- Home/

- News

Latest News

GST Collection Rises 12.6% To All Time High Of Rs 2.37 Lakh Crore In April

Press Trust of India | Thursday May 01, 2025 , New DelhiGoods and Services Tax (GST) collection rose 12.6 per cent Y-o-Y to an all-time high of about Rs 2.37 lakh crore in April, government data showed on Thursday.

- Written by NDTV Movies News Desk , Edited by NDTV Movies News Desk | Wednesday April 30, 2025 , New Delhi

The Ahmedabad concerts proved to be more than simply a musical extravaganza, drawing over 2,22,000 fans over the course of two nights

- Press Trust of India | Friday April 18, 2025 , New Delhi

Businesses will be able to get GST registration within 7 days, while applications flagged as risky will be processed within 30 days after physical verification of the premises.

- Indo-Asian News Service | Friday April 18, 2025 , New Delhi

The Finance Ministry on Friday made it clear that the government is not considering any proposal to levy Goods and Services Tax (GST) on UPI transactions over Rs 2,000.

- Indo-Asian News Service | Tuesday April 01, 2025 , Chennai

Three members of a family, including a one-year-old child, were killed in a tragic road accident on GST Road near Singaperumal Koil in Chennai on Tuesday.

- Edited by Abhinav Singh | Saturday March 29, 2025

From changes in the tax slabs to the UPI to the launch of the Unified Pension Scheme, here's a complete list of the changes that you can expect.

- Written by Anurag Dwary | Friday March 28, 2025 , Damoh/Aligarh

An egg seller and a juice vendor in Madhya Pradesh and Uttar Pradesh were in for a huge shock when they received notices for dues worth crores from the Income Tax (I-T) department.

- Edited by Saikat Kumar Bose | Tuesday March 11, 2025 , New Delhi

Amid a nationwide debate on work-life balance, the wife of a GST official, who jumped to death from his Noida flat yesterday, has said he was under work pressure and that he was a "victim of the system"

- Press Trust of India | Monday March 10, 2025 , Noida

A GST deputy commissioner allegedly jumped to death on Monday from the 15th floor of his apartment building in Noida Sector 75, with his family claiming that he was in depression, police said.

