- Home/

- News

Latest News

Was Wrong Perfume-Maker Raided? No, Say Officials; Politics Takes Over

Reported by Arvind Gunasekar, Alok Pandey, Edited by Saikat Kumar Bose | Wednesday December 29, 2021 , New DelhiThe raid on Uttar Pradesh businessman Piyush Jain is not a case of mistaken identity, sources in the agency that investigates GST evasions said after the unearthing of heaps of unaccounted cash from his premises made national headlines.

- Asian News International | Wednesday December 29, 2021 , Kanpur

A team of Directorate General of GST Intelligence (DGGI), Lucknow Unit visited the office and residence of another Kanpur-based businessman late on Tuesday for the verification of tax evasion allegations.

- Asian News International | Wednesday December 29, 2021 , Kannauj

The Directorate General of GST Intelligence (DGGI) on Wednesday concluded the raids at businessman Piyush Jain's residence in Uttar Pradesh's Kannauj.

- Asian News International | Tuesday December 28, 2021 , New Delhi

The Directorate of Revenue Intelligence (DRI) has been roped after the Directorate General of GST Intelligence (DGGI) recovered approximately 23 kg of gold from the factory premises of Kanpur-based businessman Piyush Jain on Monday.

- Reported by Mukesh Singh Sengar, Edited by Chandrashekar Srinivasan | Monday December 27, 2021 , New Delhi

UP IT Raid, Piyush Jain: Tax raids on Uttar Pradesh businessman Piyush Jain, who is part of the perfume industry, have so far recovered Rs 194.45 crore in cash and 23 kg in gold, the Directorate General of GST Intelligence (DGGI) said Monday.

- Edited by Akhil Kumar | Monday December 27, 2021 , Lucknow

Kanpur businessman Piyush Jain has been arrested for evasion ofGoods and Services Tax.

- Asian News International | Sunday December 26, 2021

Directorate General of GST Intelligence (DGGI) Ahmedabad has recovered Rs 10 crore more cash from the factory and residence of perfume businessman Piyush Jain, promotor of Odochem Industries of Kannauj district in Uttar Pradesh, official sources said

- Press Trust of India | Tuesday November 23, 2021 , New Delhi

The Congress today accused the BJP government of trying to divert the country's attention from real problems like price rise faced by common people to "non-issues" of caste and religion.

- Asian News International | Friday November 05, 2021 , Pune

Nationalist Congress Party chief Sharad Pawar today demanded the release of GST compensation to the states for them to reduce value-added tax (VAT) on fuel. His remarks come days after the Centre reduced the excise duty on petrol and diesel.

- Asian News International | Saturday October 16, 2021 , Pune

NCP chief Sharad Pawar today hit out at the centre for blaming the states for delaying the payment of coal, adding that the centre is yet to give the GST amount to the state but nobody is saying anything on the issue.

- Asian News International | Thursday October 14, 2021 , New Delhi

The officers of CGST Commissionerate, Delhi East unearthed a network of fictitious exporters who were availing and utilizing fake Input Tax Credit (ITC) of Rs 134 crore under the Goods and Services Tax (GST)

