- Home/

- Highlights

Schools are beginning to reopen amidst a lot of chaos. Teachers have had to undergo salary cuts, many parents have not been able to pay the school fees due to job losses. For low income households, the challenge is accentuated further. With classes going online, thousands of children have had to scramble for gadgets to get online. The digital divide has never been more obvious, resulting in several kids dropping out of school.

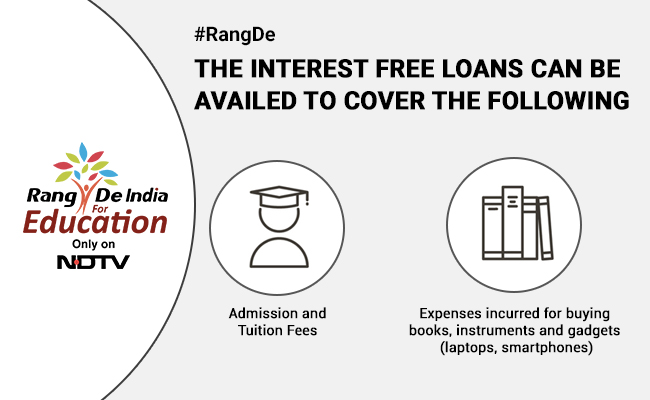

To address the brewing crisis in the education space, Rang De along with NDTV hopes to intervene by providing interest free loans to low income households. The campaign aims to create awareness about the problem and raise interest free loans for student communities across India.

Rang De is a peer-to-peer lending platform that enables individuals to invest in fellow Indians. Started in 2008 as a non-profit, Rang De is now an RBI regulated peer-to-peer lending platform (NBFC-P2P).

Rang De's mission is to provide access to low cost, collateral-free loans with respect and dignity. Since inception, Rang De has been supporting farmers, artisans and small businesses and individuals who have been denied credit or cannot afford high-interest loans.