- Home/

- News

Latest News

Union Budget 2022: Here's What FADA Expects For The Used Car And Bike Segment

Pratik Rakshit | Monday January 31, 2022FADA has given its recommendations to the Ministry Of Finance, to assist the automotive industry, as well as provide relief in the used-vehicle space.

- Written by Seshan Vijayraghvan | Sunday January 30, 2022

Finance Minister, Nirmala Sitharaman will be announcing the union budget for FY2023 on February 1, 2022, and like all other industries, the auto sector is also eagerly waiting to see what is in store for them.

- Press Trust of India | Thursday January 27, 2022 , New Delhi

GST officers have busted a syndicate involved in the creation of fake firms and bogus invoices which led to a GST evasion of Rs 362 crore, the finance ministry said on Thursday.

- Press Trust of India | Friday January 14, 2022 , New Delhi

GST officers have arrested one person for operating a syndicate and issuing fake invoices of Rs 4,521 crore for availing input tax credit (ITC) benefit under goods and services tax, an official statement said on Friday.

- Press Trust of India | Thursday January 06, 2022 , Mumbai

A joint commissioner of the Goods and Services Tax (GST) went missing from his office in Mumbai's Mazgaon area on Wednesday, police sources said.

- Written by carandbike team | Monday January 03, 2022

Considering the automobile business to be one of the leading businesses in any given country, it has affected India. The price of the car increased by a huge amount, but the method of implication made it quite different too.

- Press Trust of India | Saturday January 01, 2022 , New Delhi

The Delhi government's Goods and Services Tax (GST) department on Saturday unearthed a Rs 347-crore "fake billing scam" involving 11 firms and one person was arrested in connection with it, according to an official statement.

- Cryptocurrency Exchanges Across India Said to Face DGCI Crackdown, Rs. 70-Crore Tax Evasion DetectedANI | Saturday January 01, 2022

After the massive tax evasion of GST by Cryptocurrency Service providers WazirX, the Directorate General of GST Intelligence has come down heavily on Cryptocurrency exchanges operating in the country, said sources.

- Asian News International | Sunday January 02, 2022 , New Delhi

After the massive tax evasion of GST by Cryptocurrency Service providers WazirX, the Directorate General of GST Intelligence has come down heavily on Cryptocurrency exchanges operating in the country, said sources.

- Press Trust of India | Saturday January 01, 2022 , New Delhi

Food aggregators like Swiggy and Zomato will have to collect and deposit tax at 5 per cent rate starting today, a move which will widen the tax base as food vendors who are currently outside the GST threshold will become liable to GST.

- ANI | Saturday January 01, 2022

GST Mumbai East Commissionerate detected a GST evasion worth Rs 40.5 crores and recovered Rs 49.2 crore in cash pertaining to GST evaded, interest, and penalty from the cryptocurrency exchange WazirX.

- Jagmeet Singh | Thursday December 30, 2021

Food ordering from platforms including Swiggy and Zomato may become costlier soon as a new tax rule is coming into force starting January 1. Under the rule, food aggregators will be required to collect a five percent Goods and Services Tax (GST) from restaurants for their food items.

- Press Trust of India | Thursday December 30, 2021 , New Delhi

Several markets dealing with garment business in Delhi remained shut on Thursday in protest against the central government's proposed move to hike GST rates on textile from existing 5 per cent to 12 per cent from January 1.

- Reported by Arvind Gunasekar, Edited by Chandrashekar Srinivasan | Thursday December 30, 2021 , New Delhi

The Directorate General of GST Intelligence on Thursday refuted rumours about its proposed handling of the Rs 197.49 crore cash and 23 kg of gold (worth an estimated Rs 11 crore) recovered last week during tax raids on UP businessman Piyush Jain.

................................ Advertisement ................................

Opinion

MoreOpinion | Why States, Not Centre, Should Get All The Credit For GST 'Savings'Derek O’Brien

Wednesday October 22, 2025Amidst all the hoopla, it is the State governments that truly deserve recognition for coming together for the GST revision. Because the States are the ones bearing the brunt of massive revenue losses.

