- Home/

- News

Latest News

Stocks Of ITC, Varun Beverages, Godfrey Phillips Decline Amid GST Hike Report

Press Trust of India | Tuesday December 03, 2024 , New DelhiShares of ITC, Varun Beverages and Godfrey Phillips India ended lower on Tuesday after the Group of Ministers on GST rate rationalisation decided to hike tax on sin goods like aerated beverages, cigarettes, tobacco and related products.

- Press Trust of India | Monday December 02, 2024 , New Delhi

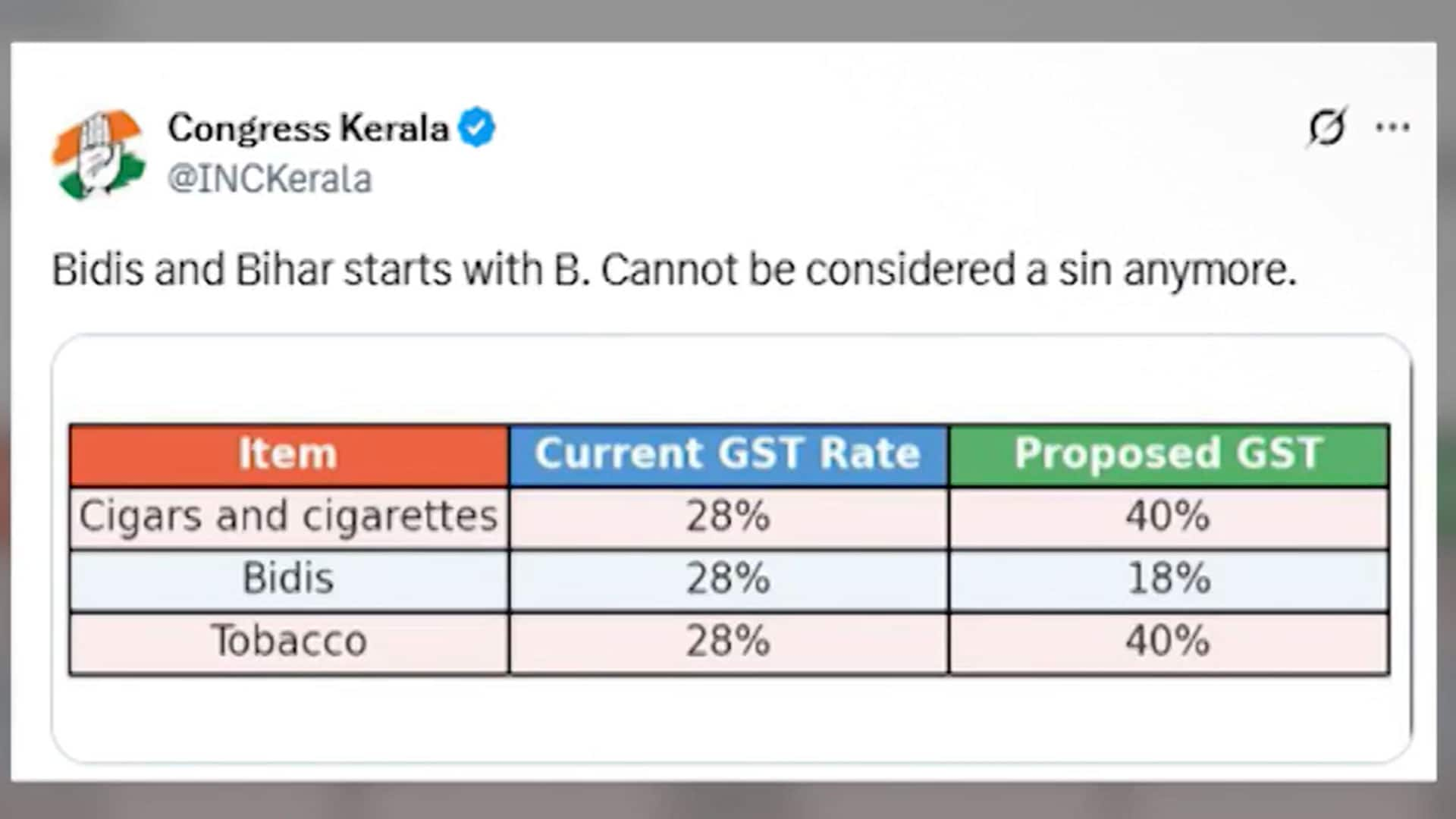

The GoM on GST rate rationalisation on Monday decided to hike tax on sin goods like aerated beverages, cigarettes, tobacco and related products to 35 per cent from the present 28 per cent, an official said.