- Press Trust of India | Saturday March 08, 2025 , Mumbai

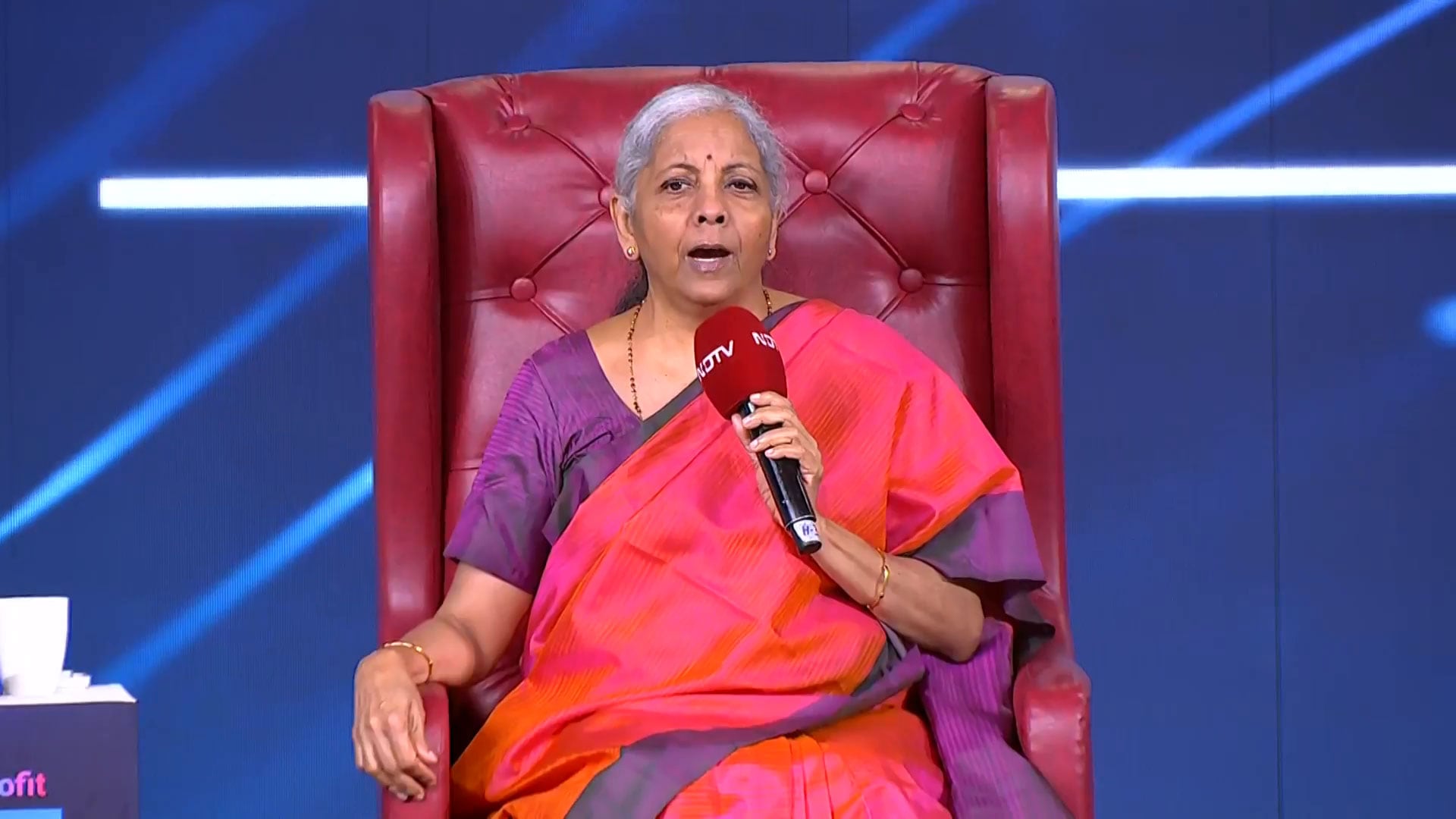

Finance Minister Nirmala Sitharaman on Saturday said the GST rates will come down further and the work on rationalising tax rates and slabs has "almost reached a finale".

- Edited by Nikhil Pandey | Friday February 28, 2025

Starting March 1, 2025, several key changes will impact personal finances, including updates to SEBI nomination rules, LPG cylinder prices, FD interest rates, UPI payment rules, tax adjustments, and GST security enhancements.

- Press Trust of India | Thursday February 27, 2025 , New Delhi

Supreme Court held that persons facing possible arrest under the GST and Customs Acts are entitled to seek anticipatory bail, even before an FIR is registered.

- Reported by Uma Sudhir, Edited by Manjiri Chitre | Saturday February 22, 2025 , Hyderabad

An additional commissioner of central excise and GST, his mother, and sister were found dead at their residence in Kerala, with the police suspecting it a case of death by suicide, officials said on Thursday.

- Written by Shaurya Tomer , Edited by Siddharth Suvarna | Friday February 21, 2025

Google Pay is now levying convenience fees on bill payments made via credit and debit cards, according to a report. Until now, the unified payments interface (UPI) platform was charging users Rs. 3 as a service fee on mobile recharges. However, it will now reportedly also levy a charge, in addition to the goods and service tax (GST), on utility bill payments for servi...

................................ Advertisement ................................

Opinion

MoreOpinion | Why States, Not Centre, Should Get All The Credit For GST 'Savings'Derek O’Brien

Wednesday October 22, 2025Amidst all the hoopla, it is the State governments that truly deserve recognition for coming together for the GST revision. Because the States are the ones bearing the brunt of massive revenue losses.

Opinion: GST Cut, Inflation Under Control: Optimism As Festival Season ApproachesBharti Mishra Nath

Friday September 19, 2025Away from politics, floods, rain-related tragedies and the Trump tariffs, there is optimism in the air. With GST rationalized, inflation in control, the upcoming festival season promises good times.

Opinion | Next-Generation GST: A Reform That Places The Middle Class At The CentrePradeep Bhandari

Saturday September 06, 2025By ensuring both direct tax relief and rationalised indirect taxes, the government has empowered the common citizen to save more, spend more, and aspire more.

Opinion | Observations From A Student of Political Communication - By Derek O'BrienDerek O’Brien

Friday September 05, 2025For a student of political communication, this week has been fodder. The language used to describe GST reforms has been nothing short of grand. "Landmark". "Biggest ever since the 1990s". The Opposition has been advocating for such 'reforms' for eigh

Latest Videos

More................................ Advertisement ................................