- Home/

- News

Latest News

Arvind Kejriwal Credits "Honest Governance" For Delhi's Rising GST Revenue

Asian News International | Thursday July 06, 2023 , New DelhiGST collections in Delhi NCT have been rising consistently over the past several years.

- Press Trust of India | Wednesday July 05, 2023 , New Delhi

GST authorities have so far cancelled over 4,900 GST registrations and detected tax evasion of over Rs 15,000 crore during the ongoing two-month drive to weed out fake GSTINs which will end on July 15, a senior tax official said on Wednesday.

- Written by J Sam Daniel Stalin | Monday July 03, 2023 , Chennai

A 34-year-old alleged mastermind of a fake input tax credit racket, which caused a loss of Rs 176 crore to the government by floating fictitious companies in the names of poor people, has been arrested while attempting to flee the country.

- Press Trust of India | Thursday June 29, 2023 , New Delhi

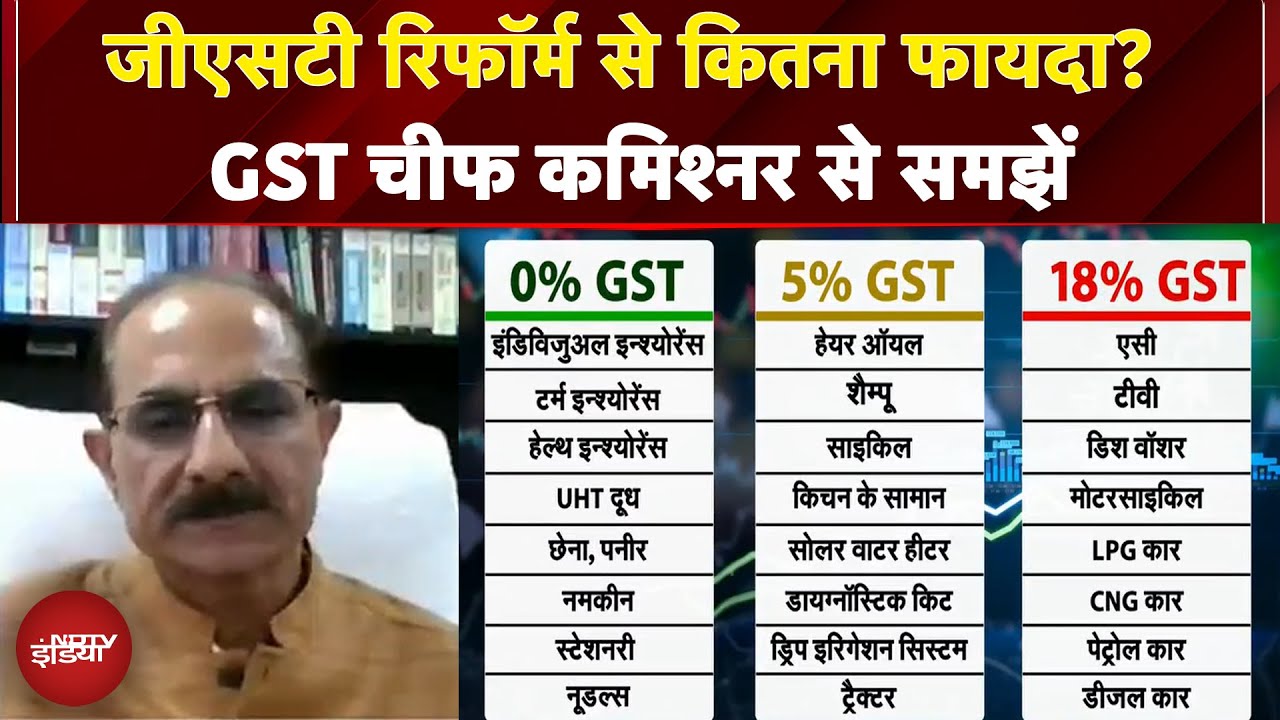

Six years after Goods and Services Tax revenue of Rs 1.5 lakh crore every month has become a new normal and tax officers are focusing on dealing with fraudsters who are adopting newer modus operandi to game the system, causing loss to the exchequer.