- NDTV News Desk | Wednesday November 27, 2024 , New Delhi

Five accused in the fake goods and services tax (GST) billing scam in Gujarat were arrested by the Rajkot branch of the economic offences wing (EOW) today. The arrests happened after the police and EOW officials searched 14 locations simultaneously.

- Indo-Asian News Service | Monday November 18, 2024 , Ahmedabad

A court inAhmedabad has denied bail to journalist Mahesh Langa in a GST fraud case, observing that the offence alleged against him is serious and the offence being an economic one, affects the economy of the nation.

- NDTV News Desk | Tuesday October 29, 2024 , New Delhi

A journalist from Gujarat, in judicial custody in a case of alleged GST evasion, was charged in a separate case last week for allegedly possessing confidential government documents, sparking outrage from some quarters, including the Editors Guild.

- Press Trust of India | Saturday October 26, 2024 , Mumbai

Introduction of the Goods and Services Tax (GST) in India was a "classical example of cooperative federalism," Chief Justice of India D Y Chandrachud said on Saturday.

- Asian News International | Saturday September 28, 2024 , Pune

Union Minister for Petroleum and Natural Gas Hardeep Singh Puri on Friday called to build consensus over bringing petrol, diesel under the Goods and Services Tax.

- Asian News International | Friday September 27, 2024 , New Delhi

Maintaining financial discipline and regulatory compliance, domestic airline SpiceJet has cleared all its Goods and Services Tax (GST) dues.

- Reported by J Sam Daniel Stalin,Uma Sudhir | Friday September 13, 2024

Tamil Nadu BJP chief, K Annamalai, found himself in a spot of bother Friday after an "unintended breach of privacy" - the sharing of a private conversation between Union Finance Minister Nirmala Sitharaman and a leading businessman from the state.

- Press Trust of India | Tuesday September 10, 2024 , Indore

Shri Ram Janmabhoomi Teerth Kshetra Trust general secretary Champat Rai has said the ongoing construction work connected to the Ram temple in Ayodhya is estimated to generate Goods and Services Tax (GST) of nearly Rs 400 crore.

- Press Trust of India | Monday September 09, 2024 , New Delhi

GST Council headed by Union Finance Minister Nirmala Sitharaman on Monday decided to set up a Group of Ministers (GoM) on reducing tax rate on life and health insurance and cut GST on cancer drugs and namkeens.

- Press Trust of India | Monday September 09, 2024 , New Delhi

At the 64th ACMA Annual Session, the SIAM President revealed that the Indian automotive industry has crossed a landmark figure of Rs 20 lakh crore.

- NDTV News Desk | Tuesday September 03, 2024

Struggling with unemployment, a young man from Muzaffarnagar was in for a big shock when a team from the GST department landed up at his doorstep and told him that a company was being run in his name and a Rs 250-crore fraud had been committed.

- Press Trust of India | Monday September 02, 2024 , New Delhi

Union Minister Nitin Gadkari on Monday said state finance ministers should consider reducing Goods and Services Tax (GST) on flex-fuel vehicles to 12 per cent in the GST Council meeting.

................................ Advertisement ................................

Opinion

MoreOpinion | Why States, Not Centre, Should Get All The Credit For GST 'Savings'Derek O’Brien

Wednesday October 22, 2025Amidst all the hoopla, it is the State governments that truly deserve recognition for coming together for the GST revision. Because the States are the ones bearing the brunt of massive revenue losses.

Opinion: GST Cut, Inflation Under Control: Optimism As Festival Season ApproachesBharti Mishra Nath

Friday September 19, 2025Away from politics, floods, rain-related tragedies and the Trump tariffs, there is optimism in the air. With GST rationalized, inflation in control, the upcoming festival season promises good times.

Opinion | Next-Generation GST: A Reform That Places The Middle Class At The CentrePradeep Bhandari

Saturday September 06, 2025By ensuring both direct tax relief and rationalised indirect taxes, the government has empowered the common citizen to save more, spend more, and aspire more.

Opinion | Observations From A Student of Political Communication - By Derek O'BrienDerek O’Brien

Friday September 05, 2025For a student of political communication, this week has been fodder. The language used to describe GST reforms has been nothing short of grand. "Landmark". "Biggest ever since the 1990s". The Opposition has been advocating for such 'reforms' for eigh

Latest Videos

More................................ Advertisement ................................