- Home/

- News

Latest News

Punjab Paid Back Electricity Subsidy For 2022-23 In Full: Chief Minister

Press Trust of India | Friday April 07, 2023 , ChandigarhPunjab Chief Minister Bhagwant Mann Friday said the state has cleared its entire electricity subsidy bill of Rs 20,200 crore for the last financial year and has witnessed a jump in excise and GST revenue.

- Edited by Ritu Singh | Wednesday March 29, 2023

Mr Tharoor also shared images of the letter he sent to the Finance Minister.

- Press Trust of India | Tuesday March 28, 2023 , Singur

Asserting that the Centre has been depriving West Bengal of its share of the Goods and Service Tax collected from the state, Chief Minister Mamata Banerjee on Tuesday said that the decision to support the passage of the GST Bill was wrong.

- Press Trust of India | Friday March 24, 2023 , New Delhi

Lok Sabha on Friday cleared changes in the Finance Bill to pave the way for setting up of an appellate tribunal for resolution of disputes under GST.

- Aditi Ahuja | Friday March 24, 2023

The Press Information Bureau of India analysed the savings on a restaurant bill in the pre and post-GST era.

- Press Trust of India | Friday March 24, 2023 , New Delhi

Lok Sabha today passed the Finance Bill 2023 with 64 official amendments, including the one that seeks withdrawal of long-term tax benefits on certain categories of debt mutual funds and another for setting up the GST Appelate Tribunal.

- Press Trust of India | Friday March 03, 2023 , New Delhi

In a bizarre case of cyber fraud, a group of fraudsters allegedly procured PAN details of several Bollywood actors and cricketers from their GST Identification Numbers which are available online, and got credit cards issued in their names.

- Reported by Himanshu Shekhar Mishra, Edited by Debanish Achom | Saturday February 18, 2023 , New Delhi

The government will clear the entire goods and services tax, or GST, compensation dues of Rs 16,982 crore from its own pocket today, Finance Minister Nirmala Sitharaman said after a meeting of the council that sets GST rates.

- Asian News International | Wednesday February 15, 2023 , New Delhi

Petroleum products can be part of GST and what is needed is the nod from the council members, said Union finance minister Nirmala Sitharaman on Wednesday.

- Press Trust of India | Saturday February 11, 2023 , Kolkata

The West Bengal government on Friday night said the Centre owes it Rs 2,409.96 crore, responding to Union Finance Minister Nirmala Sitharaman's statement that the state has not sent GST compensation cess claim with accountant general (AG) certificate

- Asian News International | Wednesday February 01, 2023 , Raipur

Ahead of the presentation of the Union Budget for fiscal 2023-24, on Wednesday, Chattisgarh Chief Minister Bhupesh Baghel said locals have put forward a demand for new trains in Jagadalpur and Surguja areas.

- Written by Saurabh Gupta | Saturday January 21, 2023 , Kolkata

The GST Council is the only institution in the country today which is totally federalist, Mr Mitra further argued, saying ministers of 31 states and union territories are part of the council, chaired by the Finance Minister of India.

- Press Trust of India | Thursday January 12, 2023 , Ludhiana, Punjab

Congress leader Rahul Gandhi today said Ludhiana's small and medium businesses can compete with China if they are given adequate support even as he attacked the Punjab government and the Centre for not supporting them.

- Press Trust of India | Friday January 06, 2023 , Panipat

Congress leader Rahul Gandhi on Friday launched a scathing attack on the BJP-led government at the Centre over a host of issues, including the Agnipath scheme and GST.

................................ Advertisement ................................

Opinion

MoreOpinion | Why States, Not Centre, Should Get All The Credit For GST 'Savings'Derek O’Brien

Wednesday October 22, 2025Amidst all the hoopla, it is the State governments that truly deserve recognition for coming together for the GST revision. Because the States are the ones bearing the brunt of massive revenue losses.

