digital payment

'digital payment' - 930 News Result(s)

- Andy Mukherjee | Bloomberg | Thursday | January 08, 2026

Stablecoins had their ChatGPT moment in 2025. Payment tokens that were until now used mostly by crypto traders are raring to go mainstream, and not just in the US, where they got regulatory blessing through the Genius Act.

- Sponsored Content | Friday | January 02, 2026

Managing everyday digital payments with Airtel Payments Bank

- Edited by Ritu SinghTuesday | December 30, 2025

Major financial rule changes in India starting January 1, 2026, will impact banking, taxation, and household budgets.

- Edited by Nikhil PandeyFriday | December 26, 2025

A Delhi man's scooty ran out of fuel around midnight, but two kind strangers, one who pushed him to a petrol station and another who paid when digital payments failed, came to his rescue.

- Edited by Astitva RajMonday | December 22, 2025

The user also mentioned changes in people's clothing, especially in women's clothing. According to him, Western-style clothing is being worn more frequently, and women appear to be wearing more modern and revealing clothing than before.

- NRI Returns After 7 Years, Amazed by India's Rapid Transformation: "Digital Payments Are Everywhere"Edited by Ritu SinghSunday | December 21, 2025

Upon moving back a few months ago, the user said he was taken aback by the visible and significant changes across various aspects of life in India.

- Written by Akash Dutta , Edited by Ketan PratapWednesday | December 17, 2025

Google Pay has introduced Flex, a UPI-powered, digital co-branded credit card built on the RuPay network, debuting with the Google Pay Flex Axis Bank Credit Card. Users can apply within the app, earn instant rewards, and manage payments and repayments directly in Google Pay. The launch is aimed at increasing everyday credit access in India.

- Edited by Amit ChaturvediThursday | December 11, 2025

If implemented as proposed, DHRUVA could become one of India's most ambitious digital infrastructure projects like Aadhaar and UPI.

- Written by Nikhil PandeyThursday | December 11, 2025

India's Gen Z is revolutionizing digital payments and credit habits, prioritizing convenience, cashback, and responsible spending, reveals super.money's superSpends 2025 report.

- Virat Kohli, Rohit Sharma's BCCI Contract Revision To Be Discussed Next Week At This Meeting: ReportWednesday | December 10, 2025

A revision of contracts for Indian superstars Virat Kohli and Rohit Sharma, along with those of women players in domestic cricket, will be discussed during the Annual General Meeting of the BCCI's apex council on December 22

- Edited by Nikhil PandeySaturday | December 06, 2025

To be eligible for Double Payday, customers must ensure their employer pays their salary directly into their bank account by the final day of each month.

- Written by Rahul Dhingra , Edited by David DelimaTuesday | December 02, 2025

Sony Bank is developing a US dollar-backed stablecoin aimed at simplifying payments across Sony’s entertainment ecosystem. The project is currently under regulatory review in the US and is being built with stablecoin provider Bastion. Sony has already begun experimenting with crypto payments, including enabling USDC purchases in Singapore, signalling a wider shift t...

- Written by Shaurya Tomer , Edited by Ketan PratapMonday | December 01, 2025

Google Pay remains one of the most popular choices because of its clean and simple UI, integration with UPI, and automatic bill reminders. Features like multi-bank support and detailed transaction history enhance the convenience factor. Paying your electricity, water, or DTH bill using Google Pay is a simple and secure process. Here’s how to do it.

- Written by Nikita Nikhil , Edited by Shubham BhatnagarThursday | November 27, 2025

If you are planning to visit Japan, you will find vending machines everywhere! Here's why they will become your companion during your travel trip.

- Written by Rahul Dhingra , Edited by David DelimaFriday | November 21, 2025

The government is assessing potential use cases for stablecoins in its upcoming Economic Survey for 2025-26, according to a report. Officials say the review may propose limited experimentation under a regulated framework. The move comes as India continues developing its digital currency plans through the RBI’s CBDC and weighs concerns around financial stability, com...

- Written by Dhruv Raghav , Edited by David DelimaWednesday | November 19, 2025

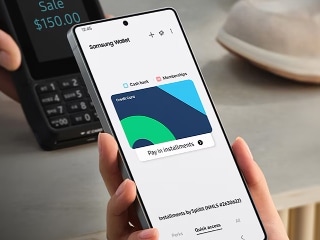

Samsung and AU Small Finance Bank are coming together to introduce the Tap & Pay feature for AU Visa Credit Card users through Samsung Wallet. The company said that this allows people to make credit card payments directly from their Galaxy smartphones, without having to carry cards in physical form. This comes as part of the slew of new features that the company has b...

- Written by Shaurya Tomer , Edited by Ketan PratapTuesday | November 18, 2025

Paytm is rolling out a new Hide Payments feature, which allows users to move certain transactions out of the primary transaction view. As per the company, it is a more private and personalised way to manage digital payments. Transactions that are marked as hidden are not deleted or altered, but remain in a separate protected section. Hidden transactions can be viewed ...

- Monday | November 17, 2025

If you are travelling to Bali, you can now use a single digital wallet linked to QR codes for payments at restaurants, shops, and attractions. The new Tourist Travel Pack simplifies checkouts, makes beach days more enjoyable, and eases your experience in local hubs.

- Written by Akash Dutta , Edited by Ketan PratapTuesday | November 11, 2025

UPI has made digital payments effortless in India, but its simplicity can sometimes lead to overspending or increased risk of fraud. Setting daily UPI limits helps users manage expenses and minimise losses from scams. Most banks allow users to set limits through their apps or NetBanking portals, while UPI Lite offers capped transactions for small, everyday payments.

- Written by Akash Dutta , Edited by Rohan PalMonday | November 10, 2025

Paytm has redesigned its mobile app with a cleaner interface and new artificial intelligence (AI) features to make payments and financial management easier. The update adds tools to track spending, categorise transactions, and search payment history more efficiently. Users can now view all linked bank balances, use Magic Paste for faster transfers, and earn digital go...

- Written by Rahul Dhingra , Edited by David DelimaFriday | November 07, 2025

A group of major blockchain organisations, including Solana Foundation, Polygon Labs, Stellar Development Foundation, and Fireblocks, has launched the Blockchain Payments Alliance to improve interoperability and compliance across stablecoin payments. The collaboration seeks to create unified standards for digital transactions, reduce fragmentation between networks, an...

- Reported by Deepak Bopanna, Edited by Manjiri ChitreTuesday | November 04, 2025 , Bengaluru

Mahendra Reddy had sent the message to the woman he was in a relationship with on a digital payment application.

- Press Trust of India | Monday | November 03, 2025 , New Delhi

Fuelled by festive buying, the transaction through the popular Unified Payments Interface touched a record high of Rs 27.28 lakh crore and 20.7 billion in value and volume terms, respectively, in October, according to data released by the NCPI

- Edited by Puniti PandeyFriday | October 31, 2025 , New Delhi

SWAYAM, a government initiative, aims to provide equitable access to quality education by bridging the digital divide through 648 courses available in the July 2025 semester.