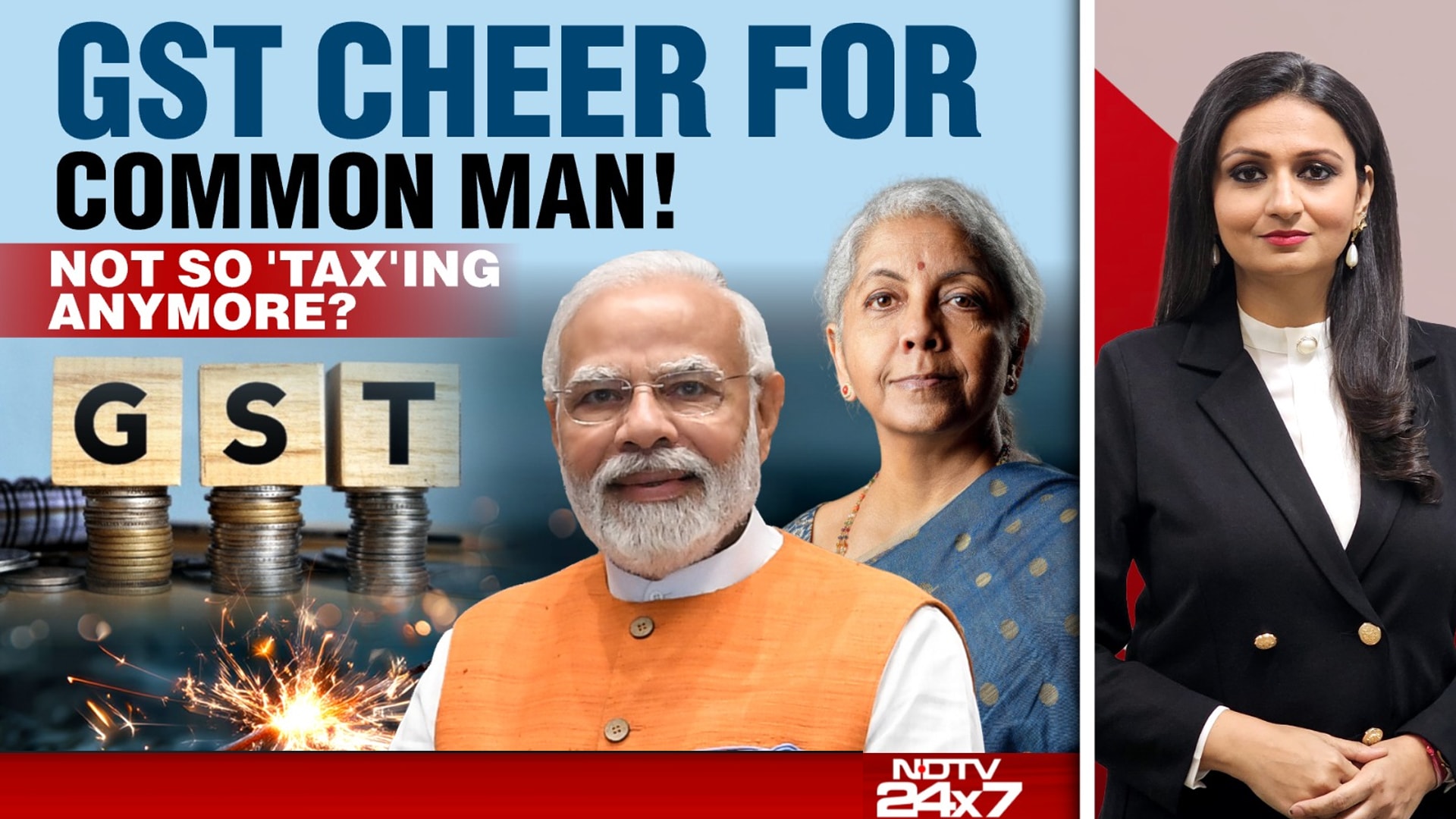

Opinion: GST Cut, Inflation Under Control: Optimism As Festival Season ApproachesBharti Mishra Nath

Friday September 19, 2025Away from politics, floods, rain-related tragedies and the Trump tariffs, there is optimism in the air. With GST rationalized, inflation in control, the upcoming festival season promises good times.

Opinion | Next-Generation GST: A Reform That Places The Middle Class At The CentrePradeep Bhandari

Saturday September 06, 2025By ensuring both direct tax relief and rationalised indirect taxes, the government has empowered the common citizen to save more, spend more, and aspire more.

Opinion | Observations From A Student of Political Communication - By Derek O'BrienDerek O’Brien

Friday September 05, 2025For a student of political communication, this week has been fodder. The language used to describe GST reforms has been nothing short of grand. "Landmark". "Biggest ever since the 1990s". The Opposition has been advocating for such 'reforms' for eigh

Latest Videos

More................................ Advertisement ................................