- Home/

- News

Latest News

"No Internal Unrest In Maharashtra Government": Uddhav Thackeray

Press Trust of India | Saturday April 02, 2022 , MumbaiClaiming that there was no internal unrest in the Maha Vikas Aghadi (MVA) government in Maharashtra, Chief Minister Uddhav Thackeray on Saturday said a befitting reply is being given through development works to those trying to topple it.

- Press Trust of India | Tuesday March 29, 2022

Indian government announced on Monday that it had recovered over Rs. 95 crore from 11 cryptocurrency exchanges including WazirX, Coin DCX, CoinSwitch Kuber, Buy Ucoin, and UnoCoin in GST evasion cases.

- Press Trust of India | Wednesday March 23, 2022 , Singapore

A jewellery firm director was fined SGD104,400 on Wednesday for conspiring with five Indian tourists to unlawfully obtain goods and services tax (GST) refunds that they were not entitled to.

- Press Trust of India | Sunday March 20, 2022 , New Delhi

The CBI has arrested a senior intelligence officer, working in the office of the Directorate General of GST Intelligence (DGGI) in Ghaziabad, for allegedly taking a bribe of Rs 60 lakh, officials said on Sunday.

- Press Trust of India | Thursday March 17, 2022 , Mumbai

Maharashtra Deputy Chief Minister Ajit Pawar on Wednesday rejected the demand of BJP legislators to make "The Kashmir Files" tax-free in the state, saying if the Centre waives GST on the movie, it will apply to the entire country.

- Aditi Ahuja | Thursday March 17, 2022

Pizza was among the top trends on Indian Twitter, and the reason was that pizza toppings were said to attract a higher GST at 18%.

