- Home/

- News

Latest News

Rs 557 Crore GST Fraud Unearthed In UP, 3 Arrested

Press Trust of India | Friday July 28, 2023 , New DelhiGST officers have unearthed two fake billing rackets involving 246 shell/fake entities involved in fraudulently passing input tax credit (ITC) of Rs 557 crore and arrested three key operatives.

- Press Trust of India | Tuesday July 25, 2023 , New Delhi

Of the Rs 3.09 lakh crore net proceeds of shareable union taxes and duties distributed to the states, Central GST collection devolution stood at Rs 94,368 crore till July.

- Oppo, Vivo, Xiaomi Found Evading Tax Worth Rs. 9,000 Crore; Rs. 1,630 Crore Recovered So Far: MoS ITPress Trust of India | Saturday July 22, 2023

Chinese smartphone makers, including Oppo Mobile, Vivo India and Xiaomi Technology, have been found evading taxes worth Rs. 9,000 crore in India, Parliament was informed on Friday. Data shared by the Minister of State for Electronics and IT Rajeev Chandrasekhar in Rajya Sabha showed tax evasion comprising customs duty and GST.

- Press Trust of India | Wednesday July 19, 2023 , New Delhi

Days after a 42-year-old man was arrested for allegedly duping a jeweller of 10 kilogrammes of gold worth Rs 6 crore, police have recovered two kilogrammes of gold following raids in Punjab's Ludhiana, officials said on Wednesday.

- Press Trust of India | Monday July 17, 2023 , New Delhi

Amid the online gaming industry raising concerns over the levy of 28 per cent GST, Union minister Rajeev Chandrasekhar on Monday said the government may request the GST Council to consider the facts of new regulatory framework for the industry.

- Press Trust of India | Sunday July 16, 2023 , Chennai

Tamil Nadu BJP chief K Annamalai on Saturday accused the ruling DMK of undertaking a disinformation campaign against the Centre issues including the Uniform Civil Code (UCC), and said the truth will be exposed in the forthcoming Parliament session.

- Edited by Ritu Singh | Thursday July 13, 2023

Shaadi.com founder and Shark Tank India judge Anupam Mittal slammed the move, saying that entrepreneurs should now build rockets rather than gaming companies.

- Press Trust of India | Wednesday July 12, 2023

Online gaming companies on Tuesday said that levying of 28 percent GST will limit their ability to invest in new games, impacting cash flows as well as business expansion. The All India Gaming Federation (AIGF), which represents companies like Nazara, GamesKraft, Zupee and Winzo, said the decision by the council is unconstitutional, irrational, and egregious.

- Edited by Amit Chaturvedi | Wednesday July 12, 2023

The $1.5 billion online gaming industry has surged in popularity in recent years and attracted foreign investment.

- Edited by Abhimanyu Kulkarni | Wednesday July 12, 2023 , New Delhi

The GST Council has announced that the bets placed in online gaming and casinos will now face 28 per cent tax.

- Press Trust of India | Tuesday July 11, 2023 , New Delhi

Delhi Chief Minister Arvind Kejriwal alleged today that with the Goods and Services Tax (GST) being linked with the Enforcement Directorate (ED), even those traders paying the tax can be arrested by the federal agency.

- NDTV News Desk | Tuesday July 11, 2023 , New Delhi

Delhi minister Atishi today said that the linking of Goods and Services Tax (GST) with the Enforcement Directorate (ED), could lead to the arrest of even those traders who pay tax.

- Press Trust of India | Monday July 10, 2023 , Kolkata

The Kolkata Zonal Unit of the Directorate General of GST Intelligence (DGGI) has arrested one person for his alleged involvement in operating syndicates in 19 states, officials said Monday.

- Asian News International | Sunday July 09, 2023 , New Delhi

The central government on Saturday issued a notification to bring the Goods and Services Tax Network (GSTN) under the Prevention of Money Laundering Act (PMLA).

................................ Advertisement ................................

Opinion

MoreOpinion | Why States, Not Centre, Should Get All The Credit For GST 'Savings'Derek O’Brien

Wednesday October 22, 2025Amidst all the hoopla, it is the State governments that truly deserve recognition for coming together for the GST revision. Because the States are the ones bearing the brunt of massive revenue losses.

