- Home/

- News

Latest News

Triumph 400cc & KTM 390cc Range Prices Hold Steady Despite GST Reforms

Written by NDTV Auto Desk | Tuesday September 23, 2025The range of Triumph 400 cc and KTM 390 cc motorcycles remains the same even with increased GST rates.

- Written by NDTV Auto Desk | Tuesday September 23, 2025

Hyundai has registered sales of 11,000 units on the first day of Navratri and GST 2.0.

- Written by NDTV Auto Desk | Tuesday September 23, 2025

The prices of Aprilia RS457 and Tuono 457 will remain the same even after GST revisions; additionally, the RS457 gets additional benefits.

- Reported by TM Veeraraghav,Vasudha Venugopal, Edited by Manjiri Chitre | Tuesday September 23, 2025 , New Delhi

Karnataka Revenue Minister Krishna Byre Gowda said that while he supports the new GST structure that came into effect on Monday, it is likely to cause a revenue loss of at least 1 to 1.5 lakh crores to states.

- Press Trust of India | Tuesday September 23, 2025 , New Delhi

As lower GST rates take effect on Monday, sales of air-conditioners, TV sets surged dramatically with buyers rushing to grab cheaper deals offered by retailers at the beginning of the Navratra festival.

- Written by Mohit Bhardwaj | Monday September 22, 2025

Honda Cars India cuts prices across the lineup post-GST reforms, passing full benefits to customers ahead of the festive season.

- Written by Mohit Bhardwaj | Monday September 22, 2025

JSW MG Motor slashes SUV prices by up to ₹3.04 lakh after GST cut; Astor, Hector, Gloster get cheaper.

- Monday September 22, 2025 , New Delhi

Prime Minister Narendra Modi interacted with traders and merchants of Arunachal Pradesh as the rationalized Goods and Services Tax came into effect across the country today.

- Press Trust of India | Monday September 22, 2025 , New Delhi

Prime Minister Narendra Modi on Monday said the next generation GST reforms will boost savings and directly benefit every section of society, as he asserted that it is imperative to walk on the path of self-reliance to achieve the collective goal of

- Written by Akarsh Anant | Monday September 22, 2025

TVS has implemented the price cut for the Apache RTR 310 and the RR 310 as per GST 2.0. Here is a variant-wise list you must check out.

- Reported by Aishvarya Jain | Monday September 22, 2025

Union minister Gajendra Singh Shekhawat said reforms in GST will increase taxpayers' savings, leading to a"direct positive impact" on the tourism sector.

- Written by Akarsh Anant | Monday September 22, 2025

Bajaj has extended the festival season offers alongside the GST benefits, making the Pulsar lineup more affordable.

- Written by Akarsh Anant | Monday September 22, 2025

Tata Motors has announced festival season offers, alongside the GST benefits on its passenger car lineup, making the Punch, Curvv, Safari, and others more affordable.

- Written by Shreya Goswami | Monday September 22, 2025

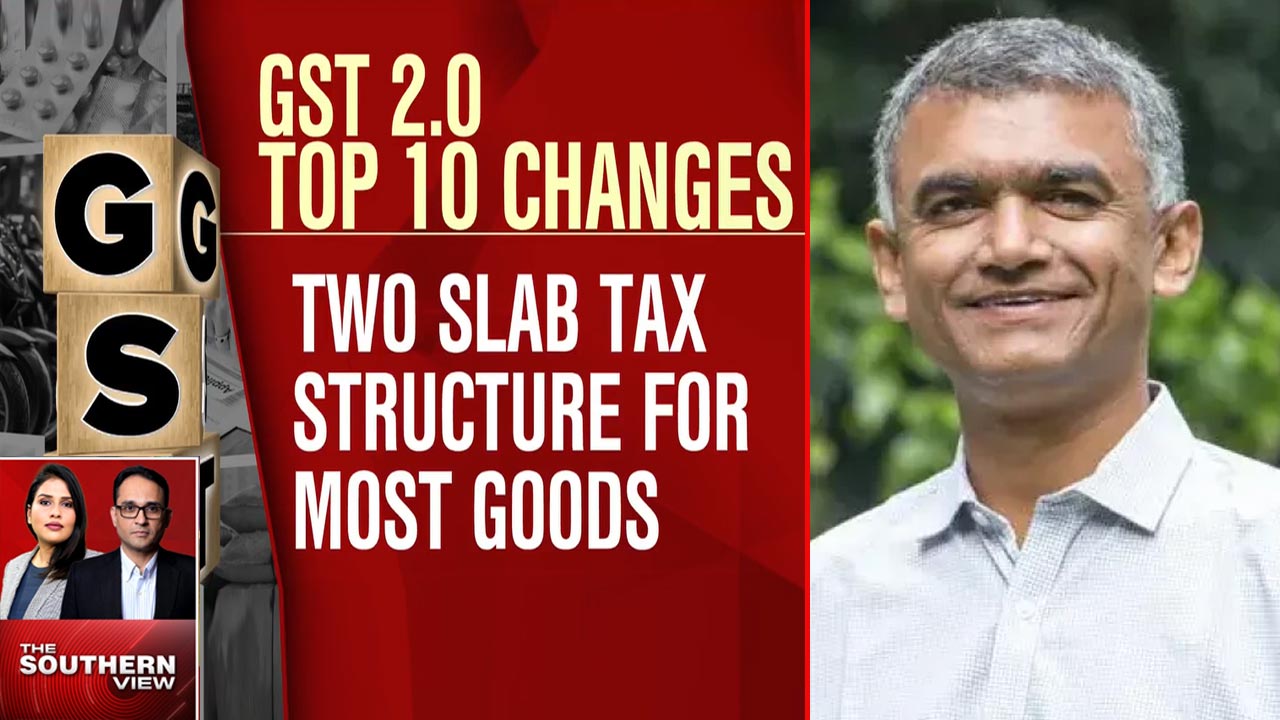

Most medicines and medical devices will now attract only 5% GST, while individual health and life insurance premiums are completely exempt.

................................ Advertisement ................................

Opinion

MoreOpinion | Why States, Not Centre, Should Get All The Credit For GST 'Savings'Derek O’Brien

Wednesday October 22, 2025Amidst all the hoopla, it is the State governments that truly deserve recognition for coming together for the GST revision. Because the States are the ones bearing the brunt of massive revenue losses.

Opinion: GST Cut, Inflation Under Control: Optimism As Festival Season ApproachesBharti Mishra Nath

Friday September 19, 2025Away from politics, floods, rain-related tragedies and the Trump tariffs, there is optimism in the air. With GST rationalized, inflation in control, the upcoming festival season promises good times.

Opinion | Next-Generation GST: A Reform That Places The Middle Class At The CentrePradeep Bhandari

Saturday September 06, 2025By ensuring both direct tax relief and rationalised indirect taxes, the government has empowered the common citizen to save more, spend more, and aspire more.

Opinion | Observations From A Student of Political Communication - By Derek O'BrienDerek O’Brien

Friday September 05, 2025For a student of political communication, this week has been fodder. The language used to describe GST reforms has been nothing short of grand. "Landmark". "Biggest ever since the 1990s". The Opposition has been advocating for such 'reforms' for eigh

Latest Videos

More................................ Advertisement ................................