- Home/

- News

Latest News

Individual Life And Health Insurance Policies To Be Exempt From GST

Edited by Ashutosh Tripathi | Thursday September 04, 2025The GST on health and insurance products, which stood at 18 per cent, has been cut to zero, in a major revamp of the GST rate structure.

- Edited by Debanish Achom | Thursday September 04, 2025 , New Delhi

The Goods and Services Tax (GST) Council announced today that only two rates will remain from September 22 - 5 per cent and 18 per cent.

- Edited by Shatabdi Chowdhury | Thursday September 04, 2025 , New Delhi

The GST Council, chaired by Finance Minister Nirmala Sitharaman, cut the current four slabs down to two - scrapping the 12 per cent and 28 per cent rates, while retaining the 5 per cent and 18 per cent slabs.

- Edited by Debanish Achom | Thursday September 04, 2025 , New Delhi

The Goods and Services Tax (GST) Council announced today that only two rates will remain from September 22 - 5 per cent and 18 per cent.

- Reported by Himanshu Shekhar Mishra, Edited by Anindita Sanyal | Thursday September 04, 2025 , New Delhi

The complicated GST slabs that gave headaches to small traders after the flagship tax overhaul came into effect eight years ago, was cleaned up by the government today, leaving only two slabs -- 5 and 18 per cent.

- Edited by Nikhil Pandey | Wednesday September 03, 2025

September is crucial for managing your finances efficiently. Completing these tasks on time can save you from unnecessary difficulties later.

- Wednesday September 03, 2025 , New Delhi

The Goods and Services Tax Council has approved measures to ease burden of compliance on businesses, sources told NDTV Wednesday evening.

- Reported by Himanshu Shekhar Mishra | Wednesday September 03, 2025 , New Delhi

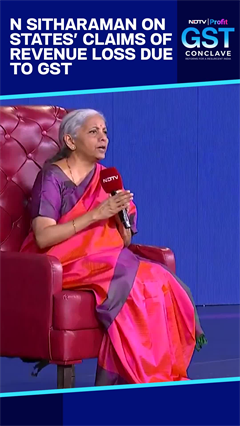

Rationalisation of the GST framework - a process that began this morning with Finance Minister Nirmala Sitharaman chairing a GST Council meet - is based on sharp differences in revenue collected under each of the existing four slabs.

- Edited by NDTV News Desk | Wednesday September 03, 2025

High hopes ride on the 56th GST Council meeting as it takes up proposals to simplify slabs and slash rates on key goods and services.

- Press Trust of India | Tuesday September 02, 2025 , Chennai

The next generation GST reforms would 'absolutely' set an economy open and transparent with further reduction in compliance burden and benefiting small businesses, Union Finance Minister Nirmala Sitharaman said on Tuesday.

- Written by Amulya Raj Srinet | Tuesday September 02, 2025

The auto industry is expecting some major changes from the GST Council meeting, which is scheduled to begin on September 3.

- Wednesday September 03, 2025

The Goods, Services Tax Council, led by Finance Minister Nirmala Sitharaman, begins a two-day meet today eto discuss a shift to a two-slab system expected to slash prices of daily-use items by reducing the brackets under which most goods are taxed.

- Reuters | Tuesday September 02, 2025 , NEW DELHI

A tax panel has proposed steep increases in consumer levies on luxury electric cars priced above $46,000, a government document showed, a move that could impact sales of carmakers such as Tesla, Mercedes-Benz, BMW and BYD.

- Edited by Nikita Nikhil | Sunday August 31, 2025

At present, GST on premium economy, business, and first-class tickets is uniformly 12 per cent, applicable across all flights.

................................ Advertisement ................................

Opinion

MoreOpinion | Why States, Not Centre, Should Get All The Credit For GST 'Savings'Derek O’Brien

Wednesday October 22, 2025Amidst all the hoopla, it is the State governments that truly deserve recognition for coming together for the GST revision. Because the States are the ones bearing the brunt of massive revenue losses.

Opinion: GST Cut, Inflation Under Control: Optimism As Festival Season ApproachesBharti Mishra Nath

Friday September 19, 2025Away from politics, floods, rain-related tragedies and the Trump tariffs, there is optimism in the air. With GST rationalized, inflation in control, the upcoming festival season promises good times.

Opinion | Next-Generation GST: A Reform That Places The Middle Class At The CentrePradeep Bhandari

Saturday September 06, 2025By ensuring both direct tax relief and rationalised indirect taxes, the government has empowered the common citizen to save more, spend more, and aspire more.

Opinion | Observations From A Student of Political Communication - By Derek O'BrienDerek O’Brien

Friday September 05, 2025For a student of political communication, this week has been fodder. The language used to describe GST reforms has been nothing short of grand. "Landmark". "Biggest ever since the 1990s". The Opposition has been advocating for such 'reforms' for eigh

Latest Videos

More................................ Advertisement ................................