- Home/

- News

Latest News

Man Accused In Rs 19 Crore GST Fraud Case Gets Bail

Asian News International | Tuesday January 03, 2023 , New DelhiA Delhi Court has granted bail to an accused allegedly involved in wrongfully passing input credit of GST amounting to Rs 19 crores.

- Press Trust of India | Saturday December 31, 2022 , New Delhi

From January 1, GST would not be payable on housing units rented to the proprietor of a proprietary concern for residential usage only, the CBIC has said.

- Press Trust of India | Tuesday December 27, 2022 , Ahmedabad

Former Union finance secretary Hasmukh Adhia, who is credited with the successful implementation of the Goods and Services Tax (GST), has been appointed as the chief advisor to Gujarat Chief Minister Bhupendra Patel, an official said on Tuesday.

- Asian News International | Tuesday December 20, 2022 , Navi Mumbai

The Central Bureau of Investigation (CBI) has arrested a Superintendent of Central Goods and Services Tax (CGST), Anti-Evasion Unit, Vashi, Navi Mumbai in an alleged bribery case.

- Press Trust of India | Monday December 19, 2022 , New Delhi

Thousands of farmers held a rally here on Monday under the banner of RSS-affiliated Bharatiya Kisan Sangh (BKS) to press for a rollback of GST on agricultural goods and other demands.

- Reuters | Sunday December 18, 2022 , New Delhi

The Goods and Services Tax (GST) Council on Saturday decided to have a single definition across all states in the country for sports utility vehicles, attracting a higher tax rate.

- Press Trust of India | Saturday December 17, 2022 , New Delhi

The GST Council on Saturday agreed to decriminalise certain offences and doubled the threshold for launching prosecution to Rs 2 crore, Revenue Secretary Sanjay Malhotra said.

- Press Trust of India | Monday December 12, 2022

The Directorate of Enforcement is investigating GST evasion of about Rs 23,000 crore by gaming companies between April 2019 and November 2022, Minister of State for Finance Pankaj Chaudhary said on Monday. The ED has attached proceeds of crime in cases related to cyber and crypto assets frauds.

- Reuters | Monday December 05, 2022

A government panel of state finance ministers has not yet submitted its report on plans to tax the online gaming sector, according to a government official. The panel is yet to decide whether to talk the profits of these firms, or the value of the entire pool of money collected from game participants.

- Reported by Anurag Dwary, Edited by Akhil Kumar | Monday November 28, 2022 , Indore

At the Rajwada palace, Rahul Gandhi again attacked the central government, saying, "What the Chinese army couldn't do to India has been done by demonetisation and a flawed GST".

- Press Trust of India | Wednesday November 23, 2022

Cellular Operators' Association of India (COAI)has urged the government for rationalisation of GST, reduce of licence fee to 1 percent from 3 percent and sought a waiver of customs duty on network equipment for the 5G rollout. During the pre-Budget discussions, the telecom operators' body also sought the removal of GST on the licence fee, spectrum usage charges and pa...

- Edited by Sanjib Kumar Das | Tuesday November 15, 2022 , Kolkata

Attending a tribal outreach programme in Jhargram, the Bengal Chief Minister, taking a swipe at the BJP, wondered whether India has become a "one-party country"

- Press Trust of India | Tuesday November 15, 2022 , Jhargram, West Bengal

Launching a tirade against the BJP-led Union government, West Bengal Chief Minister Mamata Banerjee today said that if the Centre does not clear the state's dues, it may have to stop paying Goods and Services Tax or GST.

- Press Trust of India | Wednesday November 02, 2022 , Mumbai

A 26-year-old man has been arrested by the Maharashtra Goods and Services Tax (GST) department for fraudulently claiming a refund of more than Rs 27 crore through a fake input tax credit involving at least two "non-genuine" firms, an official said.

................................ Advertisement ................................

Opinion

MoreOpinion | Why States, Not Centre, Should Get All The Credit For GST 'Savings'Derek O’Brien

Wednesday October 22, 2025Amidst all the hoopla, it is the State governments that truly deserve recognition for coming together for the GST revision. Because the States are the ones bearing the brunt of massive revenue losses.