- Press Trust of India | Friday June 16, 2023 , Gurugram

The GST Intelligence officers have unearthed a racket involving 461 shell/fake entities, which had passed on fraudulent input tax credit of Rs 863 crore.

- Press Trust of India | Thursday June 15, 2023 , New Delhi

The GST Council on Thursday said it will hold a meeting, chaired by Union Finance Minister Nirmala Sitharaman, on July 11.

- Press Trust of India | Tuesday June 06, 2023 , New Delhi

Hitting out at the government, the Congress said on Tuesday that "no amount of headline management" with GDP growth numbers and GST revenues can hide the economic distress faced by a majority of Indians as it cited a surge in the

- Press Trust of India | Wednesday May 31, 2023 , New Delhi

Delhi Finance Minister Kailash Gahlot on Wednesday said the collection of GST and VAT in the city was more than Rs 34,000 crores in 2022-23, and claimed Delhi will be a leading state for tax administration through the intervention of AI.

- Press Trust of India | Wednesday May 03, 2023

Finance Minister Nirmala Sitharaman on Tuesday said the GST Council is deliberating on taxation policy for online gaming and exuded confidence that the sector will attract investment once it is finalised.

- Press Trust of India | Wednesday May 03, 2023 , Seoul

Finance Minister Nirmala Sitharaman on Tuesday said the GST Council is deliberating on taxation policy for online gaming and exuded confidence that the sector will attract investment once it is finalised.

- Asian News International | Tuesday May 02, 2023 , New Delhi

Prime Minister Narendra Modi called GST revenue collection for April 2023 being highest ever at Rs 1.87 lakh crore "great news for the Indian economy."

- Press Trust of India | Thursday April 27, 2023

The Finance Ministry is considering classifying online gaming into categories of skill and chance, and levying a differential rate of GST, an official said. Currently, online gaming attracts 18 percent GST. The tax is levied on gross gaming revenue, which is the fees charged by online gaming portals.

- Press Trust of India | Thursday April 13, 2023 , New Delhi

The Delhi High Court has upheld the centre's decision to levy GST on the services offered by an auto-rickshaw or other non-air-conditioned carriages through electronic commerce operators like Uber.

- Press Trust of India | Friday April 07, 2023 , Surat

A superintendent with the Central Goods and Services Tax (GST) department and two others were arrested in Surat in Gujarat for allegedly extorting Rs 12 lakh from a shopkeeper, a police official said on Friday.

................................ Advertisement ................................

Opinion

MoreOpinion | Why States, Not Centre, Should Get All The Credit For GST 'Savings'Derek O’Brien

Wednesday October 22, 2025Amidst all the hoopla, it is the State governments that truly deserve recognition for coming together for the GST revision. Because the States are the ones bearing the brunt of massive revenue losses.

Opinion: GST Cut, Inflation Under Control: Optimism As Festival Season ApproachesBharti Mishra Nath

Friday September 19, 2025Away from politics, floods, rain-related tragedies and the Trump tariffs, there is optimism in the air. With GST rationalized, inflation in control, the upcoming festival season promises good times.

Opinion | Next-Generation GST: A Reform That Places The Middle Class At The CentrePradeep Bhandari

Saturday September 06, 2025By ensuring both direct tax relief and rationalised indirect taxes, the government has empowered the common citizen to save more, spend more, and aspire more.

Opinion | Observations From A Student of Political Communication - By Derek O'BrienDerek O’Brien

Friday September 05, 2025For a student of political communication, this week has been fodder. The language used to describe GST reforms has been nothing short of grand. "Landmark". "Biggest ever since the 1990s". The Opposition has been advocating for such 'reforms' for eigh

Latest Videos

More................................ Advertisement ................................