Opinion: GST Cut, Inflation Under Control: Optimism As Festival Season ApproachesBharti Mishra Nath

Friday September 19, 2025Away from politics, floods, rain-related tragedies and the Trump tariffs, there is optimism in the air. With GST rationalized, inflation in control, the upcoming festival season promises good times.

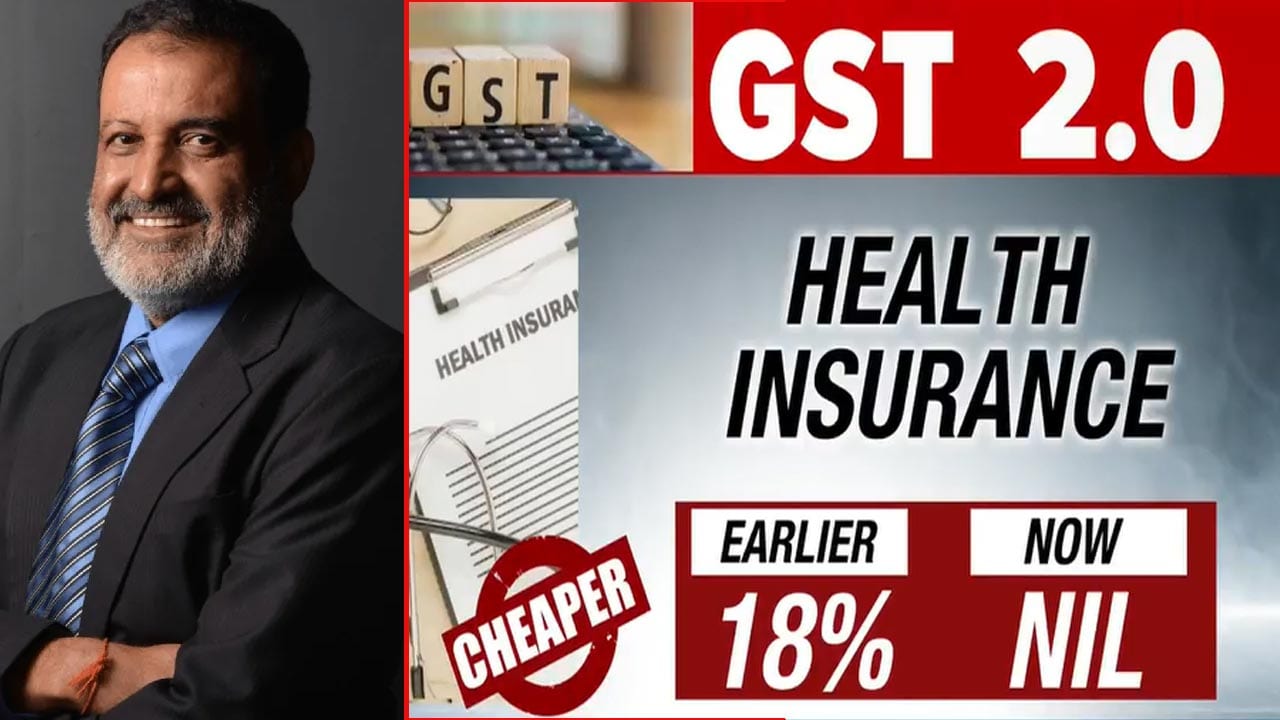

Opinion | Next-Generation GST: A Reform That Places The Middle Class At The CentrePradeep Bhandari

Saturday September 06, 2025By ensuring both direct tax relief and rationalised indirect taxes, the government has empowered the common citizen to save more, spend more, and aspire more.

Opinion | Observations From A Student of Political Communication - By Derek O'BrienDerek O’Brien

Friday September 05, 2025For a student of political communication, this week has been fodder. The language used to describe GST reforms has been nothing short of grand. "Landmark". "Biggest ever since the 1990s". The Opposition has been advocating for such 'reforms' for eigh

Latest Videos

More................................ Advertisement ................................