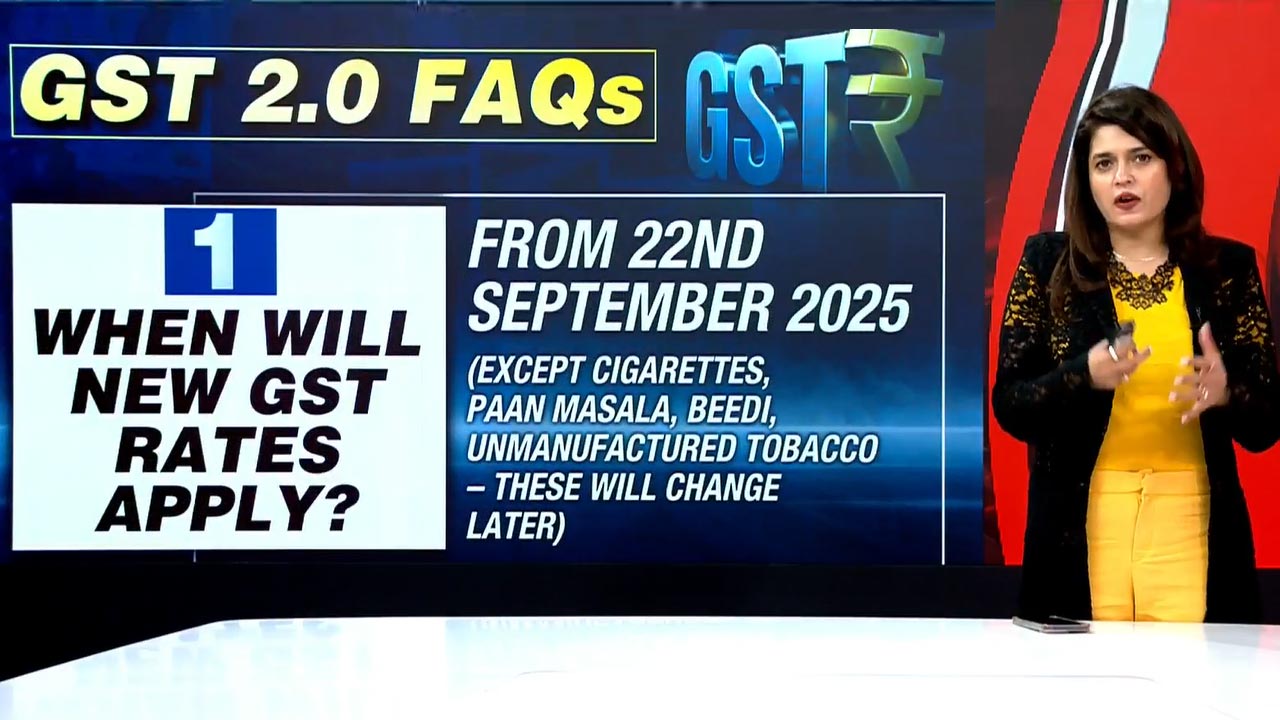

Opinion: GST Cut, Inflation Under Control: Optimism As Festival Season ApproachesBharti Mishra Nath

Friday September 19, 2025Away from politics, floods, rain-related tragedies and the Trump tariffs, there is optimism in the air. With GST rationalized, inflation in control, the upcoming festival season promises good times.

Opinion | Next-Generation GST: A Reform That Places The Middle Class At The CentrePradeep Bhandari

Saturday September 06, 2025By ensuring both direct tax relief and rationalised indirect taxes, the government has empowered the common citizen to save more, spend more, and aspire more.

Opinion | Observations From A Student of Political Communication - By Derek O'BrienDerek O’Brien

Friday September 05, 2025For a student of political communication, this week has been fodder. The language used to describe GST reforms has been nothing short of grand. "Landmark". "Biggest ever since the 1990s". The Opposition has been advocating for such 'reforms' for eigh

Latest Videos

More................................ Advertisement ................................