opinion | Observations From A Student of Political Communication - By Derek O'BrienDerek O’Brien

Friday September 05, 2025For a student of political communication, this week has been fodder. The language used to describe GST reforms has been nothing short of grand. "Landmark". "Biggest ever since the 1990s". The Opposition has been advocating for such 'reforms' for eigh

................................ Advertisement ................................