- Press Trust of India | Friday October 08, 2021 , New Delhi

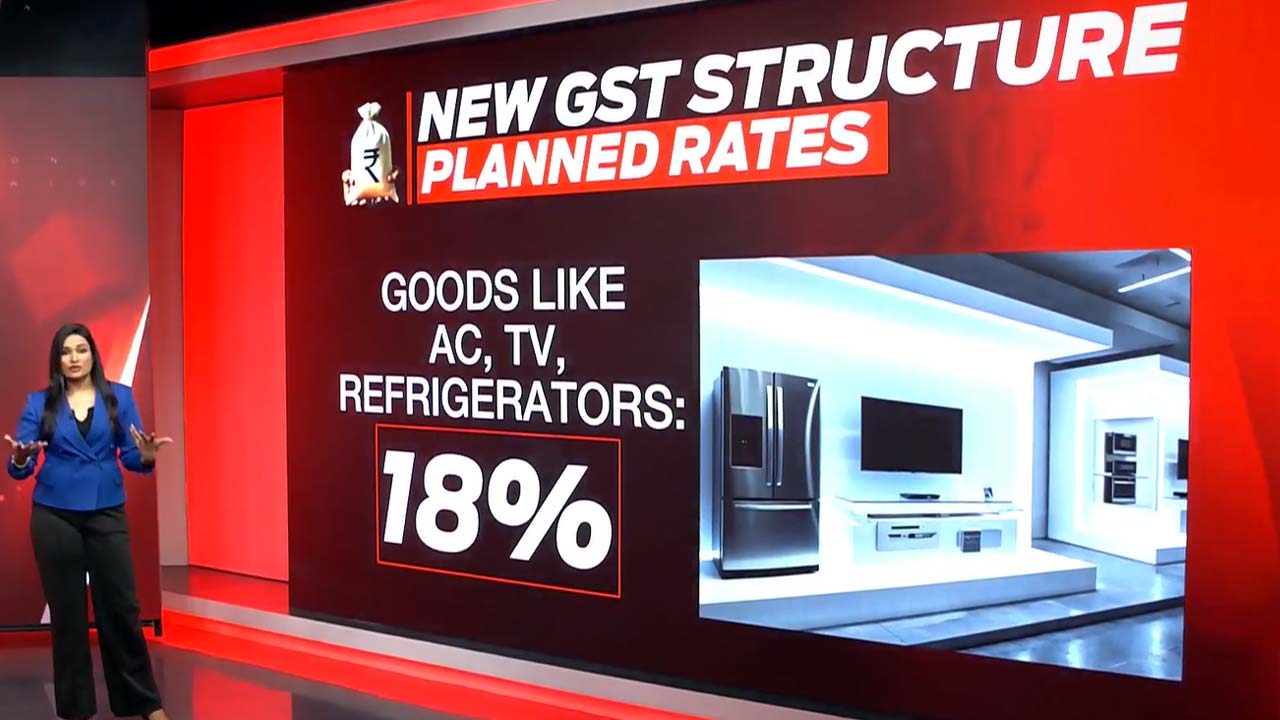

The first meeting of the Group of Ministers set up for rationalising GST rates and to shore up revenue will be held soon, its chairman and Karnataka Chief Minister Basavaraj Bommai said on Friday.

- Press Trust of India | Thursday September 23, 2021 , Kolkata

Petrol prices in the country are not coming down as the states do not want to bring fuel under the ambit of the Goods and Services Tax or GST, Petroleum Minister Hardeep Singh Puri said.

- Press Trust of India | Saturday September 18, 2021 , New Delhi

Finance ministers of Opposition-ruled states have demanded that the GST compensation cess regime be extended beyond June 2022.

................................ Advertisement ................................

Opinion

MoreOpinion | Why States, Not Centre, Should Get All The Credit For GST 'Savings'Derek O’Brien

Wednesday October 22, 2025Amidst all the hoopla, it is the State governments that truly deserve recognition for coming together for the GST revision. Because the States are the ones bearing the brunt of massive revenue losses.

Opinion: GST Cut, Inflation Under Control: Optimism As Festival Season ApproachesBharti Mishra Nath

Friday September 19, 2025Away from politics, floods, rain-related tragedies and the Trump tariffs, there is optimism in the air. With GST rationalized, inflation in control, the upcoming festival season promises good times.

Opinion | Next-Generation GST: A Reform That Places The Middle Class At The CentrePradeep Bhandari

Saturday September 06, 2025By ensuring both direct tax relief and rationalised indirect taxes, the government has empowered the common citizen to save more, spend more, and aspire more.

Opinion | Observations From A Student of Political Communication - By Derek O'BrienDerek O’Brien

Friday September 05, 2025For a student of political communication, this week has been fodder. The language used to describe GST reforms has been nothing short of grand. "Landmark". "Biggest ever since the 1990s". The Opposition has been advocating for such 'reforms' for eigh

Latest Videos

More................................ Advertisement ................................