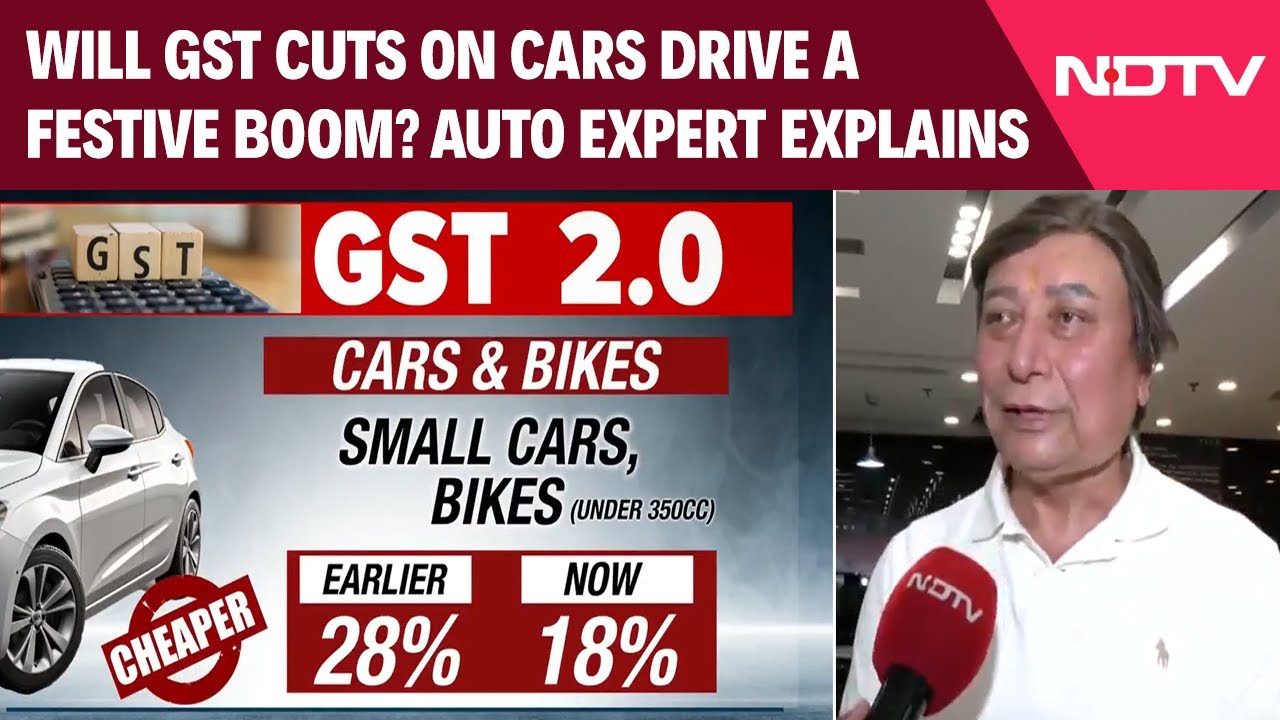

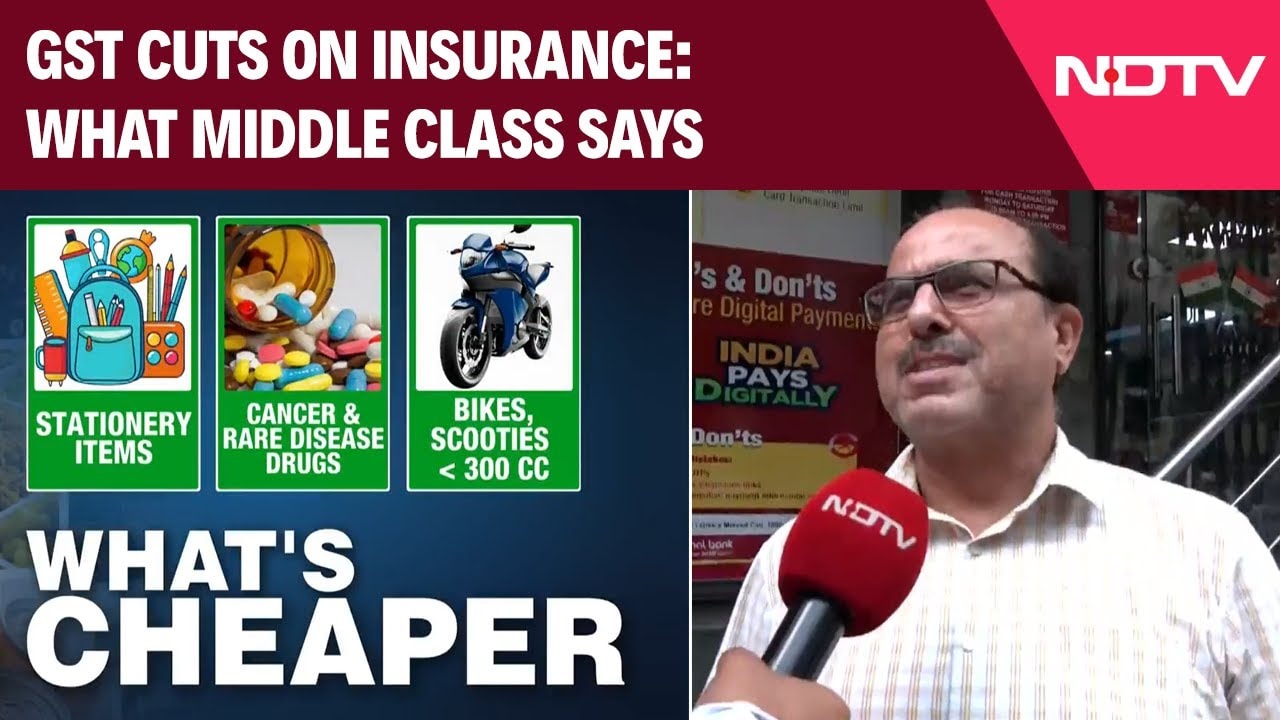

Opinion: GST Cut, Inflation Under Control: Optimism As Festival Season ApproachesBharti Mishra Nath

Friday September 19, 2025Away from politics, floods, rain-related tragedies and the Trump tariffs, there is optimism in the air. With GST rationalized, inflation in control, the upcoming festival season promises good times.

Opinion | Next-Generation GST: A Reform That Places The Middle Class At The CentrePradeep Bhandari

Saturday September 06, 2025By ensuring both direct tax relief and rationalised indirect taxes, the government has empowered the common citizen to save more, spend more, and aspire more.

Opinion | Observations From A Student of Political Communication - By Derek O'BrienDerek O’Brien

Friday September 05, 2025For a student of political communication, this week has been fodder. The language used to describe GST reforms has been nothing short of grand. "Landmark". "Biggest ever since the 1990s". The Opposition has been advocating for such 'reforms' for eigh

Latest Videos

More................................ Advertisement ................................