- Written by carandbike team | Tuesday March 29, 2022

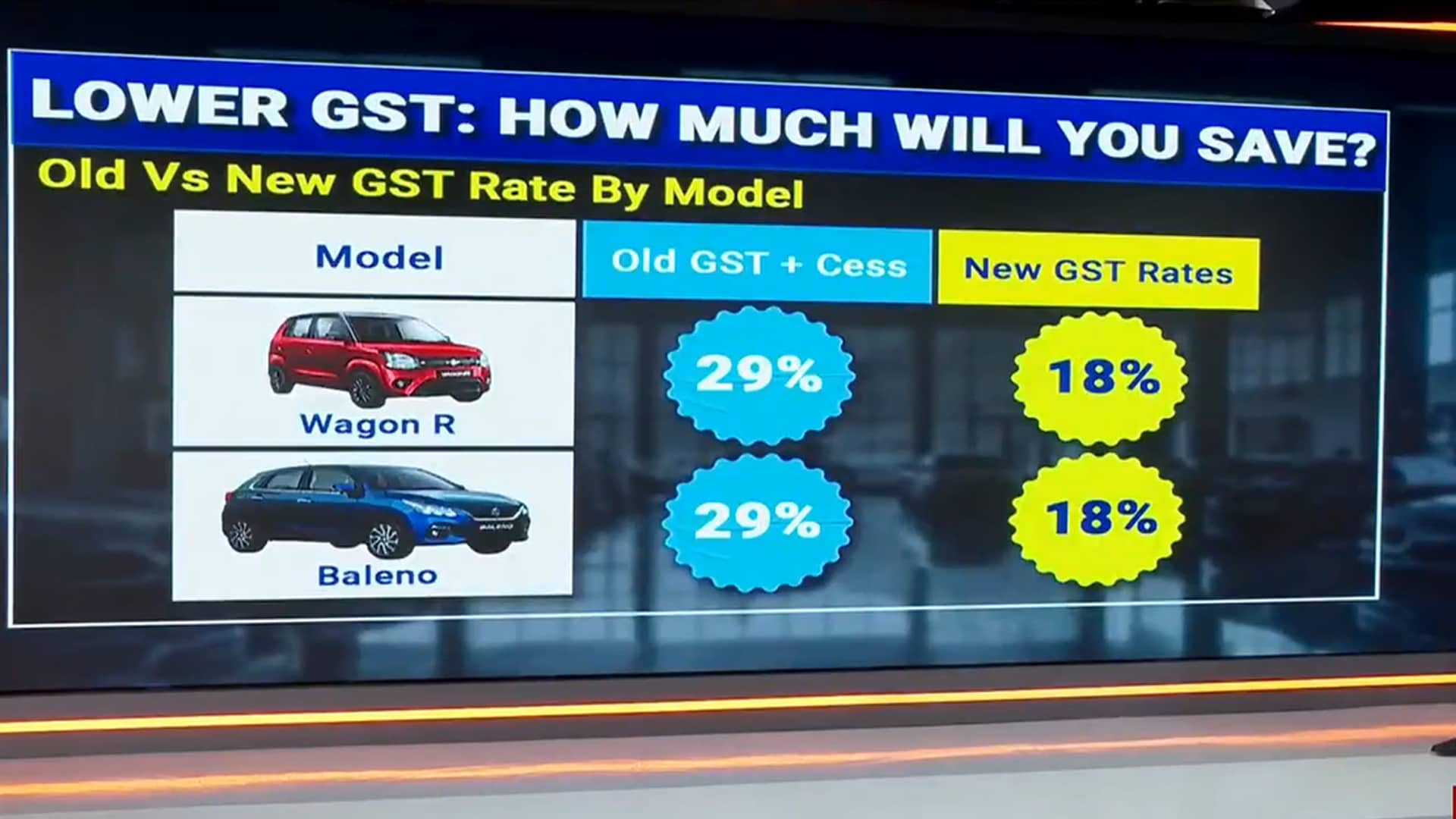

Introduction of GST impacted prices of many things people use in their daily lives including automobile prices.

- Asian News International | Saturday March 05, 2022 , Raigad (Maharashtra)

A team of CGST Commissionerate, Raigad, Mumbai Zone, busted a fake GST input tax credit (ITC) racket and arrested the proprietor of a Kalamboli-based firm named Zaid Enterprises on Saturday.

- Press Trust of India | Thursday February 17, 2022 , Thane

The Central Goods and Services Tax (CGST) Commissionerate in Navi Mumbai on Wednesday said it has busted a racket of fake input tax credit (ITC) invoices worth Rs 21 crore and arrested the proprietor of a firm.

- Press Trust of India | Friday February 11, 2022 , Mumbai

The Maharashtra GST department has arrested a couple from Surat in neighbouring Gujarat for tax evasion and an input tax credit (ITC) fraud of over Rs 450 crore, an official said on Friday.

- Written by carandbike team | Monday February 28, 2022

By offering subsidies, incentives, and advantages to customers and the EV sector as a whole, the Indian government has sown the seed for electric vehicles.

- Press Trust of India | Friday February 04, 2022 , Thane

The owner of a steel company in Maharashtra's Thane district has been arrested for allegedly availing input tax credit using fake invoices to the tune of Rs 60 crore, an official said on Thursday.

- Press Trust of India | Tuesday February 01, 2022

The government will infuse Rs 44,720 crore into loss-making state-owned telecom firm BSNL in the next financial year, according to Budget documents.

- Press Trust of India | Monday January 31, 2022 , New Delhi

The Aam Aadmi Party (AAP) on Monday raised the Pegasus spyware issue at an all-party meeting and demanded a discussion on it during the Budget Session of Parliament.

................................ Advertisement ................................

Opinion

MoreOpinion | Why States, Not Centre, Should Get All The Credit For GST 'Savings'Derek O’Brien

Wednesday October 22, 2025Amidst all the hoopla, it is the State governments that truly deserve recognition for coming together for the GST revision. Because the States are the ones bearing the brunt of massive revenue losses.

Opinion: GST Cut, Inflation Under Control: Optimism As Festival Season ApproachesBharti Mishra Nath

Friday September 19, 2025Away from politics, floods, rain-related tragedies and the Trump tariffs, there is optimism in the air. With GST rationalized, inflation in control, the upcoming festival season promises good times.

Opinion | Next-Generation GST: A Reform That Places The Middle Class At The CentrePradeep Bhandari

Saturday September 06, 2025By ensuring both direct tax relief and rationalised indirect taxes, the government has empowered the common citizen to save more, spend more, and aspire more.

Opinion | Observations From A Student of Political Communication - By Derek O'BrienDerek O’Brien

Friday September 05, 2025For a student of political communication, this week has been fodder. The language used to describe GST reforms has been nothing short of grand. "Landmark". "Biggest ever since the 1990s". The Opposition has been advocating for such 'reforms' for eigh

Latest Videos

More................................ Advertisement ................................